Lottery ticket stocks are equities perceived by investors to provide a small chance of a huge payoff. Like playing the lottery, many investors find these stocks — usually low-priced, thinly traded with little or no earnings — very alluring. However, studies show that — like the lottery — gambling on lottery ticket stocks isn’t profitable. These stocks are typically losers.

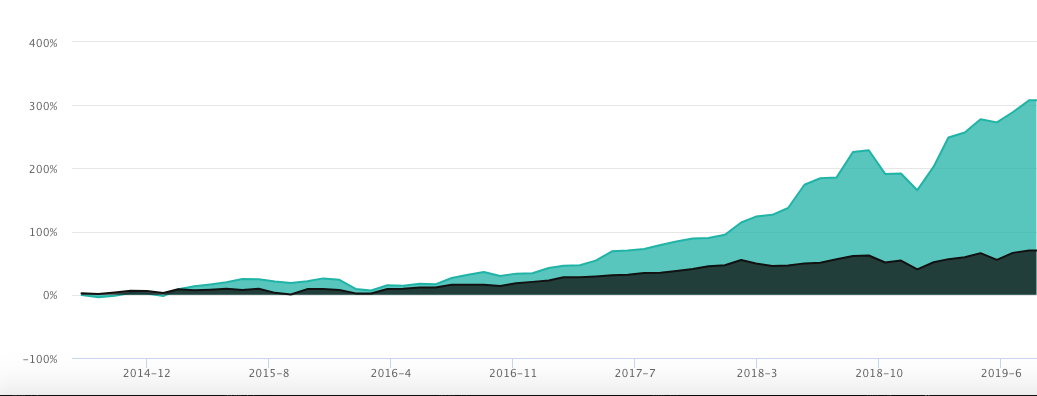

But a few low-priced stocks of unseasoned or abandoned companies do in fact become big winners. A hypothetical portfolio of “lottery ticket stocks,” held in the 13F portfolios of top hedge funds returned 61% annually over the last five years (below). If you want to speculate on lottery ticket stocks — and consistently make money — you may want to copy the moves of professional managers when they buy speculative stocks.

The lottery is like a money toilet — the more you play, the more you’ll flush.

Now I’m not big on playing the lottery. I can’t even remember the last time I bought a lottery ticket. What’s the point? You’re more likely to get struck by lightning, attacked by a shark and hit by a meteorite at the same time than win the big Powerball jackpot. And lottery tickets with smaller, more frequent payoffs are like a money toilet — the more you play, the more you’ll flush.

Yet huge sums are spent on lottery tickets — $80 billion in the U.S. alone last year. Clearly, people love gambling on lottery tickets, even though the odds of winning are daunting. How do we explain people’s attraction to betting “strategies” that almost assuredly have a negative expectation of profit? Here are some explanations:

Playing the lottery is entertainment.

We’re happy to spend $5 for 20 seconds of irrational hope, for the pleasure of dreaming about what might happen if we’d suddenly won millions of dollars. It’s escapism. And it can be social: It’s fun to share stories over the water cooler about “what I’ll do when I hit it big.”

People get a rush from gambling.

Depending on how stimulating the “big winner” fantasy is, a lotto player likely gets a dose of “gambler’s high.” Chemicals, including dopamine and endorphins, flow into the brain when the gambler plays the lottery. For many people the chemical stimulation becomes a problem — gambling addiction is very similar to drug addiction.

Humans are terrible with probabilities.

We evolved on the plains of Africa where risk and emotion were often intertwined. When confronted by a lion — a risky event — the emotional part of the brain takes over and floods us with adrenaline. This “fight or flight” response is activated in modern gamblers (and traders), and overrides the logical brain. We are hard-wired to be impulsive, not logical, when presented with risk.

People don’t take gambling seriously — even though they may “invest” substantial capital in it.

If you’re getting into, say, the restaurant business, you’d devise a business plan and analyze your likelihood of profit. But when allocating capital to their gambling “business,” people have minimal or no plans, and shoot wildly from the hip.

Of course, investing can be gambling. The “Wall Street Casino” is a well worn metaphor. Without a doubt, the lottery ticket mentality of “the big, quick profit” is pervasive among many investors. This helps to explain why 95% of short-term traders are said to lose money.

The basic difference between gambling and investing is that the latter has a positive expectation. Keep gambling with poor odds and you’ll eventually go broke. Invest consistently with a positive expectation and you’ll eventually get rich.

Do you like playing the lottery & gambling? The Lottery Ticket Stocks Portfolio might be just as exciting — and actually make money

So, for those of us who love to gamble, who like like the “action” of playing games of chance or buying lottery tickets, why not take gambling to the next level? Why not get your gambling “fix”, but do it with a strategy that has a good chance of being profitable over the long term?

Here is the basic Lottery Ticket Stock (LTS) strategy:

Identify small cap “lottery ticket-like” stocks disclosed quarterly in the 13F portfolios of the very best hedge fund managers. We’re looking for: Stocks that have the highest risk-reward payoffs. We want stocks that could be four-baggers, 10 baggers or more. These are likely to be smaller cap stocks with considerable or even extreme volatility.

Manage a portfolio of lottery ticket stocks vetted by elite managers

For our ideas, we’ll pick the brains of the 50 smartest, top performing hedge fund managers. With help from WhaleWisdom’s 13F Backtester, we’ll manage a portfolio of higher risk stocks, “vetted” by these elite managers. Top hedge funds often spend millions on research — if they hold a “lottery ticket stock” in their portfolio, we can assume the company has real potential, and is not some pump-and-dump penny stock.

We’ll choose the 20 small cap stocks most held by the top 50 funds. 46 days after the end of every quarter we recalculate the top 20 and rebalance accordingly. Some holdings might persist for years, others for just three months.

Initially I looked at the smallest stocks — those with less than $250 million market cap. But including slightly larger stocks in the portfolio actually was more profitable when tested. Including stocks with market caps under $10 billion tested best. This suggests to me that professional HF managers rarely buy the most speculative micro-cap stocks. These guys are pros — they don’t buy junk.

Nonetheless, as you can see in the portfolio held on May 16, based on Q1 13F holdings, there are plenty of speculative names — and a couple multi-baggers. The next portfolio rebalance will be August 16, when Q2 13F filings must be filed.

Lottery Ticket Stocks portfolio entered 5-16-19

| Stock | % of Portfolio | Total Return | Original Purchase Date |

| SWI SolarWinds Corp | 5.00% | -7.39% | 5/16/19 |

| ZEN Zendesk Inc | 5.00% | 222.32% | 8/15/17 |

| RNG Ringcentral Inc | 5.00% | 458.12% | 2/16/16 |

| TLND Talend SA ADR | 5.00% | -18.71% | 2/15/18 |

| ZAYO Zayo Group Holdings Inc | 5.00% | 33.79% | 2/15/19 |

| MDB MongoDB Inc | 5.00% | 68.51% | 2/15/19 |

| COUP Coupa Software Inc | 5.00% | 121.47% | 11/15/18 |

| DBX Dropbox Inc | 5.00% | 4.38% | 5/16/19 |

| AVLR Avalara Inc | 5.00% | 17.52% | 5/16/19 |

| GWRE Guidewire Software, Inc. | 5.00% | -5.59% | 5/16/19 |

| NYT New York Times, Inc. ClasA | 5.00% | 47.06% | 8/15/18 |

| CDXS Codexis Inc | 5.00% | 18.22% | 8/15/18 |

| MSG Madison Square Garden | 5.00% | -1.88% | 2/15/19 |

| OKTA Okta Inc | 5.00% | 65.21% | 2/15/19 |

| PFPT Proofpoint Inc | 5.00% | 4.49% | 5/16/19 |

| CSOD Cornerstone OnDemand Inc | 5.00% | 67.80% | 2/16/16 |

| SRCL Stericycle Inc. | 5.00% | -5.84% | 5/16/19 |

| PAGS Pagseguro Digital Ltd | 5.00% | 51.30% | 5/16/19 |

| FWONA Liberty Media Corp Series A | 5.00% | -1.44% | 5/16/19 |

| KTOS Kratos Defense & Security Solutions Inc | 5.00% | 19.71% | 5/16/19 |

Limiting your Lottery Stocks Portfolio to “mad money” funds would be wise.

WhaleWisdom’s 13F backtester allows users to customize many elements of this strategy. For instance, you may want to choose a different group of funds to clone for ideas. Or investigate different ways to allocate holdings within the portfolio. One can backtest profit targets or stop losses to discover if that helps performance.

And a word of caution: Years before Jim Cramer popularized the term, “mad money” referred to that small portion of one’s wealth set aside for impulsive, speculative investing. Mad money is distinguished from the longer term, more conservative investments you engage in with the bulk of your investments. If you think of the investing pyramid, mad money would be at the top pinnacle.

So, unless you’re a hedge fund manager, or you have a track record of successful speculation, you’d be wise to keep your Lottery Ticket Stocks portfolio small relative to your total assets.

Have questions about the Lottery Ticket Stocks Portfolio? Feel free to email me: mark@whalewisdom.com.

Disclaimer:

Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this blog is meant for educational and informational purposes only. Do your own research before investing and don’t risk more than you can afford to lose. This article expresses my own opinions, and I am not receiving compensation for it (other than from WhaleWisdom). I do not have a business relationship with any company whose stock is mentioned in this article. I or my associates may hold positions in the stocks discussed.