We can assume that the 50 best performing hedge funds over the last few years have been doing something right. The managers of the top 50 funds exploited an edge the other 930 hedge funds in WhaleWisdom universe didn’t have.

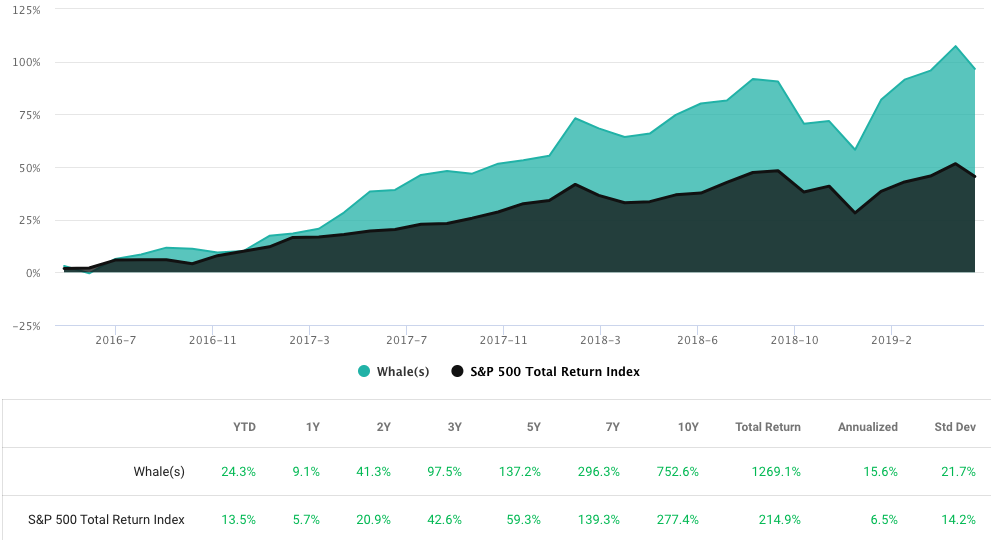

No doubt there is a random element to fund performance, but the 50 best performing hedge funds have averaged a 15.6% return over the last three years. Compare that to a 6.5% average total return for the S&P 500 over the same period.

50 best performing hedge funds based on WhaleScore

The hedge fund returns are based on 13F filings — portfolio disclosures made by large institutional investors 45 days after the end of each quarter.

The 50 top hedge funds over last 3 years averaged returns 2.4x the S&P 500

So as a group, the 50 best performing hedge funds averaged 13F returns 2.4x the market over the last three years. I’ve used WhaleWisdom’s WhaleScore ranking to determine the top funds.

WhaleScores use a mixture of return and risk measures to quantify past risk-adjusted performance and predict future outperformance. Filers are ranked in terms of these measures and scored against each other and against the S&P 500. You can read more about WhaleScores here. For our list, I’ve filtered out funds with less than 11 holdings.

Below is a list of the top 20 stocks held by the top performing funds. The highest consensus holdings, if you will. To construct this list: First, the percent a stock represents in each fund’s portfolio is determined. Then all securities’ percent of portfolio are tallied.

Q1 top 20 consensus holdings of 50 best performing hedge funds – includes date stock first made the list and subsequent return

| Stock Name | Total Return – since initiated | Original Purchase Date |

| CPB Campbell Soup Co. | -12.50% | 11/16/15 |

| AABA Altaba Inc. (Yahoo) | 47.60% | 2/16/16 |

| TWLO Twilio Inc | 60.10% | 11/15/18 |

| AMZN Amazon.com Inc. | 193.10% | 5/18/15 |

| FB Facebook Inc | 130.20% | 8/15/13 |

| SWI SolarWinds Corp | -7.00% | 2/15/19 |

| MSFT Microsoft Corp. | 156.00% | 8/17/15 |

| CHTR Charter Communications | 66.60% | 5/16/14 |

| NOW ServiceNow Inc | 194.30% | 2/15/17 |

| NFLX Netflix Inc | -1.40% | 2/15/19 |

| ZEN Zendesk Inc | 10.40% | 2/15/19 |

| GOOG Alphabet Inc. Class C | 46.10% | 8/17/15 |

| UAL United Continental Holdings | 22.60% | 11/16/15 |

| RNG Ringcentral Inc | 15.40% | 2/15/19 |

| DATA Tableau Software Inc | 6.40% | 8/15/18 |

| PANW Palo Alto Networks Inc | 27.60% | 2/15/18 |

| BABA Alibaba Group Holding Ltd | -11.10% | 5/16/19 |

| TLND Talend SA ADR | -3.40% | 5/16/19 |

| CRM Salesforce.com Inc. | 16.70% | 5/16/18 |

| PYPL PayPal Holdings Inc | -3.50% | 5/16/19 |

Here are the 10 stocks most most purchased by the 50 top performing hedge funds in Q1. The return since 13Fs were filed on May 15 is also shown.

| Stock Name | Total Return | Original Purchase Date |

| NOW ServiceNow Inc | -4.70% | 5/16/19 |

| AABA Altaba Inc. (Yahoo) | -11.80% | 5/16/19 |

| SVMK SVMK Inc | 1.70% | 5/16/19 |

| SIRI Sirius XM Holdings Inc | -4.60% | 5/16/19 |

| GS Goldman Sachs Group Inc | -3.60% | 5/16/19 |

| WP Worldpay Inc Class A | 1.20% | 5/16/19 |

| SE Sea Ltd ADR | 13.60% | 5/16/19 |

| SQ Square Inc | -4.00% | 5/16/19 |

| LYFT LYFT Inc | 4.50% | 5/16/19 |

| AMAT Applied Materials Inc. | -4.10% | 5/16/19 |

Disclaimer:

Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this blog is meant for educational and informational purposes only. Do your own research before investing and don’t risk more than you can afford to lose. This article expresses my own opinions, and I am not receiving compensation for it (other than from WhaleWisdom). I do not have a business relationship with any company whose stock is mentioned in this article. I or my associates may hold positions in the stocks discussed.