Back in December of 2019, three Cassava Sciences insiders bought $3.2M of their own stock at $2.25. Two weeks later the stock closed at $9.65. So its understandable that investors might aggressively bid up Cassava Sciences (SAVA) stock after two insiders disclosed on Thursday the purchase of...

Jeff Bezos sold $3B of Amazon stock on Nov. 2 - Nov. 3. The world's richest person unloaded 1 million shares of his company at an average price of $3022.84. Amazon(AMZN) closed today at $3143.74, down 4.57%. The sales reduced the founder's stake in the giant online...

On Friday afternoon, CASI Pharma CEO He Wei-Wu filed a Form 4 disclosing the purchase of nearly $7.9M of CASI stock. The insider bought the shares in a public offering of 20M CASI shares at $1.90. President Larry Zhang also bought 20,153 shares in the secondary offering,...

By Mark W. Gaffney

For WhaleWisdom.com

“Don’t tell me what you think, just tell me what’s in your portfolio.”

Nassim Taleb in Skin in the Game

In his most recent book Skin in the Game, Nassim Taleb asserts that if you offer an opinion, and someone follows it, you are morally obligated to...

Jab Holdings B.V. disclosed via Form 4 filings on August 28 buying over $32 million of Coty Inc. (NYSE:COTY) shares at prices ranging from $11.98 to $12.90 on August 24 through August 28. Last December 31 JAB filed a 13G disclosing a 76% stake in the beauty company. Since filing the 13G at years end, JAB has acquired an additional 30 million shares of COTY spending nearly $83 million dollars.

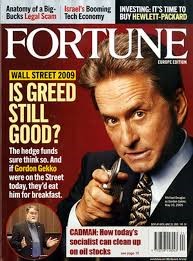

We’ve heard the Warren Buffett’s saying a hundred times: Be fearful when others are greedy and greedy when others are fearful. Over the last year, corporate insiders as a group have done just that. During most of 2018 officers and directors sold heavily. However, as panic selling by investors has intensified in recent weeks, so has insider buying.

Through Thursday of this holiday-shortened trading week, the WhaleWisdom Insider Sell vs Buy ratio was at 0.44.

The Chairman, President and CEO of First Horizon Corp. (NYSE:FHN) bought $444K of his own stock on the open market two weeks after telling Jim Cramer on CNBC’s Mad Money that FHN stock was “on sale.” In a Form 4 filing yesterday, Bryan D. Jordan disclosed he bought 25,000 shares of First Horizon stock at an average price of $17.76 on July 31.

Stock market prognosticators are getting bearish. “We’re now in a bear market, get ready for lower prices…” a growing chorus of pessimistic “experts” are saying. “Watch out for the Death Cross!” Yikes.

Of course, this great advice comes after the market has already tanked 10%. Where was this helpful advice in Sept. before things went south in a hurry?

Insider buying and large 13F increases don’t always immediately translate into higher stock prices. A case in point is the development-stage biotech company Pfenex Inc. (AMEX:PFNX).

When the stock market swoons, I like to watch insider buying to see where the smart money is finding value. Here are three stocks with interesting insider activity that also showed good relative strength in Monday’s weak market.