Howard Mark's Oaktree Capital navigated a volatile Q2 2019, returning 9.03%. That's based on an equal-weighted portfolio of the fund's top 20 holdings. It was the best quarterly return for large Hedge Funds -- those with greater than $5 billion in 13F securities.

Oaktree's...

Sun Valley Gold led all hedge funds in Q2 of 2019 with a 56% 13F-based return. But the eye-popping performance by the Ketchum, Idaho-based fund comes with an asterisk, as explained below.

Ketchum-based Sun Valley is a materials-focused hedge fund managed by Peter F....

Arlington Value's Allan Mecham increased his position in Warren Buffett's Berkshire Hathaway(BRK.B) by 8% during the second quarter of 2019. Including Berkshire A and B shares, Berkshire was 29.93% of Arlington's portfolio at Q2 end. The Salt Lake City-based fund's 13F also showed increases in its Alliance...

Scion Management's Q2 holdings are out, revealing extensive turnover orchestrated by manager Michael Burry. The renowned value investor added four new stocks to his portfolio, but closed-out eight positions, cutting the total number of long holdings in his hedge fund to just 10.

Maybe...

Starboard Value cut its Cars.com stake aggressively after the online auto retailer's strategic search failed and the company announced disappointing Q2 results. In a 13D/A filing submitted Wednesday afternoon, the hedge fund disclosed selling 4.47 million shares of the online automobile retailer on August 5-6 at...

Lottery ticket stocks are equities perceived by investors to provide a small chance of a huge payoff. Like playing the lottery, many investors find these stocks -- usually low-priced, thinly traded with little or no earnings -- very alluring. However, studies show that -- like the...

Light Street Capital filed a 13G on Monday July 22, disclosing a 5.2% stake in cybersecurity firm Carbon Black, Inc. (CBLK).

The Palo Alto-based hedge fund acquired the $69 million CBLK position as cyber attacks become an increasing problem for U.S. corporations, and...

Abdiel Capital Advisors has never held more than 9 long positions since the 4th quarter of 2015. Over that period, the $1.4 billion hedge fund has averaged a 55.1% annual return (based on 13F filings). Abdiel's portfolio concentration is anathema to Modern Portfolio Theory, which preaches diversification...

The Tiger Cub Hedge Funds market-beating performance continues. Though Julian Robertson's Tiger Management folded up its tent nearly two decades ago, his protégés are doing him proud. A portfolio of top holdings of hedge funds linked to Tiger Management was up 14.94% year-to-date through Q2's end. That's...

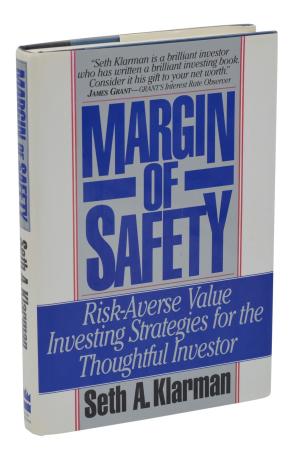

In 1991 the first (and only) edition of Seth Klarman's book Margin of Safety: Risk-Averse Value Investing Strategies for the Thoughtful Investor was published. Just 5000 copies were printed, and initial sales were slow. You could have bought it for $25. Today, it might be worth $3000.