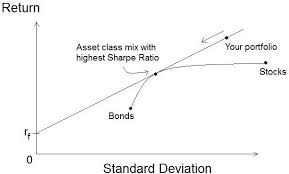

The Sharpe ratio is a popular way to measure the return of an investment compared to the amount of risk taken. Risk is measured as volatility or standard deviation. So, the equity managers with the highest Sharpe ratios in the WhaleWisdom database have demonstrated skill picking stocks...

Last week, Abdiel Capital added to its its Appian and Fastly stakes -- core positions for the top-performing fund.

Managing partners Colin Moran and Geoffrey Gentile of New York-based Abdiel Capital Advisors aren't big on diversification. The managers prefer to focus on a...

We can assume that the 50 best performing hedge funds over the last few years have been doing something right. The managers of the top 50 funds exploited an edge the other 930 hedge funds in WhaleWisdom universe didn't have.

No doubt there is...

RA Capital has outperformed all other healthcare hedge funds over the past decade, based on 13F holdings. In fact, RA's 30.88% annualized return of it's equal-weighted top 20 long portfolio led all other hedge funds over that period. So, when RA manager Peter Kolchinsky discloses portfolio changes,...

Michael Burry bought Tailored Brands at $13 in Q4 2018. But over four months later, a TLRD insider bought the tumbling stock at $7.41.

Tailored Brands (TLRD), a top Q4 holding of Michael Burry's Scion Hedge Fund, spiked higher Tuesday after a corporate insider...

If you had to choose one fund to follow, Tiger Global might be it. Chase Coleman's Tiger Global has been the best large hedge fund over the last 3 years. At least based on long-only positions disclosed via 13F filings. Copying or "cloning" Tiger Global's long positions...

Cloning Carl Icahn is a good idea.

Now I'm of course not talking about a laboratory experiment whereby we create an army of little corporate activists that will grow into so many billionaires.

Rather, I'm referring to following the renowned...

Howard Mark's Oaktree Capital navigated a volatile Q2 2019, returning 9.03%. That's based on an equal-weighted portfolio of the fund's top 20 holdings. It was the best quarterly return for large Hedge Funds -- those with greater than $5 billion in 13F securities.

Oaktree's...

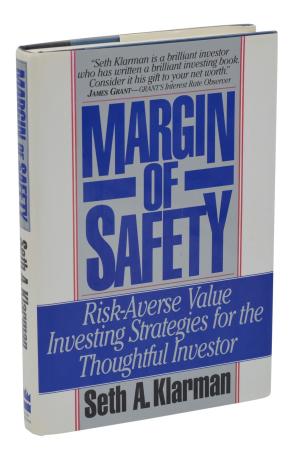

In 1991 the first (and only) edition of Seth Klarman's book Margin of Safety: Risk-Averse Value Investing Strategies for the Thoughtful Investor was published. Just 5000 copies were printed, and initial sales were slow. You could have bought it for $25. Today, it might be worth $3000.

Perceptive Advisors' Neptune Wellness Solutions (NEPT) position increased by 50% during the 3rd quarter of 2019, to 4.5 million shares. The stake represents 14.53% of the Cannabis extraction company's outstanding shares. NEPT was Perceptive Advisors' #20 position at Q3 close.

The increase in Perceptive'...