GE is another Enron, only worse. That's according to forensic accountant Harry Markopolos, famous for raising red flags about Bernie Madoff ’s Ponzi scheme before most anyone else had a clue.

Markipolos released a report on Thursday claiming General Electric (GE) has been...

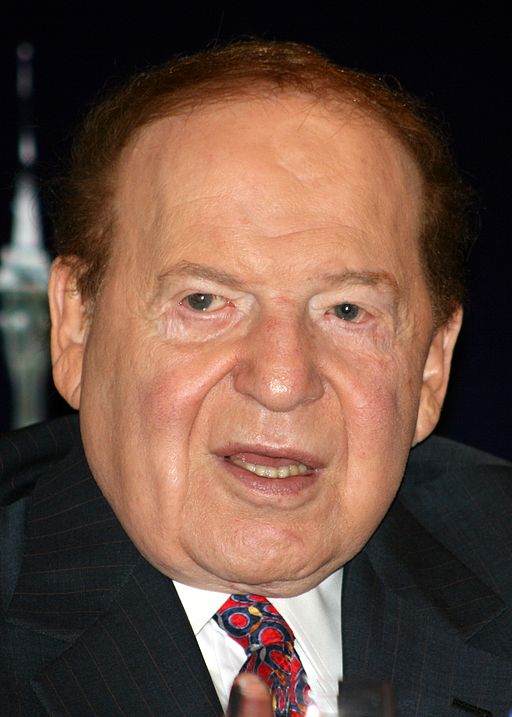

On Sunday, January 18, 2009, as the financial crisis intensified, the Las Vegas Sun ran an article entitled: “Las Vegas Sands: A big rise, a big fall.” The piece chronicled how Las Vegas Sands casino founder and CEO Sheldon Adelson’s personal fortune peaked in 2007 at $28 billion on the strength of his stake in Las Vegas Sands (NYSE:LVS) stock, making him the third richest man in America.

Hudson Executive Capital disclosed on Monday that it bought 143,200 shares of USA Technology (USAT) at $4.46 along with call options giving the fund the right to buy another 1,250,000 shares of stock at $10. The call options expire on Jan. 17, 2020.

Insiders buy market crashes, backing up the truck if their shares get cheap enough. The smartest fund managers can make their year -- even careers -- acquiring great companies at phenomenal bargains during market crashes. True market crashes are rare--black swans. But garden variety "panics" occur fairly...

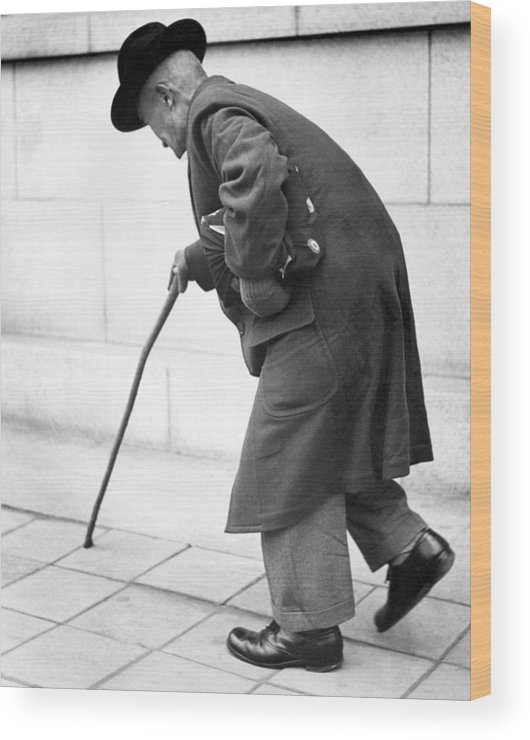

Baron Rothschild purportedly said: “Buy when there’s blood in the streets, even if the blood is your own.” During the financial crisis of 2008-09, investor blood flooded Wall Street – and main street. But for many prescient corporate insiders, buying during the market carnage earned them fortunes. And for investors who had the foresight – and nerve – to follow insiders into these ultra-contrarian investments, the worst of times turned into the best of times.

Bill Stiritz may not have the name recognition of Jeff Bezos, Elon Musk or Warren Buffett, but the 84-year-old Non-Executive Chairman of Post Holdings, Inc. may be one of the greatest CEOs of the last half century.

An investment of $100 made in Ralston Purina in 1981 when Stiritz was named CEO, would have would have been worth $5,700 by 2000 -- a compound annual return of 20%.

A Mellanox (MLNX) insider bought $2.2 million of the Israeli chip designer as fears China will block a proposed merger with Nvidia Corp (NVDA) pushed the price of MLNX well below the buyout price.

Stephen Sanghi, a director of Sunnyvale-based Mellanox since February...

Somewhere, Benjamin Graham is smiling. The father of Value Investing and mentor to Warren Buffett had a favorite investment strategy: Buying “Net-Net” stocks. These are stocks that because of bad markets, bad business, bad luck – or a combination of all three -- are trading for less than the net cash they have in the bank.

BlueLinx insiders bought after their company's stock price was cut in half after a surprise revenue decline.

On Nov. 5, BXC closed at $31. Then came an earnings report showing a significant revenue decline. On Thursday morning BlueLinx (BXC) traded as low as $13.47...

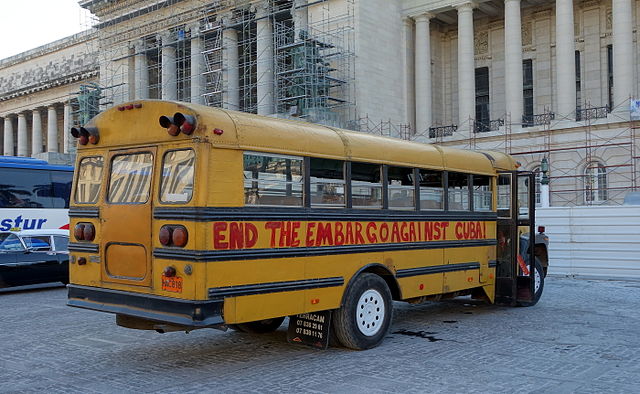

On April 30, Phillip Goldstein disclosed a 9.9976% position in Herzfeld Caribbean Basin Ltd. (CUBA). In a 13D filing, Goldstein said that if the founder and manager of the CUBA closed-end fund was to "dissolve" it, shareholders would gain "about 25%."

Goldstein is...