Investors who mimicked Hite Hedge Asset Management’s long portfolio on Nov. 15 would have been up 29.49% through Feb 15., making Hite the top hedge fund for Q4.

Established in 2012, Quincy, MA-based Hite Hedge is focused on MLPs in the energy sector. The fund’s 13F portfolio returned 29.49% in the 4th quarter. That performance makes Hite Hedge the top fund for Q4 – at least based on 13F filings. 13Fs are lists of portfolio holdings which must be submitted to the SEC by firms with over $100 million in managed equities. 13Fs must be filed within 45 days of the end of a calendar quarter.

Investors who mimicked Hite Hedge’s long portfolio on Nov. 15 would have been up 29.49% through Feb 15.

An equal weighting of Hite’s top twenty long holdings bought on Nov. 15 last year (when the fund’s Q3-end portfolio was disclosed) would have returned 29.49% through Feb. 15 (when Q4 13Fs were released) — making Hite’s long portfolio the best performing in Q4. The S&P 500’s total return (including dividends) over the same period was 1.1%.

Hite Hedge Asset Management LLC is owned and managed by James Meyers Jampel. The firm began managing assets in 2004, and now has $963 million under management. In addition to Hite Hedge, the firm manages assets via several other partnerships.

NGL Energy was a big Q4 winner for Hite Hedge

A big reason Hite Hedge was the top Q4 fund was its position in NGL Energy Partners (NGL), a holding that first appeared in Hite’s portfolio in Q3 of 2015. On Nov. 15 NGL traded at $9.63. On Feb. 15 the MLP closed at $13.66 – a total return of 46%. An earnings beat and oil price strength helped NGL’s performance.

NGL’s three-month return included a $0.39 dividend. The stock’s trailing twelve-month dividend yield is 11.3%

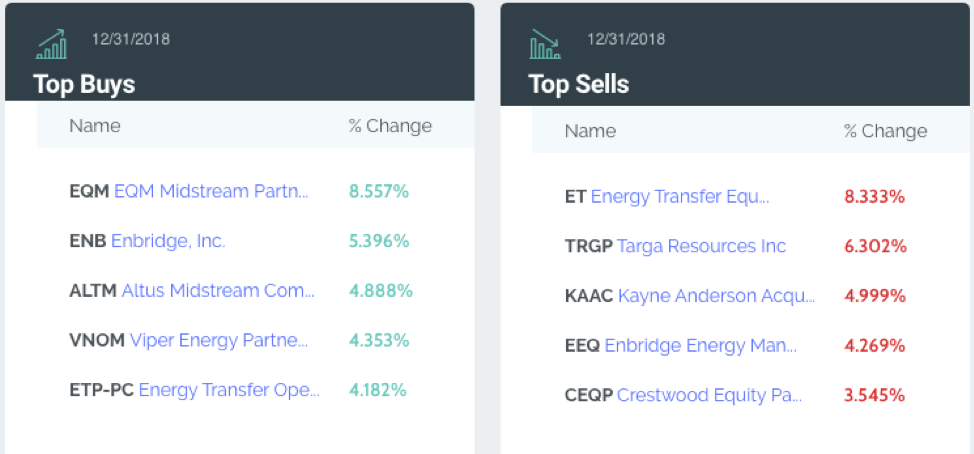

Below were Hite Hedge’s portfolio changes at year-end (long positions only).

Here’s how Hite describes its investment strategy in its ADV part 2 on file with the SEC:

Hite Hedge is focused on relative-value trading of MLPs.

“HITE focuses exclusively on relative-value trading of master limited partnership and related securities (“MLPs”). In our hedged portfolios, where we are both long and short MLPs, we focus on minimizing the risks related to being long MLPs, and attempt to generate returns uncorrelated with any asset class. We also have a long-only unlevered trading strategy in MLPs for investors seeking unhedged exposure to MLPs, using the same value-oriented analysis to identify trading and investing opportunities.”

“MLPs are United States publicly-traded partnerships that receive special tax treatment from legislation passed by Congress in 1986 and 1987. Two implications of these laws are that, for tax reasons, most institutional investors avoid MLPs, and for regulatory reasons, mutual funds and ETFs cannot have more than 25 percent of their portfolio invested in MLPs without suffering deleterious tax consequences.

Hite believes investor fixation on yields creates mis-pricings and opportunity in MLPs.

“Without typical institutional interest and ownership, HITE believes the primary market for MLPs is United States investors attracted more by MLP “yields” rather than by an understanding of MLP fundamentals; thereby creating frequent mis-pricings in the sector. HITE also believes these specific circumstances unique to MLPs, set in motion by the tax legislation and now including upwards of 100 companies with over $380 billion in market flotation having elected MLP status, creates a good environment for relative-value trading.”

It should be noted that hedge funds must only report equity holdings in 13F portfolio disclosures. That means short positions, and some derivative holdings, are not reflected in 13Fs. That means the returns experienced by Hite’s fund investors could be more or less than the long-only portfolio.

Hite Fund has been adding to its big holding, Falcon Minerals (FLMN)

Hite’s largest holding is Flacon Minerals Corp. (FLMN) with a beneficial interest of over 14%. Hite disclosed via Form 4 filings buying 113,000 shares on Feb.1 – Feb. 6 at an average price of $8.23. Falcon Minerals is an oil & gas minerals company which owns mineral rights positions in the prolific Eagle Ford Shale in south Texas. FLMN closed at $8.00 on Feb. 15, down about 6% year-to-date.

Hite Hedge Asset Management LLC holdings as of 12-31-18.

| Stock | Symbol | Type | Shares Held | Market Value | % of Portfolio | Ranking | Change in shares | % Change in shares |

| Flacon minerals corp | FLMN | Stock | 6,429,479 | 54,651,000 | 9.56% | 1 | 2,220,598 | 52.76% |

| Eqm midstream partners | EQM | Stock | 1,156,252 | 50,008,000 | 8.75% | 2 | 1,132,852 | 4841.25% |

| Viper energy partners lp | VNOM | Stock | 1,735,295 | 45,187,000 | 7.91% | 3 | 1,195,378 | 221.40% |

| Enbridge inc. | ENB | Stock | 992,357 | 30,842,000 | 5.40% | 4 | 992,357 | new |

| Altus midstream | ALTM | Stock | 3,614,271 | 27,938,000 | 4.89% | 5 | 3,614,271 | new |

| Cnx midstream partners | CNXM | Stock | 1,704,529 | 27,750,000 | 4.86% | 6 | -71,269 | -4.01% |

| Ngl energy partners | NGL | Stock | 2,874,730 | 27,569,000 | 4.82% | 7 | 666 | 0.02% |

| Energy transfer lp | ETP-PC | Stock | 1,809,331 | 23,901,000 | 4.18% | 8 | 1,809,331 | new |

| Cheniere energy | LNG | Stock | 334,306 | 19,788,000 | 3.46% | 9 | 73,897 | 28.38% |

| Cvr refining lp | CVRR | PUT | 8,689 | 19,257,000 | 3.37% | 10 | -31 | -0.36% |

Disclaimer: Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this post is meant for educational and informational purposes only. I or my affiliates may hold positions in securities mentioned in the article.