Michael Burry bought Tailored Brands at $13 in Q4 2018. But over four months later, a TLRD insider bought the tumbling stock at $7.41.

Tailored Brands (TLRD), a top Q4 holding of Michael Burry's Scion Hedge Fund, spiked higher Tuesday after a corporate insider...

James Simons' Renaissance Technologies is possibly the most successful hedge fund in history. Renaissance's Medallion fund, available only to the firm's employees, has reportedly generated returns of almost 80% a year before fees since inception in 1988. After a 5% management fee and 44% performance fee, that's...

On February 28 , Martha Stewart's Sequential Brands (SQBG) announced that the lifestyle celebrity has teamed up with Canopy Brands (CGC) to develop and promote a line of hemp-based CBD products. SQBG stock spiked higher on the news, nearly doubling at one point before settling at $2.00...

Hedge fund managers with hundreds of millions of dollars rarely buy the illiquid shares of a micro-cap company -- but when they do it's often a prelude to much higher prices for that stock. Below I discuss the 13F "secret" to uncovering micro-cap winners as the "Whales"...

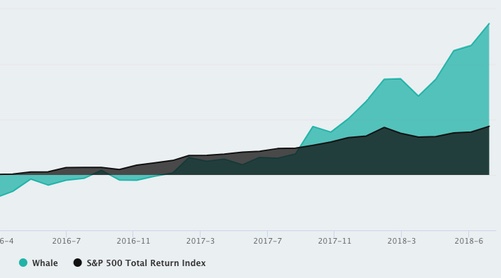

Investors who mimicked Hite Hedge Asset Management's long portfolio on Nov. 15 would have been up 29.49% through Feb 15., making Hite the top hedge fund for Q4.

Established in 2012, Quincy, MA-based Hite Hedge is focused on MLPs in the energy sector. The...

Dr. Michael Burry's Scion Asset Management disclosed holdings on Feb. 15 for the first time in over two years. The investing legend was one of the first people to recognize the massive risk in the pre-2007 sub-prime real estate market -- the then unknown money manager bet...

Warren Buffett is generally regarded as the greatest investor of our time. That’s why every quarter, when Buffett’s fund Berkshire Hathaway updates portfolio holdings, Buffett followers scrutinize the reports, hoping to profit from the moves of the world’s 3rd richest person

Whether they’re called penny stocks, micro-caps, OTC stocks or “lottery tickets,” low-priced, illiquid stocks of small companies have a bad reputation with many investors. Unquestionably micro-cap stocks can be illiquid, risky and highly speculative. Nonetheless, Hedge Funds can and do hold lots of micro-caps.

Marijuana stocks may finally be getting some respect from professional investors. Funds holding stock in Ontario-based marijuana producer Canopy Growth (NYSE:CGC) increased their holdings massively in the 2nd quarter. In Q1 2018, CGC comprised a total of 1.69% of all 13F portfolios holding the stock. In the 2nd quarter that number jumped to 31.30%

Acuta Capital Partners, LLC rode a surge in health care stock prices to the top spot in 2nd quarter hedge fund performance.