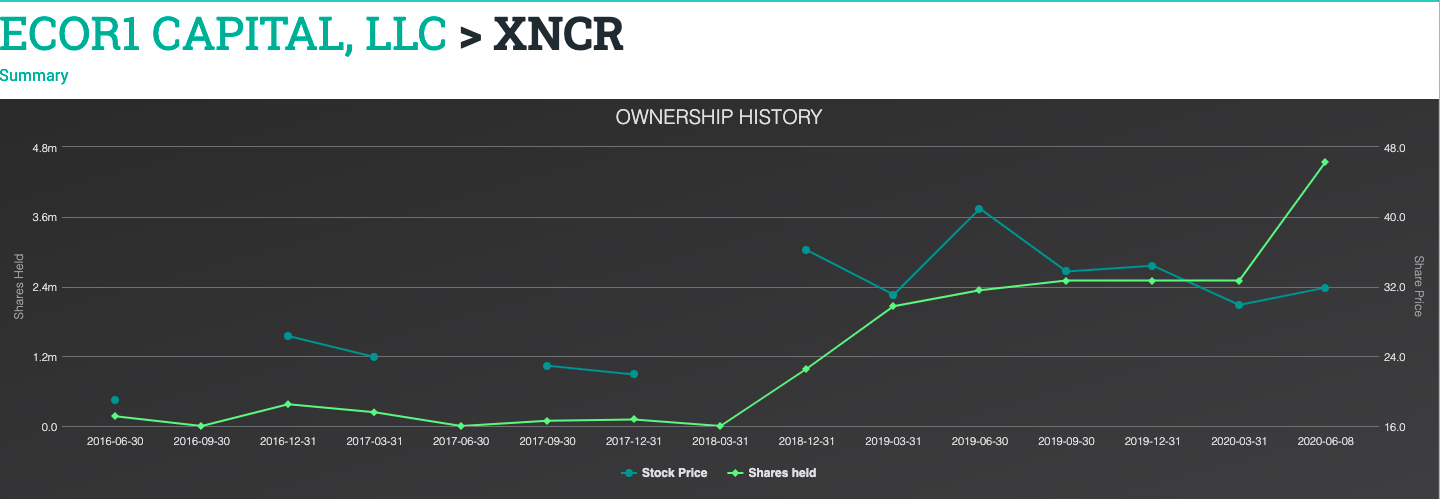

On June 17, EcoR1 Capital filed a 13G on Xencor Inc. (XNCR), disclosing the purchase of over 2M shares. EcoR1 now owns 8% of Xencor. The purchase makes XNCR the #1 position in EcoR1’s $957M 13F portfolio.

Xencor is a clinical-stage biopharmaceutical company developing therapies for the treatment of cancer and autoimmune diseases.

EcoR1 founder and Managing Director Oleb Nodelman is known for taking an unconventional value approach toward Biotech investing. In an April 2018 presentation at the Sohn Conference Nodelman had this to say.

“Investing in Biotech is a horrible idea. Investing in biotech companies is easily in the top 5 of worst ideas, sandwiched somewhere between eating tide pods on one end, and investing in tulips and cryptocurrency on the other.”

He went on to tell attendees that:

- Biotech stock valuations are based on hopes and dreams, and less than 10% of the sector is profitable.

- The underlying science is often complicated and unpredictable.

- When a company is lucky enough to get a drug approved, it has an average of 9 years of exclusivity. So rather than a castle with a moat, they have a melting ice cube.

- Success is often idiosyncratic and not repeatable, so these are not companies that you can buy and hold forever.

EcoR1’s Nodelman: “Investing in Biotech is a horrible idea”… Unless you focus on “opportunities with a discernable margin of safety.”

If Biotech investing is so fraught with difficulties, why does Oleg Nodelman manage $1.31B of client assets by investing in Biotech stocks? In the Sohn Presentation, Nodelman went on to explain his philosophy.

At EcoR1 we start our analysis by focusing on opportunities with a discernable margin of safety based on patterns that we have identified over years of biotech investing experience. In terms of understanding the assets, we are one of the few biotech focused funds not managed by PhDs or MDs, which for us means that we don’t fall in love with the science. Instead we have fluency for the language of biotechnology that serves as a filter. We often invest in companies that are unfollowed, unloved, misunderstood or left for dead that have great downside protection. These are extraordinary companies that have found themselves in an extraordinary time.

One doesn’t often hear “Biotech investing” and “margin of safety” uttered in the same sentence. It seems Oleb Nodelman is making a name for himself as the Warren Buffett or Seth Klarman of biotech investing.

Indeed, things are going quite well for the Ukranian-born Nodelman who founded San Franciso-based EcoR1 Capital in 2013. EcoR1 recently announced it is raising $125M via a blank check IPO. The company will “search for a target business operating in the biotechnology sector.” Here’s the prospectus.

EcoR1 is raising $125M via a blank check IPO, targeting businesses operating in the biotech sector

EcoR1 Capital gets its name from the EcoR1 restriction enzyme found in E. coli, according to SPACInsider. These enzymes are found in bacteria and act as defense mechanisms against invading viruses. Technically, the enzyme cuts up the DNA sequence of the virus, which is useful for scientists experimenting with molecular cloning applications like gene therapy.

EcoR1 now owns 8% of Xencor, a stake initiated in the second quarter of 2016. The recent purchases represent the fund’s first buying of the stock since Q2 2019.

Guggenheim analyst Etzer Darout upgraded Xencor to a buy in February. The analyst set a $44 price target ahead of multiple pipeline updates coming in 2020 he believed were not reflected in the stock price. Near-term pipeline opportunities for the company’s bispecific platform not reflected in the stock included XmAb18087 in neuroendocrine tumors and gastrointestinal stromal tumors as well as three tumor microenvironment programs that are all currently in Phase 1, Darout said in a report. He also saw Xencor’s durable royalty stream and strong cash position providing downside support.

You can follow 13Fs, insider buying and other SEC filings at WhaleWisdom.com.

Contact Mark about investing based on SEC filings and smart money disclosures.

Disclaimer:

This investment blog (the “Blog”) is created and authored by Mark W. Gaffney (the “Content Creator”) and is published and provided for informational and entertainment purposes only (collectively, the “Blog Service”). The information in the Blog constitutes the Content Creator’s own opinions. None of the information contained in the Blog constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. You understand that the Content Creator is not advising, and will not advise you personally concerning the nature, potential, value or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter. To the extent any of the information contained in the Blog may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person.

From time to time, the Content Creator or its affiliates may hold positions or other interests in securities mentioned in the Blog. The Content Creator or affiliates may trade for their own account(s) based on the information presented, and may also take positions inconsistent with the views expressed in its messages on the Blog.

The Content Creator may hold licenses with FINRA, the SEC or states securities authorities. These licenses may or may not be disclosed by the Content Creator in the Blog.

Investing in the investments discussed in the Blog may be risky and speculative. The companies may have limited operating histories, little available public information. The stocks discussed may be volatile and illiquid. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital not required for other purposes, such as retirement savings, student loans, mortgages or education.