Its 13F filings season again — when hedge fund managers show their hands.

Forty-five days after the end of every quarter, every U.S. institutional investor with assets over $100 million is required to report its holdings to the SEC via 13F filings. Last quarter over 5000 13Fs were filed. For an investor seeking investment ideas, the vast majority of these filings are just noise. However, there is a small subset of investment managers with proven expertise at picking winning stocks. The moves of these select managers are very much worth following.

Here are ten funds whose 13F filings may be especially interesting — and profitable — to follow:

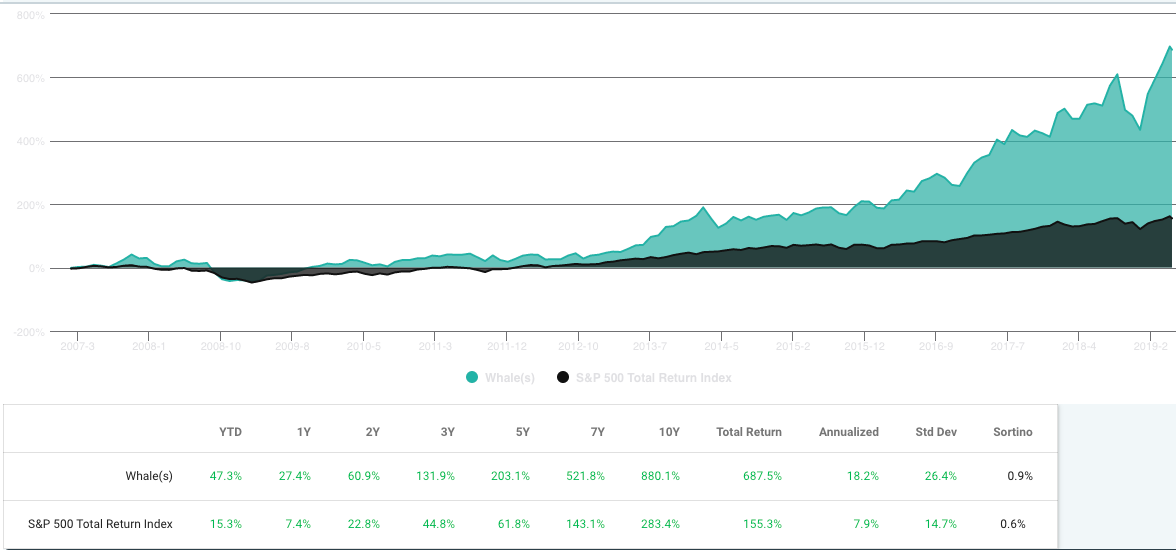

WHALE ROCK CAPITAL MANAGEMENT

Whale Rock Capital is focused on tech, telecom and media. Replicating an equal weighting of Whale Rock’s 13F positions would have been very profitable over the last decade — generating a 29.71% annualized return. Founder and portfolio manager Alex Sacerdote is one of the most talented stock pickers around.

| Whale Rock Capital Top 10 Holdings – Q4 2018 | % of Portfolio |

| Amazon.com Inc. (AMZN) | 11.5994 |

| Twilio Inc Cl A (TWLO) | 6.9994 |

| MongoDB Inc (MDB) | 6.3749 |

| Netflix Inc (NFLX) | 5.5325 |

| Salesforce.com Inc. (CRM) | 4.9027 |

| Facebook Inc (FB) | 4.8039 |

| Shopify Inc (SHOP) | 4.7216 |

| Coupa Software Inc (COUP) | 4.4318 |

| CERIDIAN HCM HOLDING INC (CDAY) | 4.313 |

| Ringcentral Inc (RNG) | 4.0222 |

HITE HEDGE ASSET MANAGEMENT

An energy-based fund managed by James Meyers Jampel, Hite Hedge had a big Q4 powered by its MLP holdings. The fund’s 13F portfolio was up 26.85% in Q4, near the top of all fund performance. Over the last three years Hite has averaged a 30.41% return. Hite’s top holdings as of 2018 year end:

| Hite Hedge Top 10 Holdings – Q4 2018 | % of Portfolio |

| Falcon Minerals Corp (FLMN) | 9.5621 |

| EQM Midstream Partners LP (EQM) | 8.7497 |

| Viper Energy Partners LP (VNOM) | 7.9062 |

| Enbridge, Inc. (ENB) | 5.3963 |

| Altus Midstream Co (ALTM) | 4.8882 |

| CNX Midstream Partners LP (CNXM) | 4.8553 |

| NGL Energy Partners LP Common Unit (NGL) | 4.8236 |

| Energy Transfer Equity LP (ET) | 4.1819 |

| Cheniere Energy Inc (LNG) | 3.4622 |

| CVR Refining LP (CVRR)PUT | 3.3693 |

CANNELL CAPITAL LLC

Alta, Wyoming-based Cannell Capital has racked-up impressive performance investing in undervalued small caps. The fund, with $358 million AUM, is the top performing 13F fund over the last three years with a 44.04% annual return. Manager J. Carlo Cannell has shown a knack for finding undervalued companies. He also often takes an activist role in his investments.

| Cannell Capital Top 10 Holdings (includes 13D filings) | % of Portfolio |

| North Amer Construction Grp Ltd Common S (NOA) | 7.525 |

| Veracyte Inc (VCYT) | 5.9577 |

| Health Insurance Innovations Inc (HIIQ) | 5.8044 |

| Hanger Inc (HNGR) | 5.2414 |

| Ring Energy Inc (REI) | 4.3109 |

| eHealth Inc (EHTH) | 4.2135 |

| Exterran Corp (EXTN) | 4.049 |

| Carrols Restaurant Group Inc (TAST) | 3.8039 |

| I.D. Systems, Inc. (IDSY) | 3.5652 |

| Craft Brewery Alliance, Inc. (BREW) | 3.324 |

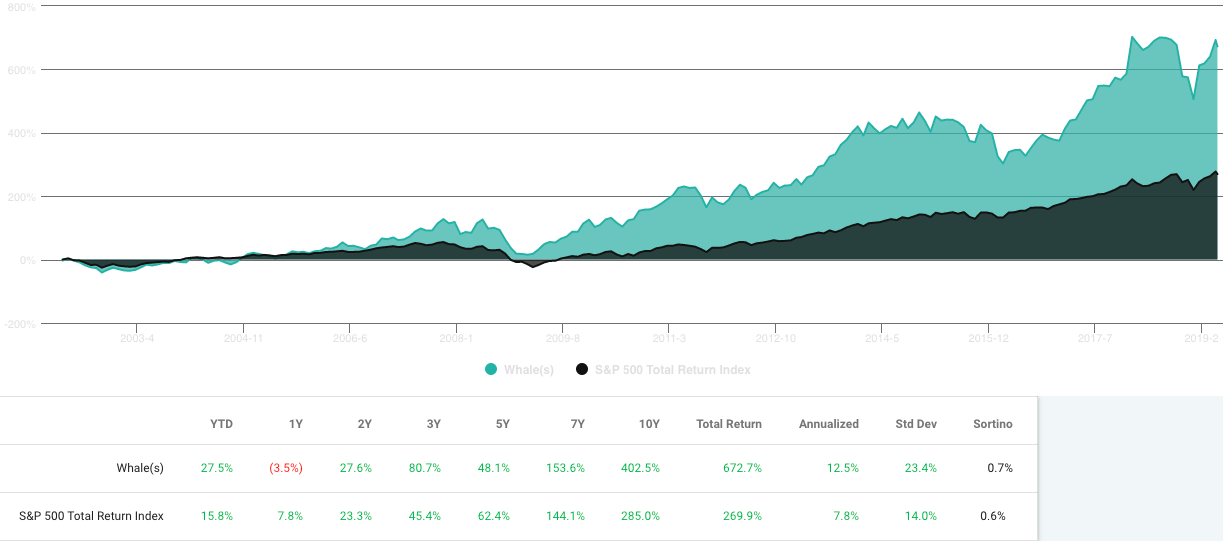

BRANDYWINE MANAGERS, LLC

Hockessin, Delaware-based Brandywine has a sterling short- and long-term track record. The fund’s 13F filings performance is 26.23% annualized over the last decade, 36.51% over the last year. Brandywine’s 13F returns show a Sharpe ratio of 1.33 over the last five years — one of the highest in the hedge fund universe. That means an equal-weighted portfolio of Brandywine’s top ten holdings has shown relatively little volatility while appreciating. Brandwine founder and CEO Michael Dever runs a fully hedged fund, but his long-only portfolio has been stellar.

GLYNN CAPITAL MANAGEMENT

Menlo Park-based Glynn Capital Management is a relatively small hedge fund ($1.1 billion AUM) with a history of exceptional stock picking in the technology sector. The annualized three-year performance of Glynn’s 13F filings portfolio is 44%, putting it a hair behind Cannell Capital for the best hedge fund returns over that period. President John W. Glynn founded the firm in 1974.

| Top 10 Holdings – Glynn Capital Q4 2018 | % Portfolio |

| ServiceNow Inc (NOW) | 9.1007 |

| Salesforce.com Inc. (CRM) | 8.17 |

| Atlassian Corp Plc (TEAM) | 8.0929 |

| Amazon.com Inc. (AMZN) | 7.7231 |

| Facebook Inc (FB) | 7.4851 |

| Workday Inc (WDAY) | 6.4583 |

| Veeva Systems Inc (VEEV) | 5.7489 |

| Netflix Inc (NFLX) | 4.419 |

| Proofpoint Inc (PFPT) | 4.0479 |

| Splunk Inc (SPLK) | 3.9937 |

TIGER GLOBAL MANAGEMENT LLC

With AUM of over $36 billion, Tiger Global is one of the top performing large hedge funds of recent years. Managed by Chase Coleman, Tiger Global’s 13F annualized performance has been 23.62% and 20.26% over the last three and ten years.

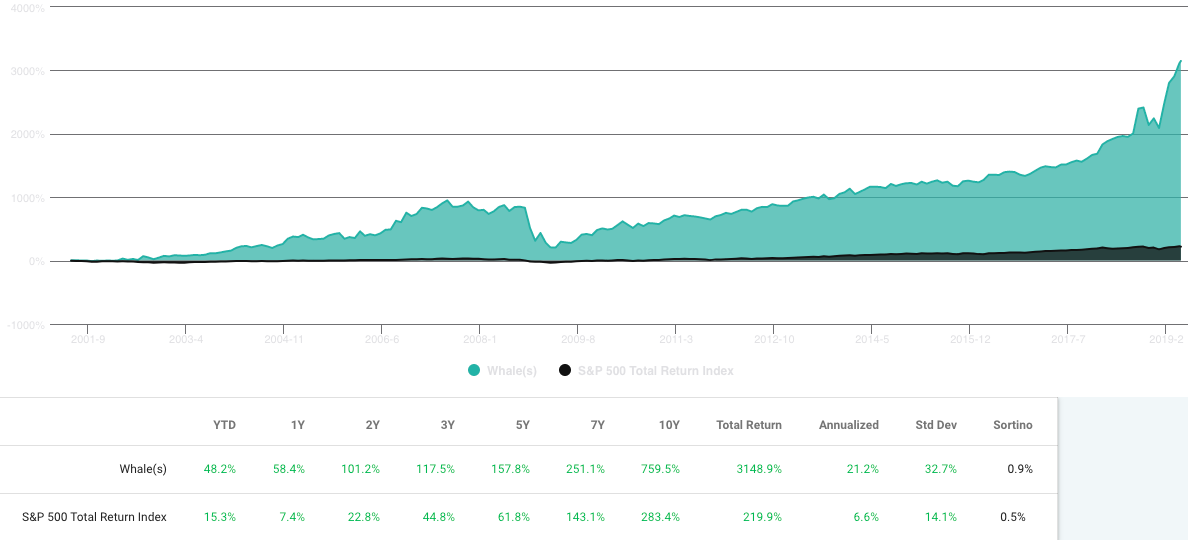

CASDIN CAPITAL

2019 has been a tough year so far for health care stocks. But where there is volatility, there is also opportunity. New York City-based Casdin Capital has been the top performing fund in the health care sector based on 13F filings over the last three years, with an annualized return of 52.90%. CIO Eli Casdin and his team have has shown a consistent ability to find hidden gems in the small cap healthcare space.

| Top 10 Holdings – Casdin Capital -Q4 2018 | % of Portfolio |

| Loxo Oncology Inc (LOXO) | 8.6269 |

| MyoKardia Inc (MYOK) | 6.6037 |

| Blueprint Medicines Corp (BPMC) | 5.9027 |

| Codexis Inc (CDXS) | 5.7857 |

| Spark Therapeutics Inc (ONCE) | 5.6249 |

| Bluebird Bio Inc (BLUE) | 5.6006 |

| Fate Therapeutics Inc (FATE) | 5.5973 |

| Sage Therapeutics Inc (SAGE) | 5.113 |

| BioLife Solutions Inc (BLFS) | 4.9984 |

| Invitae Corp (NVTA) | 4.5412 |

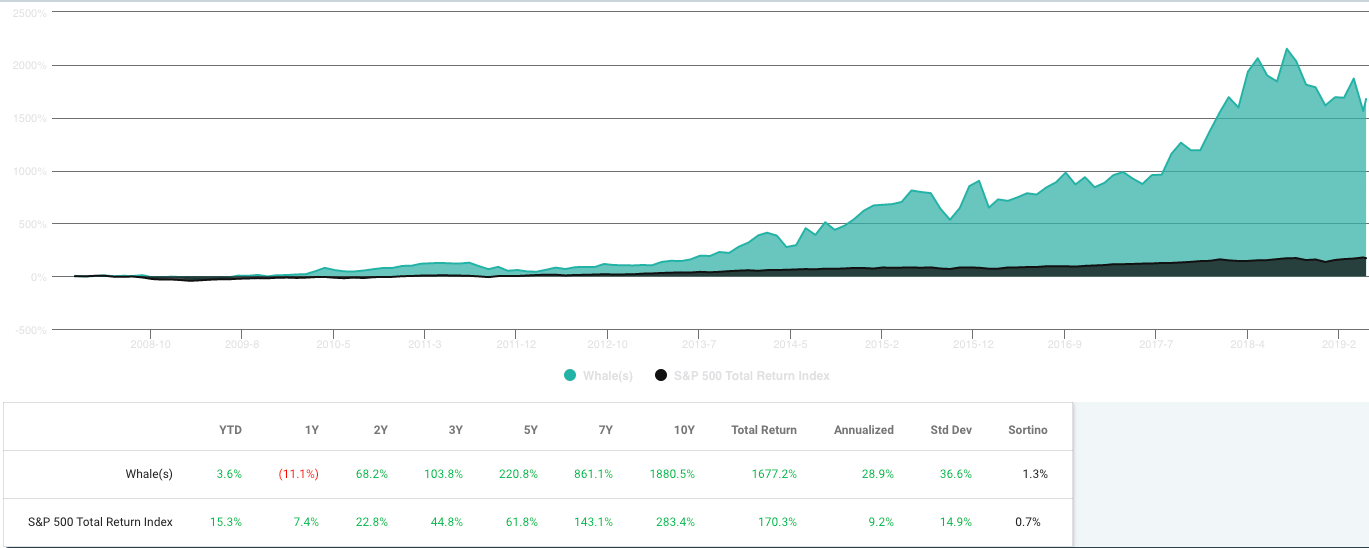

RA CAPITAL MANAGEMENT

RA Capital Management has one of the best 13F performances over the last ten years is — 37.4% annualized. I discussed RA Capital previously. Managed by Peter Kolchinsky, RA Capital is renowned for its extensive due diligence. Given the upheaval in the health care sector, Kolchincky’s portfolio changes will be scrutinized carefully.

SCION ASSET MANAGEMENT

Michael Burry, profiled in The Big Short, made clients in his Scion hedge fund hundreds of millions shorting sub-prime real estate during the financial crisis. The reclusive Burry seemed to drop out of sight for a couple of years before Scion Asset Management filed a 13F last Feb. 15 for the first time in over two years.

BERKSHIRE HATHAWAY

It would’t be 13F filings season without the quarterly fixation on Warren Buffett’s portfolio changes. This time around, the Oracle of Omaha has already said his fund has been buying Amazon (AMZN) — which had zero exposure in Berkshire’s portfolio at the end of Q4. It will be interesting to see the size of Berkshire’s AMZN position, and his other moves as of Q1 end.

| Berkshire Hathaway – Top 10 Holdings – Q4 2018 | % Portfolio |

| Apple Inc (AAPL) | 21.506 |

| Bank of America Corp. (BAC) | 12.0621 |

| Wells Fargo & Co. (WFC) | 10.7423 |

| Coca Cola Co. (KO) | 10.346 |

| American Express Co (AXP) | 7.8942 |

| Kraft Heinz Co. (The) (KHC) | 7.6559 |

| U.S. Bancorp (First National Bank of Cincinnati) (USB) | 3.228 |

| JPMorgan Chase & Co. (Chemical Bank) (JPM) | 2.6725 |

| Bank Of New York Mellon Corp (BK) | 2.0811 |

| Moodys Corp (MCO) | 1.8872 |

Disclaimer: Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this blog is meant for educational and informational purposes only. Do your own research before investing and don’t risk more than you can afford to lose. This article expresses my own opinions, and I am not receiving compensation for it (other than from WhaleWisdom). I do not have a business relationship with any company whose stock is mentioned in this article. I or my associates may hold positions in the stocks discussed.