Biotech insiders may be the smartest investors in the world. No group has better information on public companies – and profitably acts on it – than corporate insiders at small-cap biotech and medical technology companies.

When one party in a transaction has more or better information than the other, economists refer to the information as asymmetric. In today’s world of internet-transmitted information, asymmetry isn’t common – most of the time markets quickly and efficiently disseminate information. However, some investors do have superior knowledge and profitably leverage that information.

We might object that this isn’t fair – in fact, regulation of insider trading is based on the idea that access to information should be equitable. But it’s the nature of public markets that people seek to exploit superior knowledge. To invest profitably, we all aspire to be experts — or receive advice from experts.

To truly understand biotech you may need a Phd.

In my experience, no market experts exploit their specialized knowledge better than insiders at medical technology companies. Why is this? Because, more than any other sector, it requires extensive technical knowledge to understand and value medtech investments. To truly understand this stuff, you may need a PhD.

Take a look at this discussion of clinical trial results I’ve chosen randomly from biospace.com:

“The primary objective of the study was PK similarity comparing ABP 798 to rituximab. The PK endpoints of the study were area under the serum concentration–time curve (AUC) and maximum serum concentration (Cmax), both of which were within the pre-specified equivalence margin. The pre-specified equivalence in efficacy endpoint was measured by Disease Activity Score 28-joint count C reactive protein (DAS28-CRP) change from baseline at week 24. Overall, safety and immunogenicity of ABP 798 were comparable to rituximab.”

Say what? Makes you want to invest in something you understand, right? Like trucking companies or beer stocks.

I’d say 95% of investors rely on experts in the biotech/medical space to interpret developments and make recommendations. I’d also wager that the corporate insiders at medical science-related companies are the smartest of smart money when it comes to medtech investing. And I set out to prove it:

Backtests reveal that following medtech insiders has historically been highly profitable

Using the insider backtester at WhaleWisdom.com, I created a hypothetical historical strategy that mimicked the buys of health care insiders. Here are the criteria for the backtest:

- Limit buying to the health care sector which includes biotech and medtech.

- Beginning in 2008, buy when C-level executives, directors or 10% owners disclose $100K or more of purchases in their own shares over a 3-day period.

- Buy on the close one day after SEC form 4s are filed reporting the purchases

- Limit buying to stocks trading above $1 per share, and with market caps under $20 billion – mid-, small- and micro-cap stocks.

- Allocate 25% of the hypothetical portfolio to each position; if the portfolio is full and new stocks need to be bought, sell worst performer in the portfolio to raise cash

- Exit a position after 30 days.

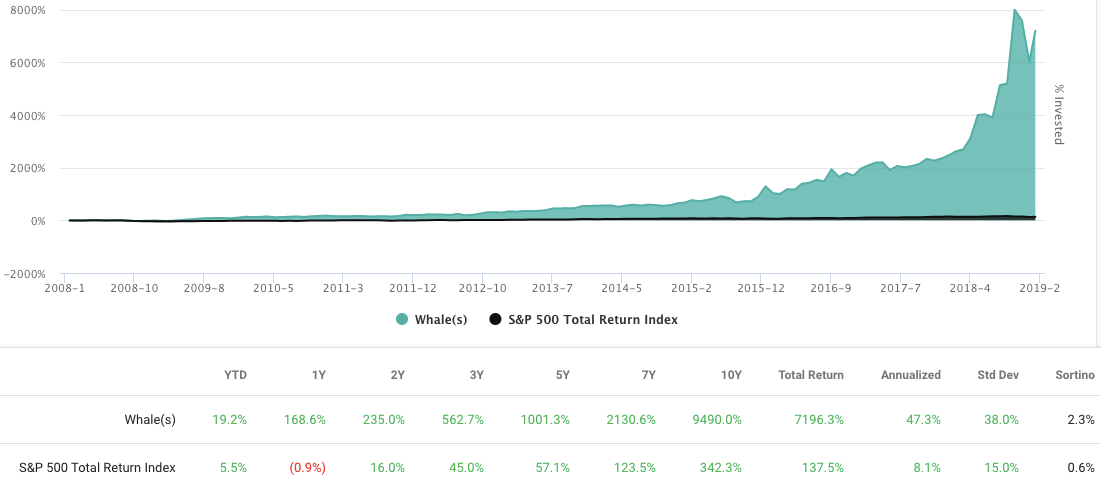

Backtest of cloning medical and biotech small caps going back to 2008.

The strategy would have returned 7196%, which is 47.3% annualized, since the beginning of 2008. That compares with 137.5% total return for the S&P 500, or 8.1% annualized. Now the standard deviation of returns, a measure of volatility, was 2.53x greater for the small-cap medtech strategy compared to the S&P, but one might put-up with that for annual returns 5.84x the market.

Now, this strategy doesn’t reflect execution slippage, commissions, and otherwise might not reflect real-world trading. And I’m not suggesting you begin blindly buying volatile, thinly traded, small-cap stocks just because insiders have made purchases. You should do follow-up research, diversify, and proceed with care.

But the above backtest suggests medtech and biotech insiders handily beat the market – and there’s money to be made copying their moves. I won’t even print what happens when we set the trade delay to 0 – effectively buying at the same price as insiders, before their trades are disclosed. Those returns are insane. Realistically though, with some work, you could create a personalized strategy that manages risk, but exploits the biotech insiders’ edge.

Shorting medtech stocks is playing with dynamite

You might wonder, what about insider selling at these companies? Do selling medtech execs time their exits profitably? There is evidence to suggest that, as a group, they do. And as I’ve written previously, preplanned trading programs may be gamed by some insiders.

But here’s the thing: Shorting biotech stocks — or any thinly traded small-cap stock for that matter – is playing with dynamite. You might get away with it most of the time, but it only takes one blow-up to maim your portfolio. If you buy a stock, the worst that can happen is you lose all your money. Short a biotech stock, and your losses are potentially infinite.

Below is a chart of Aquinox Pharmaceuticals (AQXP), a micro-cap stock that went stratospheric in 2015 after the company announced favorable test results and Baker Bros. Advisers disclosed an increased stake in the company. If you had shorted just $10,000 of the stock at $2 on Friday August 7, you could have conceivably been bought-in by your broker at $55 on Monday. That would have been a $265,000 loss. A nightmare! Don’t short biotech stocks!

On the other hand, getting long a few shares alongside the insider Baker Bros. would have worked out pretty well…

Interactive Brokers

Disclaimer: Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this post is meant for educational and informational purposes only. I or my affiliates may hold positions in securities mentioned in the article.