As I've written about before, there is an inverse relationship between hedge fund AUM and performance. Below we look at the top ten small hedge funds posting big returns over the last year.

Academic studies have shown that small hedge funds tend to outperform large funds.

Why are smaller funds returns...

It's been a challenging investing landscape over the last year, to say the least. From Sept. 30, 2019 through Feb. 19, 2020, the S&P 500 gained 14%. Then the Coronavirus pandemic swept in like a giant Black Swan. The market swooned 34% over the next month, bottoming on March 23. Despite the pandemic, stocks then marched 50%...

Famed money manager Michael Burry, main character in the book and movie "The Big Short," began reporting his Scion Asset Management holdings in Q4 of 2018 after a two year hiatus. Since then, Scion has averaged about 12 positions in its quarterly 13F portfolio. But Scion's Q3 2020 13F reveals Burry holding 33 positions, including 13 new...

Hanesbrands (HBI) Chairman of the Board Ronald Nelson bought 50,000 shares of the apparel company at $12.73 on Nov. 9. The long-time Hanesbrands insider disclosed in a Nov. 10 Form 4 buying $636,600 of HBI.

It was Nelson's largest insider purchase of HBI since he became a director in 2008. The buying came after...

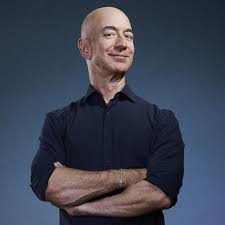

Jeff Bezos sold $3B of Amazon stock on Nov. 2 - Nov. 3. The world's richest person unloaded 1 million shares of his company at an average price of $3022.84. Amazon(AMZN) closed today at $3143.74, down 4.57%. The sales reduced the founder's stake in the giant online retailer by 0.46% to 53.8M shares. That's about 10.72%...

San Francisco-based HMI Capital filed a 13G this morning disclosing a 6.11% position in SailPoint Technologies Holdings (SAIL). The software company was HMI's #12 holding as of the second quarter's close. But after HMI Capital increased its SailPoint stake by 162%, purchasing 3.4 million additional shares as of October 22, SAIL becomes HMI's top position.

It's typically bullish when a corporate insider buys shares of his or her company. Insiders have knowledge about their companies that outsiders don't. But when multiple corporate insiders purchase their own stock at the same time, it's typically an even stronger buy signal. Such "cluster buying" implies agreement among the company's insiders that the stock is...

Tiger Global has been selling Sunrun shares as fellow "Tiger Cub" Coatue Management buys shares of the solar systems retailer. Sunrun Inc. (RUN) has been a huge winner for Tiger Global, surging 352% year-to-date. But since Oct. 1, the $41B hedge fun run by Chase Coleman has cut its stake by 17%.

Tiger...

In the roaring stock market of the 1920's, it was common for groups of shrewd traders to secretly accumulate big stakes in a stock, then promote it, and drive up the price. When unsuspecting buyers chased the stock higher, the manipulators would sell at a big profit, leaving duped investors with plunging prices. 13D and 13G...

Back in 2013, Bloomberg ran a profile of Brad Gerstner's Altimeter Capital that described the up-and-coming hedge fund manager as an adventurer -- an amateur pilot and heli-skier who hangs out with big-time CEOs at Burning Man. The article said Gerstner wanted to build a Venture Capital Empire.

Fast forward seven years, and Gerstner...