Due to to years of lagging performance, investors have largely abandoned energy stocks. But with the recent explosion of U.S – Iran tensions, oil stocks are suddenly in the spotlight again. Investors must now consider the possibility that a Mid East war could cause a “super spike” in oil prices to $150 per barrel. It’s a good time to have some exposure to the energy sector. By analyzing changes in energy stocks 13Fs during Q3, investors can identify oil stocks that were under accumulation by hedge funds. (Q4 2019 13Fs must be filed by Feb. 15.)

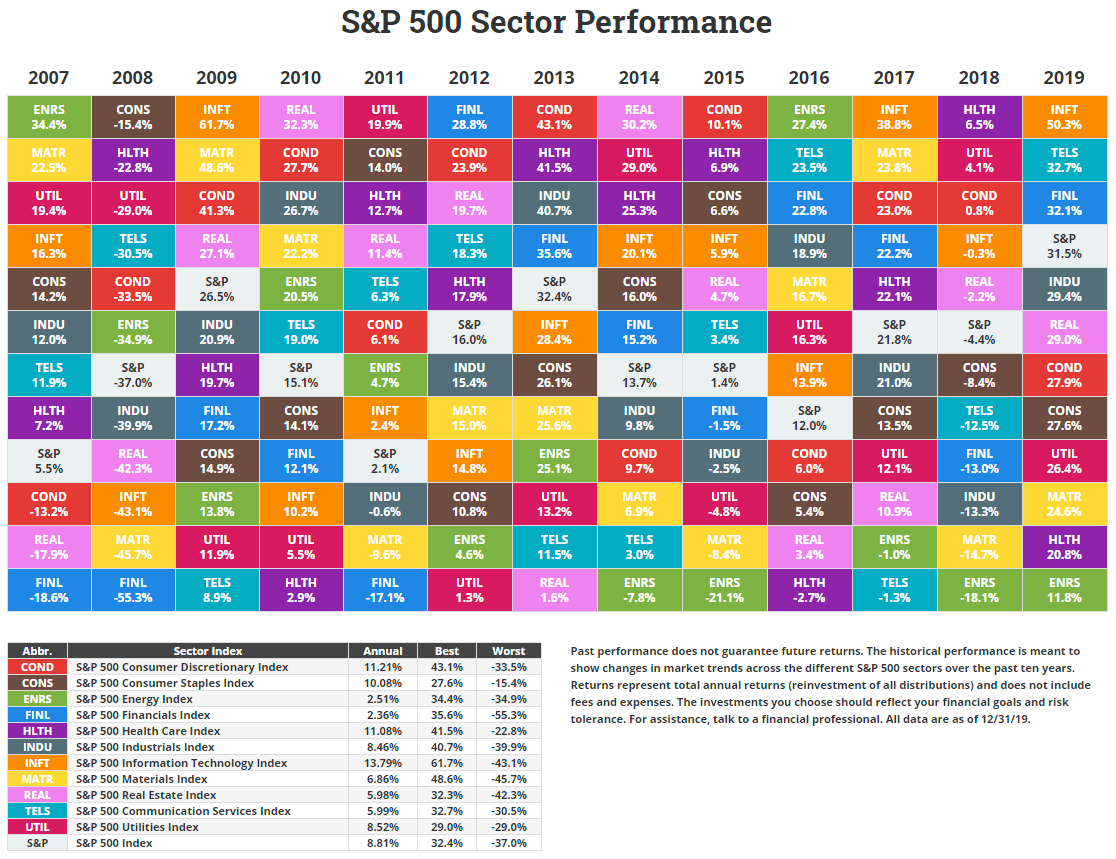

Energy was the worst performing of the 11 S&P 500 sectors last year. Energy stocks have been the worst performer since Donald Trump’s 2016 election. In fact, Energy has been the worst performing sector four out of the last six years. Not surprisingly, the S&P 500 energy sector has its lowest weight in the overall S&P 500 index for at least the last two decades. It represents under 5% of the benchmark index, down from over 15% in mid 2008, when oil prices reached historic highs at over $140 a barrel, over 2.3 times current levels.

While a Middle East war remains improbable, should hostilities disrupt the global oil supply the stock market would most certainly take a hit. Energy stocks however, can be expected to move higher if crude spikes.

In 2016, oil prices surged off a 13-year low early in January and closed that year much higher. West Texas crude touched $36.50 in January, and closed 2016 over $57. It was the first time the S&P 500 Energy Index, up 27.4%, was the top performing sector since 2007. Many small cap energy stocks had huge years in 2016. For instance, Middle Resolute Energy (REN) and Clayton Williams Energy (CWEI) gained about 800% and 300%, respectively. Among large caps: Oneok (OKE) was up 138% and Continental Resources (CLR) gained 128%.

In 2016 crude rallied nearly 60% after hitting 13-year lows early that year. Many energy stocks soared.

Source: novelinvestor.com

Source: novelinvestor.com

One way to discover equity ideas in the oil sector is to analyze energy stocks 13Fs. Investors with over $100 million under management must disclose their long stock holdings via 13F filings within 45 days after the end of every calendar quarter. Stocks showing accumulation by well informed hedge funds may have improving prospects or offer unusual value.

Energy stocks 13Fs. Below are the stocks with the largest % increase in 13F holdings by institutions during Q3. You can use WhaleWisdom.com’s stock screener to further analyze 13F changes.

| Name | Ticker | Industry | # Funds held by | Market Cap | 13F Market Cap | QoQ % Change in 13F Market Cap |

| <$500m mkt cap | ||||||

| CONTANGO OIL & GAS CO. | MCF | OIL & GAS PRODUCERS | 34 | $76,412,400 | $57,598,703 | 124.36% |

| ENVISION SOLAR INTERNATIONAL INC | EVSI | ENERGY EQUIPMENT & SERVICES | 12 | $29,127,000 | $4,434,000 | 34.53% |

| NET ELEMENT INC | NETE | ENERGY EQUIPMENT & SERVICES | 15 | $18,457,600 | $1,489,000 | 24.60% |

| TRANSATLANTIC PETROLEUM LTD | TAT | OIL & GAS PRODUCERS | 27 | $31,378,500 | $7,888,000 | 16.27% |

| $500m to $10b | ||||||

| TPI COMPOSITES INC | TPIC | ENERGY EQUIPMENT & SERVICES | 135 | $647,814,500 | $2,857,975,120 | 271.37% |

| CVR ENERGY INC | CVI | ENERGY EQUIPMENT & SERVICES | 220 | $4,280,567,400 | $10,035,480,830 | 112.26% |

| BALLARD POWER SYSTEMS, INC. | BLDP | ENERGY EQUIPMENT & SERVICES | 98 | $1,130,630,400 | $46,425,611 | 64.46% |

| NEW FORTRESS ENERGY LLC | NFE | ENERGY EQUIPMENT & SERVICES | 28 | $3,017,702,100 | $220,411,000 | 56.58% |

| GOLDEN OCEAN GROUP LIMITED | GOGL | OIL & GAS PRODUCERS | 47 | $812,379,800 | $311,026,000 | 16.53% |

| COMSTOCK RESOURCES INC. | CRK | OIL & GAS PRODUCERS | 76 | $1,295,237,700 | $47,872,899 | 46.48% |

| CRESCENT POINT ENERGY CORP | CPG | OIL & GAS PRODUCERS | 136 | $2,106,720,000 | $827,686,426 | 41.60% |

| DHT HOLDINGS INC | DHT | OIL & GAS PRODUCERS | 121 | $1,035,507,200 | $403,731,017 | 35.92% |

| FRONTLINE LTD. (BERMUDA) SPONSORED ADR | FRO | OIL & GAS PRODUCERS | 95 | $2,161,567,200 | $361,695,938 | 31.77% |

| SOLAREDGE TECHNOLOGIES INC | SEDG | ENERGY EQUIPMENT & SERVICES | 271 | $4,183,943,400 | $3,108,234,592 | 28.83% |

| THERAPEUTICSMD INC | TXMD | OIL & GAS PRODUCERS | 149 | $870,804,200 | $623,752,300 | 27.98% |

| >$10b mkt cap | ||||||

| BAKER HUGHES CLASS A | BHGE | ENERGY EQUIPMENT & SERVICES | 451 | $22,190,729,600 | $23,140,825,874 | 87.00% |

| MPLX L.P. | MPLX | OIL & GAS PRODUCERS | 323 | $28,596,989,500 | $9,332,303,049 | 17.33% |

| TC ENERGY CORP | TRP | OIL & GAS PRODUCERS | 418 | $47,367,076,200 | $30,445,483,577 | 12.14% |

| VISTRA ENERGY CP | VST | OIL & GAS PRODUCERS | 351 | $13,344,195,200 | $12,441,043,266 | 11.82% |

| CHENIERE ENERGY PARTNERS LP | CQP | OIL & GAS PRODUCERS | 150 | $21,412,602,400 | $10,270,951,905 | 9.05% |

Contact Mark about investing based on SEC filings and smart money disclosures.

Disclaimer:

This investment blog (the “Blog”) is created and authored by Mark W. Gaffney (the “Content Creator”) and is published and provided for informational and entertainment purposes only (collectively, the “Blog Service”). The information in the Blog constitutes the Content Creator’s own opinions. None of the information contained in the Blog constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. You understand that the Content Creator is not advising, and will not advise you personally concerning the nature, potential, value or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter. To the extent any of the information contained in the Blog may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person.

From time to time, the Content Creator or its affiliates may hold positions or other interests in securities mentioned in the Blog and may trade for their own account(s) based on the information presented. The Content Creator may also take positions inconsistent with the views expressed in its messages on the Blog.

The Content Creator may hold licenses with FINRA, the SEC or states securities authorities and these licenses may or may not be disclosed by the Content Creator in the Blog.

Investing in the investments discussed in the Blog may be risky and speculative. The companies may have limited operating histories, little available public information, and the stocks they issue may be volatile and illiquid. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes, such as retirement savings, student loans, mortgages or education.