Arlington Value’s Allan Mecham increased his position in Warren Buffett’s Berkshire Hathaway(BRK.B) by 8% during the second quarter of 2019. Including Berkshire A and B shares, Berkshire was 29.93% of Arlington’s portfolio at Q2 end. The Salt Lake City-based fund’s 13F also showed increases in its Alliance Data (ADS) and Cimpress N.V. (CMPR) holdings. Mecham reduced other holdings. The Fund’s top 10 positions represented 98.57% of its 13F portfolio.

Arlington Value’s Allan Mecham — Q2 2019 13F Holdings

| Stock | Symbol | Shares Held | Market Value | % of Portfolio | Change in shares | % Ownership |

| Berkshire hathaway inc class b | BRK.B | 2,006,516 | 427,729,000 | 28.9986% | 149,050 | 0.0815% |

| Alliance data systems corp | ADS | 1,398,360 | 195,952,000 | 13.2849% | 266,397 | 2.6384% |

| Cimpress n.v | CMPR | 2,149,638 | 195,381,000 | 13.2462% | 52,377 | 6.9998% |

| Spectrum brands holdings (zapata off-shore – hrg group) | SPB | 3,079,135 | 165,565,000 | 11.2247% | -71,275 | 1.5161% |

| Autonation inc. (republic industries) | AN | 3,386,118 | 142,014,000 | 9.6281% | -45,300 | 3.7598% |

| Monro muffler brake inc. | MNRO | 1,641,378 | 140,010,000 | 9.4922% | -15,520 | 4.9588% |

| Jefferies financial group inc | JEF | 4,072,067 | 78,306,000 | 5.3089% | -71,410 | 1.143% |

| Interactive brokers group inc | IBKR | 1,329,415 | 72,054,000 | 4.885% | -21,800 | 0.3213% |

| Spirit airlines inc | SAVE | 487,748 | 23,280,000 | 1.5783% | -9,800 | 0.7127% |

| Berkshire hathaway inc class a | BRK.A | 43 | 13,689,000 | 0.9281% | 0 | 0.0026% |

| Gci liberty inc. (liberty interactive corp.) | GLIBA | 208,877 | 12,838,000 | 0.8704% | -5,922 | 0.2066% |

| Bank of america corp. (north carolina national bank) | BAC | 267,880 | 7,769,000 | 0.5267% | -9,500 | 0.0026% |

| Charter communications inc | CHTR | 883 | 349,000 | 0.0237% | 0 | 0.0004% |

| Deswell industries inc | DSWL | 22,981 | 64,000 | 0.0043% | 0 | 0.1446% |

| Molson coors brewing company | TAP | 0 | 0 | -577,321 | 0.00% |

Allan Mecham, “the 400% Man.”

It’s only fitting that Mecham has invested 29% of his portfolio in Berkshire Hathaway stock. The value-focused manager has often been called the “Next Warren Buffett.” Back in 2012 Brett Arends wrote a Marketwatch article on Mecham, entitled “The 400% Man.” From the piece:

Over a 12-year stretch, through the end of 2011, Mecham, now a mere 34 years old, has earned an astounding cumulative return of more than 400 percent by investing in the stock of U.S. companies — many of them larger ones like Philip Morris, AutoZone and PepsiCo. That investment performance leaves the stock market indexes and most mutual funds trailing far in the dust… And Mecham has done this mostly while sitting in an armchair, in an office above a taco shop, in downtown Salt Lake City.

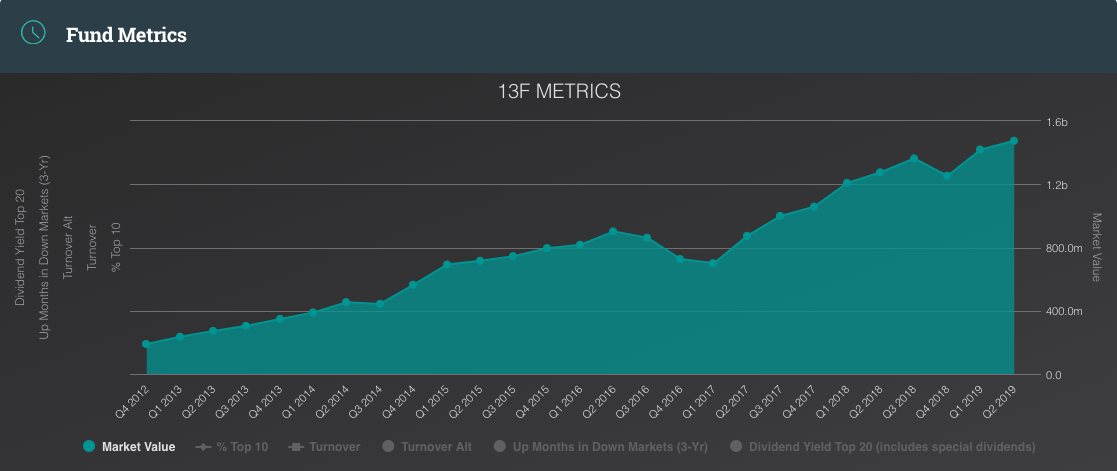

When that article was written, “The 400% Man” was managing about $80 million. Over seven years later, Arlington Value Capital’s AUM is now $1.47 billion. If you’re a young hedge fund manager with a phenomenal track record and you’re touted as the second coming of the Oracle of Omaha, it’s possible to raise a lot of money…

How has Mecham’s performance been since being dubbed “the Next Warren Buffett?” Well, it hasn’t been 400%, but it’s been pretty good. Since Q2 2013, Arlington Value’s manager weighted 13F performance has been 102.36%, which is 11.3% annualized.

“The 400% Man” has seen his performance lag a bit as Arlington’s AUM has grown.

That Mecham’s returns have fallen off compared to his early days when he built his reputation is not surprising. With hedge funds, there is a well-established relationship between size and performance. The smaller the fund the better the performance.

Also, the years since 2013, when Arlington Value’s Allan Mecham started managing big money, have been tough for value managers. The relentless bull market has perpetuated a love affair with growth and index investing among investors.

In this article, Mercer Capital asks: “Are Value Managers Undervalued?” According to the piece, the last time growth outperformed value like it has over the last few years was during the 2000 tech bubble. Back then, the Russell 2000 Growth Index beat its value counterpart by 68% (annualized) from October 1, 1998 to March 1, 2000. But…it gave it all back (and then some) over the next couple of years.

Worth noting…is BRK-A gaining 32% the following year when the S&P and NASDAQ shed a respective 9% and 45%. We’re not forecasting that level of mean reversion but do want to emphasize how quickly relative outperformance can swing the other way.

So, value investors like Arlington Value’s Allan Mecham are overdue for great performance. When the steady returns from growth investing turn to steady red ink, investors will likely gravitate to value-oriented managers, like they have in the past. Which is no doubt why “the Next Warren Buffett” added to his Berkshire Hathaway stake. Leave it to a talented young value investor to know when the greatest value investor’s fund is cheap.

Disclaimer:

Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this blog is meant for educational and informational purposes only. Do your own research before investing and don’t risk more than you can afford to lose. This article expresses my own opinions, and I am not receiving compensation for it (other than from WhaleWisdom). I do not have a business relationship with any company whose stock is mentioned in this article. I or my associates may hold positions in the stocks discussed.