Cloning Carl Icahn is a good idea.

Now I’m of course not talking about a laboratory experiment whereby we create an army of little corporate activists that will grow into so many billionaires.

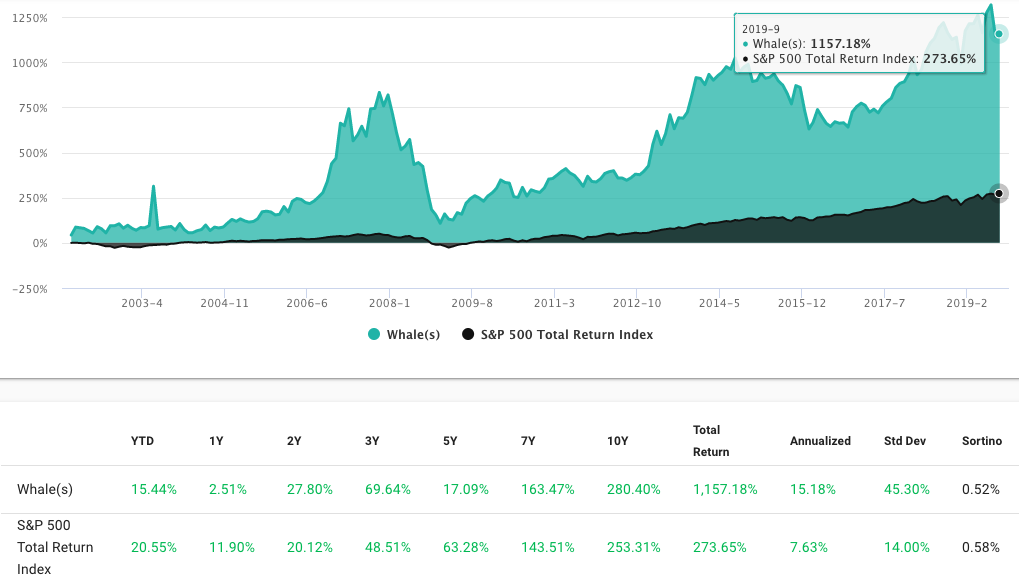

Rather, I’m referring to following the renowned activist’s moves in and out of the stocks that he buys and sells. Since the 3rd quarter of 2001, a portfolio based on Carl Icahn’s 13Fs, updated quarterly, that mimics the manager’s conviction level (manager weighted), would have generated an annualized return of 15.09%. That’s more than double the return of the S&P 500 total return over the same time period. WhaleWisdom.com’s 13F backtester was used to analyze the historical performance.

Carl Icahn is one of Wall Street’s most successful investors and likely the most successful corporate activist in history. Forbes estimates his net worth at $17.4 billion, making him the 26th-wealthiest person on the Forbes 400, and the 5th-wealthiest hedge fund manager.

Icahn grew up in Far Rockaway, Queens and graduated from Princeton with a degree in philosophy in 1957. He began his Wall Street career in 1961 as a stockbroker. In 1968, with $150,000 of his own money and a $400,000 investment from his uncle, he bought a seat on the New York Stock Exchange, and formed Icahn & Co., focusing on risk arbitrage and options trading.

Icahn pioneered corporate activism in the 1970s, targeting first closed-end funds, then stocks that traded at a discount to underlying asset values. He would then agitate/coerce management into closing the valuation gap — or pay him off. In 1976 he published “the Icahn Manifesto,” as it was later to be called by his biographer.

Cloning Carl Icahn & “The Icahn Manifesto”

“It is our opinion that the elements in today’s economic environment have combined in a unique way to create large profit-making opportunities with relatively little risk. The real or liquidating value of many American companies has increased markedly in the last few years; however, interestingly, this has not at all been reflected in the market value of their common stocks. Thus, we are faced with a unique set of circumstances that, if dealt with correctly can lead to large profits, as follows: The management of these asset-rich target companies generally own very little stock themselves and, therefore, usually have no interest in being acquired.

“It is our contention that sizable profits can be earned by taking large positions in “undervalued’ stocks and then attempting to control the destinies of the companies in question by:

a) trying to convince management to liquidate or sell the company to a “white knight.’

b) waging a proxy contest.

c) making a tender offer.

d) selling back our position to the company.”

Icahn Enterprises has been the #1 holding of Icahn’s hedge fund since 2004.

Icahn’s no-holds-barred style rubbed many the wrong way, and he was generally loathed by corporate America. The term “corporate raider” came to be synonymous with Icahn. The character of Gordon Gekko in the 1987 movie “Wall Street” is said to be based, in part, on Carl Icahn.

While Icahn’s style has mellowed somewhat over the years, his talent for building wealth has been relatively consistent, as the historical performance of following his 13Fs shows.

An interesting aspect of cloning Carl Icahn 13Fs is that Icahn Enterprises LP (IEP) has been his hedge fund’s #1 holding since 2004. At Q2 2019 end, IEP was 48.02% of Icahn’s portfolio. IEP is the vehicle through which Icahn conducts his operations. It’s an unusual company that is part investment fund and part an owner of entire businesses. The Company owns subsidiaries which Icahn has acquired. Among the industries in which IEP is engaged: Investment, Automotive, Gaming, Railcar, Food Packaging, Metals, Real Estate and Home Fashion. Icahn owns about a 90% stake. IEP yields 11.5%.

Carl Icahn holdings as of Q2 2019

| Stock | Symbol | Shares Held | Market Value | % of Portfolio | Previous % of Portfolio | Ranking | % Change in shares |

| Icahn enterprises lp | IEP | 190,847,599 | 12,824,958,653 | 48.0151% | 52.7721% | 1 | 2.9752% |

| Cvr energy inc | CVI | 71,198,718 | 3,559,224,000 | 13.3253% | 12.1704% | 2 | 0.00% |

| Occidental petroleum corp. | OXY | 33,244,429 | 1,671,530,000 | 6.258% | 3 | ||

| Herbalife nutrition ltd | HLF | 35,227,904 | 1,506,345,000 | 5.6396% | 7.7449% | 4 | 0.00% |

| Cheniere energy inc | LNG | 21,585,094 | 1,477,500,000 | 5.5316% | 6.2341% | 5 | (1.7989%) |

| Caesars entertainment corp | CZR | 119,975,363 | 1,397,712,979 | 5.2329% | 3.5784% | 6 | 20.8808% |

| Xerox corp. (haloid co.) | XRX | 23,456,087 | 687,028,788 | 2.5722% | 3.1122% | 7 | 0.00% |

| Hertz global holdings inc | HTZ | 43,925,852 | 658,887,780 | 2.4668% | 8 | 2.7122% | |

| Newell brands inc | NWL | 41,119,415 | 634,061,000 | 2.3739% | 2.617% | 9 | 0.00% |

| Navistar international corp. | NAV | 16,729,960 | 576,347,000 | 2.1578% | 2.242% | 10 | 0.00% |

Disclaimer:

Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this blog is meant for educational and informational purposes only. Do your own research before investing and don’t risk more than you can afford to lose. This article expresses my own opinions, and I am not receiving compensation for it (other than from WhaleWisdom). If you buy a book after clicking on one of the above links, I may received an affiliate fee. I do not have a business relationship with any company whose stock is mentioned in this article. I or my associates may hold positions in the stocks discussed.