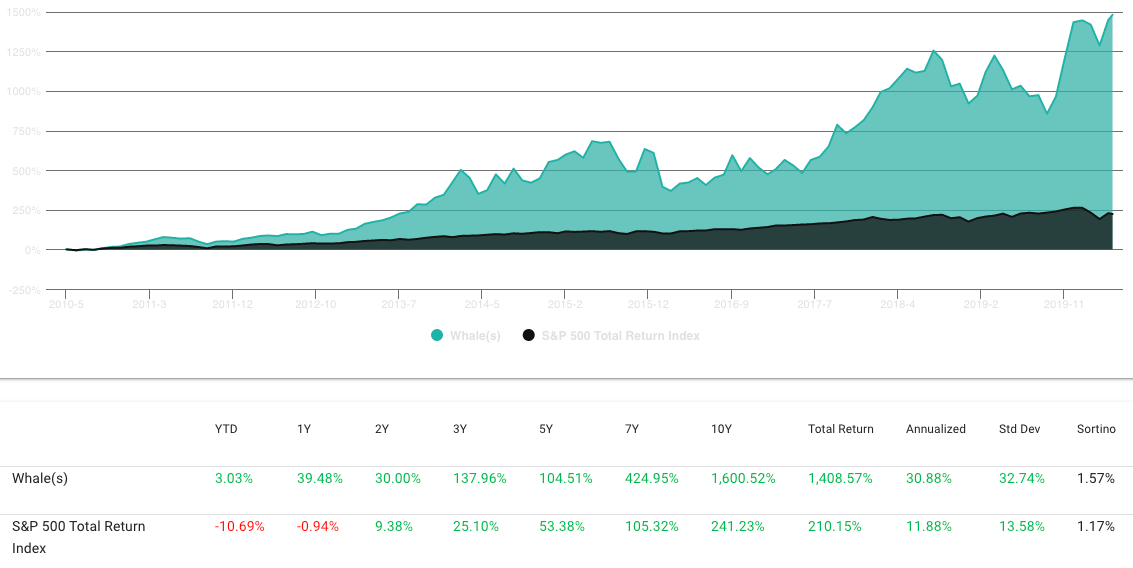

RA Capital has outperformed all other healthcare hedge funds over the past decade, based on 13F holdings. In fact, RA’s 30.88% annualized return of it’s equal-weighted top 20 long portfolio led all other hedge funds over that period. So, when RA manager Peter Kolchinsky discloses portfolio changes, investors may want to pay attention. RA Capital’s Q1 portfolio disclosed yesterday shows that Kolchinsky reduced or closed-out only 8 stocks of the 41 held at the end of Q4. Meanwhile he established or added to 25 positions.

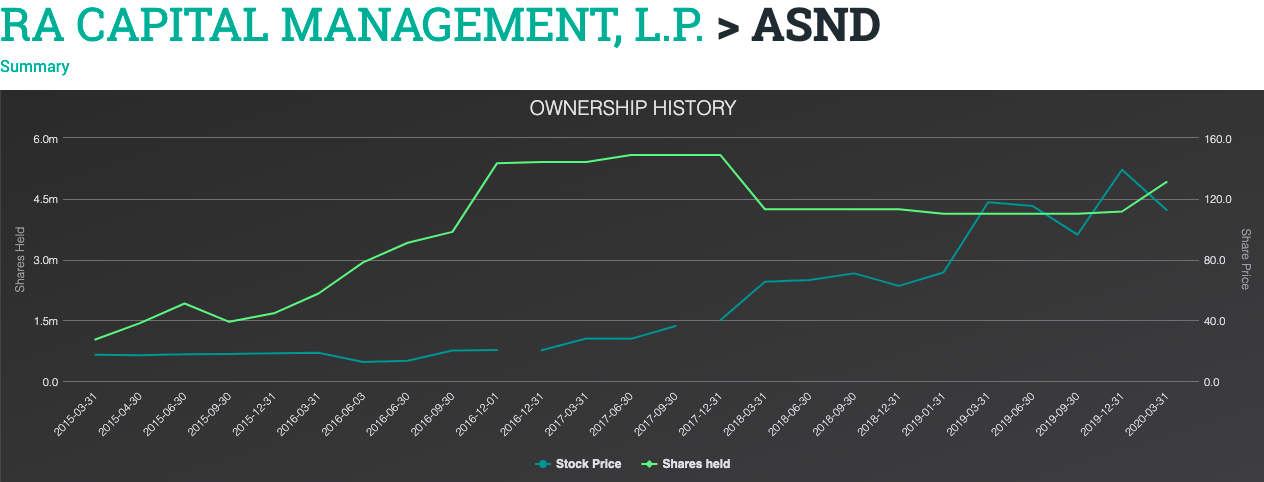

RA Capital’s #1 position is Ascendis Pharma. Up 800% since bought in 2015.

RA’s top position is Ascendis Pharma (ASND), representing 17.48% of RA’s portfolio. ASND is a biopharmaceutical company focused on extended-release technology. The stock was first disclosed as a RA holding in Q1 of 2015, when it traded at just over $17. The stock closed at $139.9 on May 15. Much of the holding’s $553M value reflects appreciation, but Kolchinsky did add to the position last quarter for the first time since Q3 2016.

The hedge fund’s top holding as of Q4 2019 was Synthorx Inc. (THOR) at 20.61% of the portfolio. However, RA closed the position in Q1 as the company was bought out by Sanofi SA (SNY).

Possibly most interesting in RA Capital’s Q1 portfolio, are the multiple new positions added by the fund during the hyper-volatile quarter which saw the S&P 500 drop over 35% in just a month. It’s a good bet that, given RA’s impressive history of picking health care stocks, many of these new holdings will be big winners. Indeed, many of them have already appreciated significantly since March 31.

RA Capital’s new positions — Q1 2020.

| Stock | Symbol | Shares Held | Market Value | % of Portfolio | Ranking | % Ownership | Avg Price |

| Exelixis inc | EXEL | 4,524,961 | 77,920,000 | 2.46% | 15 | 1.48% | 17.77 |

| Avalanche biotechnologies inc | ADVM | 7,272,714 | 71,054,000 | 2.24% | 17 | 9.13% | 9.77 |

| Black diamond therapeutics inc. | BDTX | 2,589,904 | 64,618,000 | 2.04% | 19 | 7.21% | 22.93 |

| Verastem inc | VSTM | 18,604,651 | 49,116,000 | 1.55% | 23 | 11.73% | 24.95 |

| Gilead sciences inc. | GILD | 548,000 | 40,968,000 | 1.29% | 25 | 0.04% | 11.75 |

| Arcutis biotherapeutics inc. | ARQT | 1,165,184 | 34,722,000 | 1.10% | 28 | 3.06% | 12.37 |

| Adaptimmune therapeutics plc adr | ADAP | 12,541,888 | 34,114,000 | 1.08% | 29 | 9.64% | 28.47 |

| Trillium therapeutics inc | TRIL | 6,361,446 | 25,700,000 | 0.81% | 32 | 7.69% | 2.64 |

| Imara inc | IMRA | 1,454,348 | 23,313,000 | 0.74% | 34 | 8.77% | 36.81 |

| Compugen ltd | CGEN | 2,957,434 | 21,471,000 | 0.68% | 35 | 3.85% | 74.76 |

| Immunogen inc. | IMGN | 5,166,303 | 17,617,000 | 0.56% | 36 | 2.96% | 13.03 |

| Novocure ltd | NVCR | 259,099 | 17,448,000 | 0.55% | 37 | 0.26% | 7.21 |

| Concert pharmaceuticals inc | CNCE | 1,858,474 | 16,429,000 | 0.52% | 38 | 6.27% | 29.80 |

| Passage bio inc. | PASG | 322,630 | 5,081,000 | 0.16% | 42 | 0.70% | 2.72 |

| Uniqure n.v. | QURE | 82,180 | 3,899,000 | 0.12% | 43 | 0.19% | 28.16 |

| Selecta biosciences inc | SELB | 870,633 | 2,098,000 | 0.07% | 46 | 1.01% | 10.74 |

| Insmed inc | INSM | 87,405 | 1,401,000 | 0.04% | 47 | 0.10% | 4.04 |

| Vericel corp | VCEL | 100,000 | 917,000 | 0.03% | 48 | 0.22% | 29.17 |

You can follow insider buying and other SEC filings at the SEC’s Edgar website or at sites like WhaleWisdom.com.

Contact Mark about investing based on SEC filings and smart money disclosures.

Disclaimer:

This investment blog (the “Blog”) is created and authored by Mark W. Gaffney (the “Content Creator”) and is published and provided for informational and entertainment purposes only (collectively, the “Blog Service”). The information in the Blog constitutes the Content Creator’s own opinions. None of the information contained in the Blog constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. You understand that the Content Creator is not advising, and will not advise you personally concerning the nature, potential, value or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter. To the extent any of the information contained in the Blog may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person.

From time to time, the Content Creator or its affiliates may hold positions or other interests in securities mentioned in the Blog and may trade for their own account(s) based on the information presented. The Content Creator may also take positions inconsistent with the views expressed in its messages on the Blog.

The Content Creator may hold licenses with FINRA, the SEC or states securities authorities and these licenses may or may not be disclosed by the Content Creator in the Blog.

Investing in the investments discussed in the Blog may be risky and speculative. The companies may have limited operating histories, little available public information, and the stocks they issue may be volatile and illiquid. Trading in such securities can result in immediate and substantial losses of the capital invested. You should use invest risk capital, and not capital required for other purposes, such as retirement savings, student loans, mortgages or education.