James Zarley, a Texas Roadhouse Inc. (TXRH) insider since 2004, filed a Form 4 disclosing the purchase of 18,900 shares of TXRH on May 1 at $52.91. The long-time director's $992K purchase was a reversal -- Zarley sold 10,900 shares of the steakhouse chain in February of 2018.

Zarley is a former CEO and...

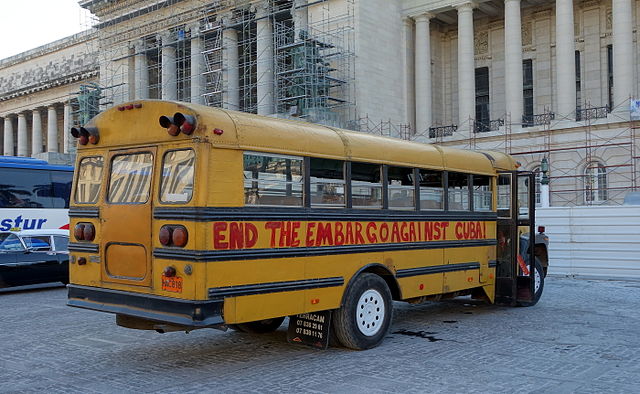

On April 30, Phillip Goldstein disclosed a 9.9976% position in Herzfeld Caribbean Basin Ltd. (CUBA). In a 13D filing, Goldstein said that if the founder and manager of the CUBA closed-end fund was to "dissolve" it, shareholders would gain "about 25%."

Goldstein is the co-founder and principal of Bulldog Investors, an activist hedge...

Archer Daniels Midland (AMD) insiders made significant buys after ADM reported a $60 million drop in first-quarter profit due to the "bomb cyclone". The CEO and CFO of the food conglomerate teamed-up to buy $1.26 million of stock into post-earnings price weakness.

On Friday ADM closed at $40.82, down 2%, after the...

Camping World Holdings (CWH) shares plunged last week following a report that CEO Marcus Lemonis was accused of illegal insider trading. However, one of CWH's largest shareholders bought into the price weakness, adding aggressively to its position.

Marcus Lemonis is CEO of Camping World, and host of the CNBC program 'The Profit'....

A.H. Belo (AHC) was the target Wednesday afternoon of a 13D filing by Minerva Advisors LLC. The hedge fund disclosed a 5.1% activist ownership position in the publisher of the Dallas Morning News, and said the company should go private. From the 13D filing:

the Reporting Persons believe it is time to engage...

RA Capital Management leads the pack when it comes to health care stock selection. Since 2008, an equal-weight portfolio of the Boston-based hedge fund's top ten 13F positions would have averaged a 37.05% annual return. So, when RA Capital adds to a position, it pays to investigate.

That's why a Form 4 filed...

The best performing hedge funds are often ones you haven't heard of. You're not doubt familiar with Berkshire Hathaway and Bridgewater Associates. But you probably don't know Casdin Capital or King Street Management.

While investors fawned over Bridgewater's 14.6% gain in 2018, more obscure managers of smaller funds -- like...

Michael Burry bought Tailored Brands at $13 in Q4 2018. But over four months later, a TLRD insider bought the tumbling stock at $7.41.

Tailored Brands (TLRD), a top Q4 holding of Michael Burry's Scion Hedge Fund, spiked higher Tuesday after a corporate insider disclosed buying $100K of the beaten-down stock. As of mid-day,...

Garelick Capital Partners isn't exactly a household name in the Hedge Fund world. But that may change if the Boston-based hedge fund maintains its torrid performance.

Based on the returns of 13F holdings through Q4's end, the Boston-based hedge fund is one of the top performers in the WhaleWisdom.com data base. Garelick's equal-weight WhaleScore...

James Simons' Renaissance Technologies is possibly the most successful hedge fund in history. Renaissance's Medallion fund, available only to the firm's employees, has reportedly generated returns of almost 80% a year before fees since inception in 1988. After a 5% management fee and 44% performance fee, that's still about 40% a year.

Renaissance Technologies'...