Hudson Executive Capital disclosed on Monday that it bought 143,200 shares of USA Technology (USAT) at $4.46 along with call options giving the fund the right to buy another 1,250,000 shares of stock at $10. The call options expire on Jan. 17, 2020.

Update: At 5:52 PM on Sept. 26, after the publication of this article, Hudson Executive Capital filed three Form 4s disclosing the purchase of an additional $8.25 million of USAT stock on Sept. 25-26 at an average price of $4.58. The buying increases the hedge fund’s USAT stake to 10.14 million shares, about 16.9% of the stock’s outstanding shares.

In an 8K filed mid-day on Tuesday, USA Technology announced it would miss another deadline to file financial statements with the Securities and Exchange Commission. USAT also disclosed that:

“On September 24, 2019, the Company received a letter from the Nasdaq Hearings Panel (the “Panel”) notifying the Company that as a result of the Company’s failure to regain compliance with its periodic reporting obligations by September 23, 2019, the Panel has determined to delist the Company’s securities from trading on The Nasdaq Stock Market LLC (“Nasdaq”) and will suspend trading in these securities effective at the open of trading on September 26, 2019.”

Hudson Executive Capital is led by former JPMorgan Chase finance chief Douglas Braunstein

Hudson Executive, led by former JPMorgan Chase finance chief Douglas Braunstein, is the beneficial owner of 13.66% of USAT. The $1.2 billion activist hedge fund’s third largest stock holding now trades in the pink sheets, these days called the OTC Markets. That’s where stocks that don’t meet Nasdaq’s minimal financial standards trade. Not a desirable thing if you’re a public company or a big investor in a pubic company.

USAT stock dropped 14.51% on Wednesday, the last trading day before delisting, on volume of 20.49 million, about 55% of the stocks float (freely trading shares). Obviously many investors chose to dump the stock rather than hold a “pink sheeter.” Notably, on it first day trading OTC, USAT shares have rebounded 17% to $5.12 as I write.

USA Technology offers unattended cashless transaction technology for the self-serve retail market. By all accounts, the demand for cashless payment technology is rising, as customers increasingly embrace a cashless world. Based on submitted financials (which the company has said may be inaccurate), USAT’S growth has been impressive. From the company’s 2018 Q3 report, which is the most recent on the company’s website:

- Revenue of $35.8 million, increased 35% year-over-year, marking the 34th consecutive quarter of growth

- On a pro-forma basis, as if the acquisition of Cantaloupe had occurred on July 1, 2016, overall revenue increased 12% year-over-year and License and transaction fee revenue increased 25% year-over-year

- New net connections of 64,000 bring total connections to 969,000

- License and transaction fee revenue of $27.0 million, an increase of 55% year-over-year

- Gross margins of 33.3% increased from 25.0% in third quarter of fiscal year 2017

- License and transaction margin of 40.7% increased from 32.0% in third quarter of fiscal year 2017

USAT has lost over 70% of its value over the last year due to accounting problems

But while business as reported has grown, accounting issues have dogged USA Technologies over the last year, and the stock has lost over 70% of its value. The company’s auditor resigned in February, and USA Tech’s board at that time warned that some financial statements and related statements were not reliable.

In an Aug. 30 8K, USAT disclosed that it had found new accounting problems unrelated to the original internal investigation.

In that report, USAT said it informed a Nasdaq panel that “it was unlikely that the company will regain compliance with its periodic filing requirements by September 9, 2019.” That determination “was due primarily to the remaining analysis required in connection with the historical accounting treatment of [Cantaloupe] leasing/rental contracts,” the filing said. The company determined the amount of finance receivables USAT recorded with the acquisition, $5.1 million, is incorrect, according to the filing.

“These issues are not related to the internal investigation, were recently discovered during the audit process, have caused delays in the audit, and must be resolved by the company in order for the company’s independent auditor to complete its audit procedures,” the filing said. “Certain trade and finance receivables relating to historical customer leasing/rental contracts of Cantaloupe appear to have been double counted on the opening balance sheet, and the company’s sales-type lease accounting policy was not consistently or accurately applied to these contracts subsequent to the date of the acquisition.”

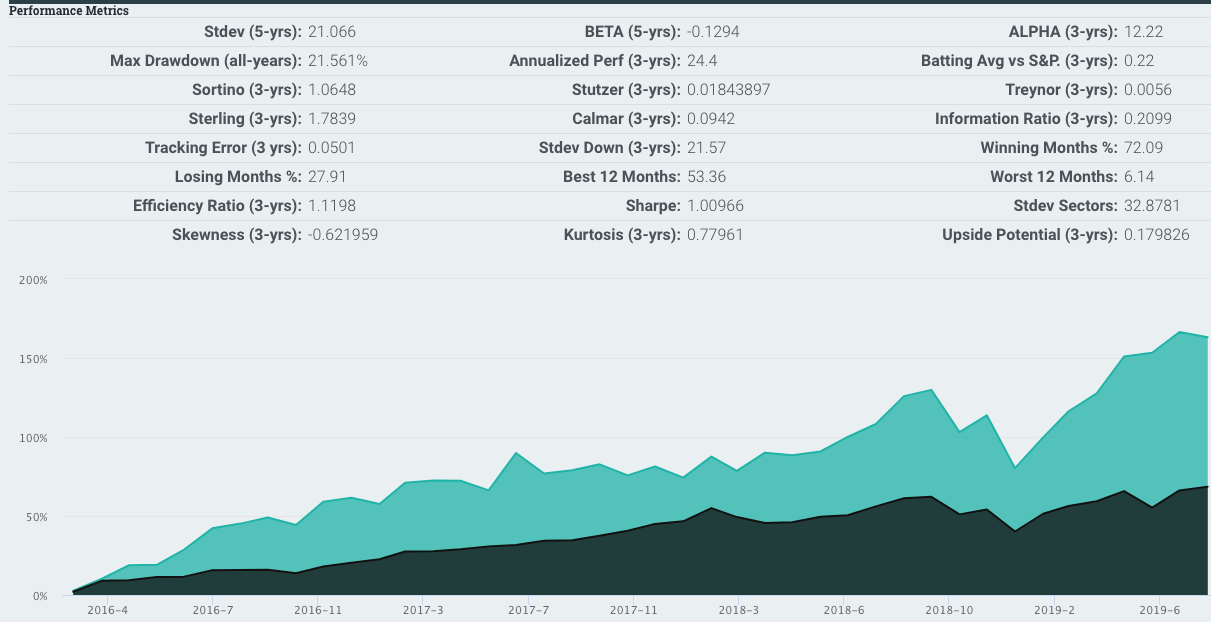

Hudson Executive Capital, USA Tech’s largest shareholder, has an impressive stock picking track record since its inception. An equal-weighted portfolio of its top 10 holdings, rebalanced quarterly, has returned 32.56% annually since the fund’s first 13F was filed in Q1 2016.

Hudson Executive Capital has an impressive stock picking track record

From the hedge fund’s ADV:

“Hudson Executive seeks to identify and invest in securities of public issuers which it believes are undervalued in the marketplace and where value can be unlocked through operational improvement and/or an actionable strategic catalyst, and Hudson Executive can facilitate the creation and implementation of that strategic catalyst by constructively and collaboratively engaging with the company’s management team, board of directors, and/or other shareholders.”

Hudson Executive began buying USAT in Q4 of 2018, after the accounting scandal was well underway. The fund filed an activist 13D on May 20, 2019. WhaleWisdom estimates the average cost of the fund’s 1,078,544 share USAT stake to be $5.49. So not exactly a disastrous trade to this point.

The market views delisting as a negative, though nothing technically changes in terms of a company’s ability to conduct business

How will delisting affect USA Technology? In business terms, its impact will be minimal. Nothing officially changes in terms of the company’s ability to conduct business. And shareholders still have the same ownership stake in the company. Options purchased before delisting continue to trade after.

However, the market generally views delisting as a negative. And of course USAT, with its accounting issues, has already lost the confidence of most investors. Trading liquidity on the OTC market will be less, analyst coverage may dwindle. Institutional investors may also be reluctant to take new positions in pink sheet stocks. Certainly, USAT could fix it’s accounting problems, regain the confidence of investors, and eventually get re-listed on Nasdaq.

Hudson Executive Capital has not made many mistakes over the last five years. It’s possible Douglas Braunstein has something up his sleeve that will unlock the intrinsic value in USAT. But the jury’s still out on whether USA Tech is a winner for the fund or whether it remains mired in the pink sheets.

But by aggressively adding to its stake even after USA Tech’s most recent accounting problems and subsequent Nasdaq delisting, Hudson Executive is sending a message it believes there’s significant value in USAT shares.

Disclaimer:

Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this blog is meant for educational and informational purposes only. Do your own research before investing and don’t risk more than you can afford to lose. This article expresses my own opinions, and I am not receiving compensation for it (other than from WhaleWisdom). If you buy a book after clicking on one of the above links, I may received an affiliate fee. I do not have a business relationship with any company whose stock is mentioned in this article. I or my associates may hold positions in the stocks discussed.