The dubious distinction of worst hedge fund performance in the 2nd quarter — based on equal weightings of 13F positions — goes to Tiger Pacific Capital LP. An equal weighting of the fund’s 14 positions returned -21.69% in the quarter, according to WhaleWisdom.com

It should be emphasized that 13F filings do not reflect short or derivative positions that may have hedged losses for Tiger Pacific fund investors in the 2nd quarter. Nonetheless, Tiger Pacific’s focus on Chinese securities did take a toll its long holdings.

| Tiger Pacific – Q2 2018 Top 10 Holdings | % of Portfolio | Q2 2018 % Return |

| Noah Holdings Limited (NOAH) | 25.0379 | -26.0% |

| BEST Inc ADS (BSTI) | 21.595 | -28.9% |

| Yum China Holdings Inc (YUMC) | 8.4424 | -7.30% |

| Alibaba Group Holding Limited (BABA) | 7.3036 | -11.00% |

| MOMO INC ADR (MOMO) | 6.5965 | 8.60% |

| TAL Education Group (TAL) | 6.465 | -19.90% |

| Baozun Inc (BZUN) | 5.5523 | 16.80% |

| Sina Corp (SINA) | 5.2803 | -20.80% |

| JD.COM INC ADR (JD) | 4.0987 | -10.30% |

| iQIYI Inc ADS (IQ) | 2.8859 | 8.00% |

Source: WhaleWisdom.com

Tiger Pacific Capital was founded by Run Ye, Junji Takegami and Hoyon Hwang who previously worked for Billionaire Hedge fund icon Julian Robertson at Tiger Asia Management, LLC. Robertson seeded TPC in late 2012.

Chinese stocks suffered in the 2nd quarter as the country’s trade dispute with the U.S. escalated. Shanghai stocks fell nearly 13% in the quarter, dropping to levels last seen in 2011. Worries over an intensifying US-China trade war hit Chinese stocks and the juan currency, with investors fearing a sliding yuan will hurt companies heavily exposed to US dollar debt. Since the 2nd quarter’s end, the Shanghai Index has fallen an additional 1.5%

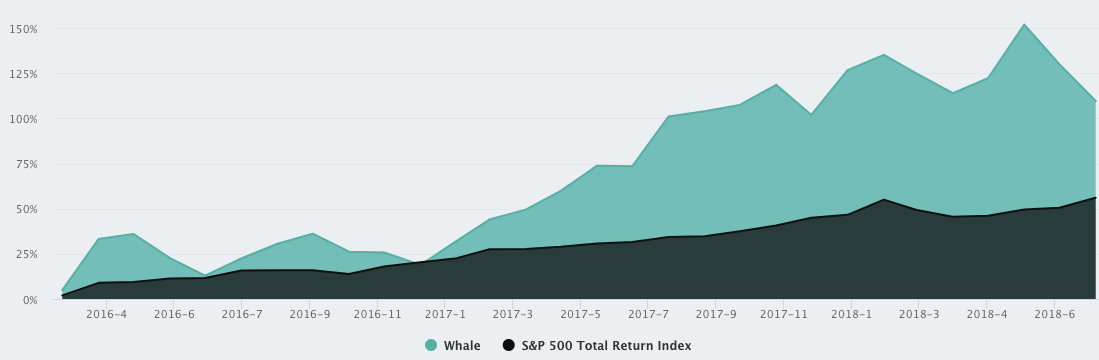

Despite the down quarter, if you’d cloned Tiger Pacific Capital’s top ten holdings since the firm filed its first 13F in the 4th quarter of 2015, you’d still be up 93%. Below is a chart showing Tiger Pacific Capital’s performance since the first quarter of 2016 (light green) versus the S&P 500’s total return (dark green).

Source: WhaleWisdom.com

Investors anticipating a rebound in China-related equities may want to analyze Tiger Pacific Capital’s 13F holdings for stock’s likely to lead a rally in that sector.