Acuta Capital Partners, LLC rode a surge in health care stock prices to the top spot in 2nd quarter hedge fund performance.

The Belmont, CA fund with $745 million assets under management outperformed all other 754 hedge funds in the WhaleWisdom data base holding more than 10 positions. An investor buying an equal weighting of Acuta’s top 20 positions on May 15 when Q1 13F filings were released, would have earned a 26.94% profit over the ensuing three months.

The hedge fund’s top holding at the end of the 1st quarter was a 5,850,000 share position in Immunomedics, Inc. (Nasdaq:IMMU), worth $85.5 million. IMMU closed March at $14.61. On June 29, it closed at 23.67 – a gain of 62%.

Below are Acuta’s top ten 13F positions as of the end of the Q2 2018, along with the previous quarter’s performance. Obviously, a huge quarter for the firm’s portfolio of health care equities.

| Acuta Capital – Q2 2018 Top 10 Stock Holdings | Symbol | Q2 % of Portfolio | Previous Quarter % | Stock Q2 Performance |

| Immunomedics Inc. | IMMU | 20.0149% | 13.9594% | 62.00% |

| Iovance Biotherapeutics | IOVA | 9.1714% | 11.7586% | -18.21% |

| Assembly bioscie | ASMB | 8.1108% | 8.9488% | -16.13% |

| Argenx se ads | ARGX | 6.6854% | 5.3053% | 7.19% |

| Kadmon holdings | KDMN | 6.4351% | 4.1302% | -3.39% |

| Veracyte inc | VCYT | 4.423% | 3.0131% | 73.28% |

| Chembio Diagnostics | CEMI | 4.0123% | 2.6219% | 42.31% |

| Ascendis Pharma a/s ADR | ASND | 3.684% | 5.8108% | 10.76% |

| Arrowhead Research Corp. | ARWR | 2.4944% | 2.0752% | 98.25% |

| Iridex Corp. | IRIX | 2.478% | 1.8685% | 20.42% |

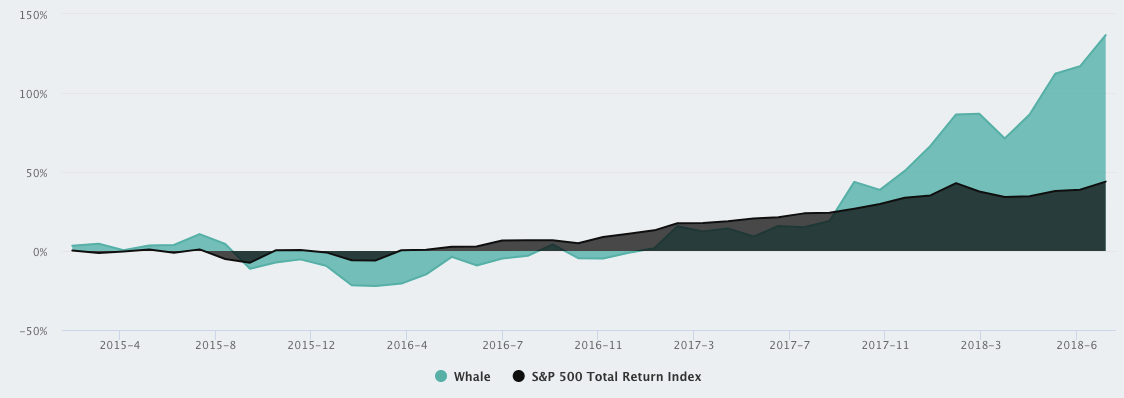

Richard Yu-Tsang Lin has been the majority owner, managing member and chief investment officer of Acuta since the firm was founded in 2011. Tamarack filed its first 13F in February of 2015 for the 4th quarter of 2014. The hedge fund’s total return since then has been 103% (light green) vs the S&P’s 500 total return of 46.3% (dark green).

Acuta Capital Partners’ performance has earned it an equal-weight WhaleScore of 79 (out of 100). The WhaleScore is a proprietary measurement that compares a fund’s three-year performance against the universe of other funds and the S&P 500. The model “equal-weights” the top 20 stocks in every qualifying funds’ portfolio and compares it against all funds’ performance over time. There is also a WhaleScore based on the manager’s actual allocation. Acuta’s Manager Weighted WhaleScore is 69.