Perceptive Advisors’ Neptune Wellness Solutions (NEPT) position increased by 50% during the 3rd quarter of 2019, to 4.5 million shares. The stake represents 14.53% of the Cannabis extraction company’s outstanding shares. NEPT was Perceptive Advisors’ #20 position at Q3 close.

The increase in Perceptive’ Advisors’ Neptune Wellness stake came amidst a terrible 2019 for Cannabis stocks in general. Since March, the North American Marijuana Index has lost nearly 2/3 of its value. The high water mark for speculation in the Cannabis sector came shortly after beverage giant Constellation Brands increased its stake in Canadian marijuana grower Canopy Growth by $4 billion in August of 2018.

Since then it’s become obvious that while the legal cannabis market is a huge growth industry — growing at 26.7% annually — it’s possible to lose lots of money speculating on public companies seeking to profit from the marijuana “boom,” and trading at dot-com-like valuations. The truth is, no one knows with any certainty what the cannabis landscape of the future will look like. When cannabis becomes legal at the federal level in the U.S., many, if not most, of the small public companies currently trading will probably be out of business. How does one pick winning companies in this sector given the uncertainty?

One way to zero-in on attractive publicly-traded cannabis stocks is to follow the investments made in the sector by well-informed fund managers. Presumably, professional investors who devote considerable resources researching the cannabis space will have insights into the best investments.

Joseph Edelman’s Perceptive Advisors in one of the leading hedge funds focused on the health care sector.

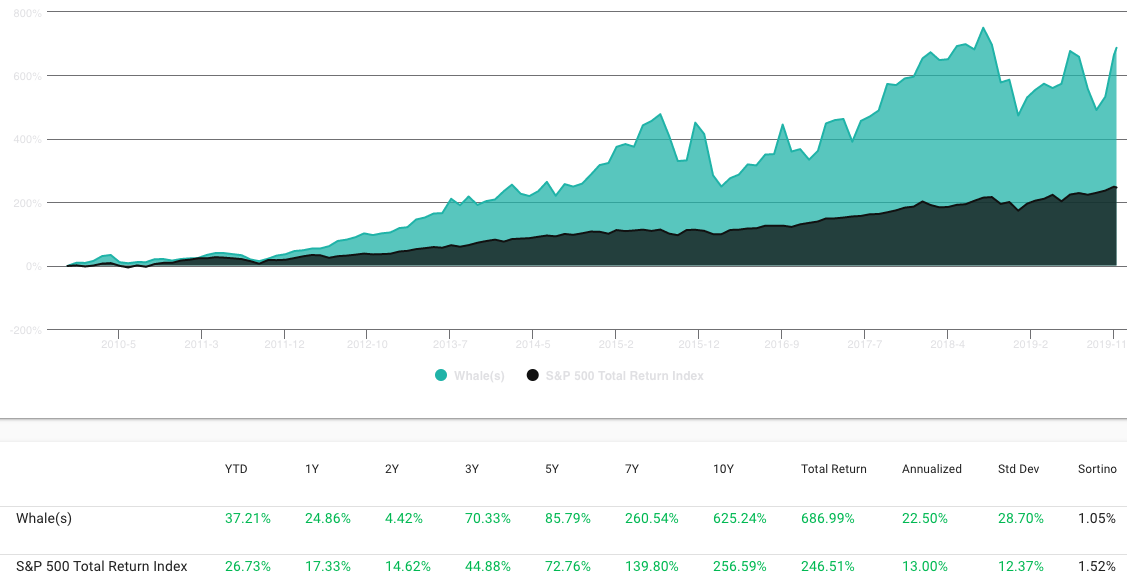

Perceptive Advisors, managed by Joseph Edelman, certainly qualifies as one of the top biotech hedge funds, if not one of the top hedge funds in general. Over the last decade an equal-weighted portfolio of Perceptive’s top 20 13F positions returned 22.50% annualized vs the S&P 500’s total return of 13.00% annualized. Year-to-date Perceptive’s long portfolio is up 37.21%

It’s significant that Perceptive Advisors’ Neptune Wellness stake is a top 20 holding. Edelman’s expertise is investing in risky small- and midcap biotech and medtech companies. These development stage companies’ fortunes often hinge on a single drug or technology that takes years to develop and can be crushed by a Food and Drug Administration rejection.

From Perceptive Advisors ADV Part 2:

The Advisor’s portfolio manager, Joseph Edelman, and his team of analysts use their substantial scientific, technical and investment expertise to identify opportunities to exploit relative value disparities and inefficiencies that exist on both the long and short side of the market. While most other Wall Street biotechnology analysts typically cover only the largest 20-30 companies in this industry, the Advisor’s analysts also focus on the remaining smaller, more inefficiently priced 300 or more companies. In addition, an active risk management style, a low amount of leverage, and the team’s focus on original investment ideas and research, primarily sourced in-house, contribute significantly to the Client Accounts’ unique value.

Neptune Wellness Solutions has contracts to extract cannabinoids for some of the largest marijuana producers.

Neptune Wellness Solutions provides extraction services to purify cannabinoids and isolate cannabinoid-containing resins from the raw plants. Neptune’s core operations revolve around the extraction and purification of various cannabinoids — including cannabidiol (CBD) — from cannabis plants. CBD, derived from legal hemp plants, is one of the hottest segments of the cannabis market. Some estimate sales of CBD products will reach $20 billion by 2024.

However, Neptune’s cannabinoid extraction business has yet to turn a profit. The company posted a negative gross profit for its Q1 2020. Net loss was CA$6.4 million, slightly worse than the CA$4.8 million net loss it recorded in the previous quarter.

Neptune does have long-term contracts with some of the largest marijuana producers, which could drive substantial revenue growth in the coming years. The company is currently ramping up its extraction capacity in both the U.S. and Canada, and these efforts might pay dividends in the future. According to the company, “We estimate that, based on a conservative capacity utilization scenario of 50%, our two facilities could support in excess of $450 million in annual revenues.”

Perceptive Advisors’ Neptune Wellness stake ranks the company among the fund’s top positions. However, it should be noted that Edelman has only spent 1.3% of his long portfolio on NEPT stock. The takeaway for investors should be this: Don’t bet the farm on speculative cannabis investments. And diversify when investing in small cap companies.

Below are cannabis-related public companies with 13F holdings of at least $1 million. The data is from 13F filings as of Q3 end. NEPT’s 13F holdings rank third on the list, behind only GW Pharmaceuticals (GWH) and Innovative Industrial Properties (IIPR).

Cannabis-related stocks ranked by hedge fund holdings. Source: WhaleWisdom.com

| Symbol | Company | Recent Price | $ Market Cap | Q3 13F shares | Q2 13F shares | % Change | HF $ Holdings |

| GWPH | GW Pharmaceuticals Plc | 100.15 | 3.09B | 5,023,000 | 3,893,000 | 29.03% | $ 503,053,450 |

| IIPR | Innovative Industrial Properties Inc. | 72.75 | 854B | 566,075 | 555,057 | 1.99% | $ 41,181,956 |

| NEPT | Neptune Wellness Solutions Inc. | 2.79 | 257M | 14,049,000 | 9,690,000 | 44.98% | $ 39,196,710 |

| CGC | Canopy Growth Corporation | 18.68 | 6.47B | 1,542,000 | 2,434,000 | -36.65% | $ 28,804,560 |

| ACB | Aurora Cannabis Inc. | 3.22 | 2.55B | 5,978,000 | 5,260,000 | 13.65% | $ 19,249,160 |

| TLRY | Tilray Inc. | 18.25 | 1.83B | 958,223 | 566,300 | 69.21% | $ 17,487,570 |

| CRON | Cronos Group Inc. | 6.72 | 2.30B | 2,573,000 | 2,819,000 | -8.73% | $ 17,290,560 |

| HEXO | HEXO Corp. | 2.76 | 529M | 2,640,000 | 3,896,000 | -32.24% | $ 7,286,400 |

| APHA | Aphria Inc. | 4.69 | 1.18B | 1,377,000 | 1,068,000 | 28.93% | $ 6,458,130 |

| OGI | Organigram Holdings Inc. | 3.42 | 405M | 1,776,000 | 3,175,000 | -44.06% | $ 6,073,920 |

| CURLF | Curaleaf Holdings Inc. | 7.65 | 2.06B | 180,203 | 247,330 | -27.14% | $ 1,378,553 |

| GTBIF | Green Thumb Industries Inc | 11 | 1.07B | 122,340 | 161,481 | -24.24% | $ 1,345,740 |

| HRVSF | Harvest Health & Recreation Inc – Ordinary Shares (Sub Voting) | 3.29 | 713M | 330,000 | 401,541 | -17.82% | $ 1,085,700 |

Contact Mark about investing based on SEC filings and smart money disclosures.

Disclaimer:

This investment blog (the “Blog”) is created and authored by Mark W. Gaffney (the “Content Creator”) and is published and provided for informational and entertainment purposes only (collectively, the “Blog Service”). The information in the Blog constitutes the Content Creator’s own opinions. None of the information contained in the Blog constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. You understand that the Content Creator is not advising, and will not advise you personally concerning the nature, potential, value or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter. To the extent any of the information contained in the Blog may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person.

From time to time, the Content Creator or its affiliates may hold positions or other interests in securities mentioned in the Blog and may trade for their own account(s) based on the information presented. The Content Creator may also take positions inconsistent with the views expressed in its messages on the Blog.

The Content Creator may hold licenses with FINRA, the SEC or states securities authorities and these licenses may or may not be disclosed by the Content Creator in the Blog.

Investing in the investments discussed in the Blog may be risky and speculative. The companies may have limited operating histories, little available public information, and the stocks they issue may be volatile and illiquid. Trading in such securities can result in immediate and substantial losses of the capital invested. You should use invest risk capital, and not capital required for other purposes, such as retirement savings, student loans, mortgages or education.