In a 13D filed on Jan. 21 targeting Garrison Capital (GARS), corporate activist Joseph Stilwell notes that he has taken an “activist position” in 68 publicly-traded companies since 2000.

In his most recent 13D, Stilwell Value, LLC disclosed a 5% stake in Garrison, a closed-end investment company. Stilwell affiliates acquired 804,980 shares of GARS on Jan.14-16 at prices ranging from $5.95 to $6.20. GARS closed at $6.13 on Jan. 29.

Garrison Capital is a debt-focused Business Development Company (BDC). BDCs are closed-end investment companies that lend money to small and mid-sized companies. BDCs are popular among income-seeking investors because of their high dividend yields. Based on its most recent distribution, GARS’ current yield is 9.72%.

According to its website, Garrison Capital’s stated investment objective is to:

“generate current income and capital appreciation by making investments primarily in debt securities and loans of U.S. based middle-market companies, which we define as those having annual earnings before interest, taxes and depreciation, or EBITDA, of between $5 million and $30 million. Our goal is to generate attractive risk-adjusted returns to our stockholders by assembling a broad portfolio of investments while limiting the downside potential of our investments…”

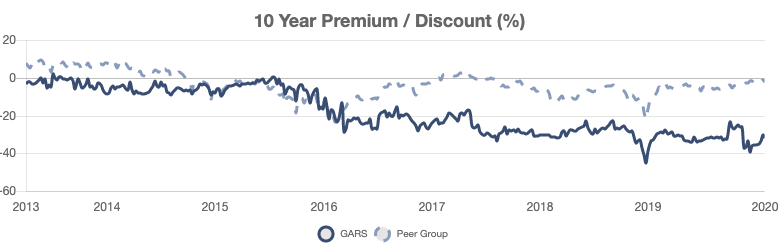

However, investors in GARS haven’t fared well in recent years. The company’s five year total return, including dividends, is -4.34%, according to Closed-End Fund Advisors. That performance ranks the company 35 out of 39 BDC’s in its peer group. As a result of the poor returns, GARS trades at about a 32% discount to the fund’s net asset value (NAV). Simply put, if the fund closed, and liquidated its portfolio, shareholders would receive the NAV of about $9 per share — nearly a 33% profit.

Which is exactly what the activist Joseph Stilwell hopes to acomplish.

Garrison Capital has traded at a large discount to NAV since 2016.

As Stilwell chronicles in detail in Item 4 of the Garrison 13D, when it comes to targeting underperforming small cap financial companies, this isn’t his first rodeo. He lists all of the 67 previous companies his firm has filed 13Ds on. And explains the accomplishments of each activist campaign, along with expectations for current campaigns.

Exactly how much money has activist Joseph Stilwell made investors in his $200 million fund? Hard to say. However, using WhaleWisdom.com data, we did a rough backtest of Stilwell’s 13D filings. We found that, since 2012, Stilwell has filed 13Ds on 39 separate companies. What if we bought the day after each 13D filing and sold 6 months later? The backtest shows 29 profitable trades and 10 losers. A win rate of 74%. The average gain was 13.10%; the average loss -4.20%.

Contact Mark about investing based on SEC filings and smart money disclosures.

Disclaimer:

This investment blog (the “Blog”) is created and authored by Mark W. Gaffney (the “Content Creator”) and is published and provided for informational and entertainment purposes only (collectively, the “Blog Service”). The information in the Blog constitutes the Content Creator’s own opinions. None of the information contained in the Blog constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. You understand that the Content Creator is not advising, and will not advise you personally concerning the nature, potential, value or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter. To the extent any of the information contained in the Blog may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person.

From time to time, the Content Creator or its affiliates may hold positions or other interests in securities mentioned in the Blog and may trade for their own account(s) based on the information presented. The Content Creator may also take positions inconsistent with the views expressed in its messages on the Blog.

The Content Creator may hold licenses with FINRA, the SEC or states securities authorities and these licenses may or may not be disclosed by the Content Creator in the Blog.

Investing in the investments discussed in the Blog may be risky and speculative. The companies may have limited operating histories, little available public information, and the stocks they issue may be volatile and illiquid. Trading in such securities can result in immediate and substantial losses of the capital invested. You should use invest risk capital, and not capital required for other purposes, such as retirement savings, student loans, mortgages or education.