Twenty-two minutes after regular market hours closed on July 2, an Orbimed Advisors Form 4 relating to Corvus Pharmaceuticals Inc (CRVS) was posted on the SEC’s website. The hedge fund, a 10%+ holder and insider in CRVS, disclosed that between June 27 and July 1 it had bought 657,344 shares of CRVS stock on the open market at an average price of $3.72. The acquisition increased Orbimed’s position in the biotech stock from 20.38% to 22.60%.

This filing seemed insignificant to most investors who happened to notice — just another SEC filing among hundreds that day. A tiny $2.44 million purchase by a hedge fund with $14.9 billion under management. After the buying, Corvus Pharmaceuticals was only the 65th largest holding in Orbimed’s portfolio.

If you bought CRVS on the morning after the Orbimed Form 4 filing, you could have doubled your money in 5 days.

However, if you bought CRVS on the morning after the Orbimed Form 4 filing, you could have doubled your money over the next five trading days. A 100% return in a week. Crazy. Why did this happen? What were the factors that caused this sudden surge in CRVS stock? Were there precipitating conditions that we can identify and watch for in future trade setups?

Even if you are a long-term investor, it’s worthwhile to study this phenomena. What a great problem to have, deciding whether to take a quick double, or to hold on for much higher prices…

It’s difficult to explain the behavior of a securities’ price over the short term. Stock price movements are substantially random. The Madness of Crowds is highly unpredictable.

That being said, a confluence of factors can make the odds of an explosive upward move more likely. While we can’t predict if or when a forest fire will break out, we can identify conditions like tinder-dry vegetation, hot weather, high winds, etc. that will accelerate a wildfire should a match get tossed into the undergrowth.

Factors coinciding with the sudden post filing surge in Corvus shares:

A compelling bullish story was emerging for Corvus Pharmaceutical .

If there is a bullish narrative on a stock, the purchase by a Whale like Orbimed is likely to give credence to the story. In the case of Corvus, Orbimed’s buying came after a significant presentation by Corvus Management that a turnaround could be in the works for this small biotech company. After an extended decline in its share price, Corvus could be perceived as a biotech bargain.

Corvus is a thinly-traded small cap stock.

Corvus Pharmaceutical is a clinical-stage biotech company with a market cap of just $160 million. In the 50 days before Orbimed’s July 2 filing, CRVS averaged just 65,000 shares traded per day. A sudden influx of demand is likely to cause a spike in the company’s share price.

High short interest provided fuel for a fire…

At the time of Orbimed’s Form 4 filing, the short interest on CRVS was 1.28 million shares. That’s about 6.5% of the stock’s float, or free trading shares. With average daily volume of about 65,000 shares, the short interest ratio or “days to cover” was about 19. That’s high–lots of shortsellers were expecting lower prices. A short squeeze occurs when investors who have borrowed shares to facilitate short positions are forced — often by their broker — to cover at the market. CRVS short sellers were likely caught in a short squeeze driven by forced buying of short positions combined with speculative buying by long investors.

The biotech sector was “risk on!”

If we use S&P Biotech ETF (XBI) as a proxy for the biotech sector, it’s apparent that biotech was in rally mode. On the fear–greed continuum, investors were feeling greedy –it was risk on! XBI had recently moved above both its 50 and 200 day moving averages. This suggests positive momentum for biotech stocks. In a more risk-averse environment for biotech, investors would be less inclined to chase price momentum.

A “Whale” — Orbimed Advisors — signaled value in the shares by disclosing a purchase.

Way back when, there was a famous television commercial that went: “When E.F. Hutton speaks, people listen.” Hutton was a big broker, and the slogan suggested its opinions were highly valued. Undoubtedly, some players in the investment world are exceptionally influential. Orbimed Advisors may not be a household name, but the firm is a powerhouse in the health care venture capital, private equity and hedge fund universe. Of the 543,783 filers in the WhaleWisdom data base, Orbimed is the 56th most popular.

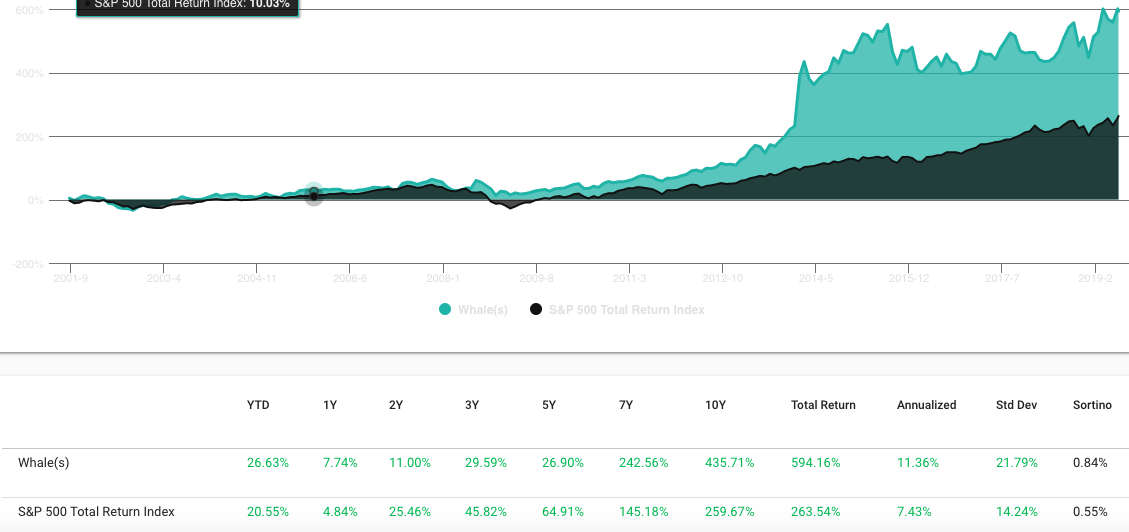

Below is the performance of Orbimed’s 13F positions since 2001.

So, when Orbimed Advisors initiates, or adds to a position, many of investors take note. This is particularly true when it comes to the biotech sector where investors rely on the expertise of experts when making decisions. They know Orbimed has done extensive research, and has a track record of picking winning positions. Investors are inclined to follow Orbimed into a new or increased position.

Conditions were ripe for a jump in CRVS’ share price. The Form 4 filing by Orbimed was the spark that ignited an explosive move.

Disclaimer:

Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this blog is meant for educational and informational purposes only. Do your own research before investing and don’t risk more than you can afford to lose. This article expresses my own opinions, and I am not receiving compensation for it (other than from WhaleWisdom). If you buy a book after clicking on one of the above links, I may received an affiliate fee. I do not have a business relationship with any company whose stock is mentioned in this article. I or my associates may hold positions in the stocks discussed.