It’s always good to see insiders buy a stock into price weakness — it suggests the selloff is a buying opportunity, rather than a sign of more weakness to come. In the case of Apple Hospitality (NYSE: APLE), insider buying indicates executives who know the REIT best believe it’s oversold.

Apple Hospitality operates 241 hotels in 34 states. The REIT is focused on midrange hotels like Hilton Garden Inn, Homewood Suites, Hampton Inn, Courtyard by Marriott, and Residence Inn. APLE is one of the largest hotel operators focused exclusively on this “select service” hotel market –providing amenities a step below ritzy luxury resorts but a notch above discount hotels. Generally, these hotels are relatively small, with 200 or less rooms and don’t have restaurant facilities. All of Apple Hospitality’s properties are managed by third-party companies, whose management fees are tied to the performance of the properties

APLE listed on the NYSE on May 18, 2015, and has paid a $0.10 dividend every month since. With the REIT’s recent selloff to $17.20 – a 10% drop since May 30 — APLE’s yield is now about 7%.

Real estate investment trust performance has lagged this year due to fears of rising interest rates. The Vanguard Real Estate Index ETF (VNQ) is down about 1.5% YTD (total return) compared to the S&P 500’s 5.3% total return over the same period.

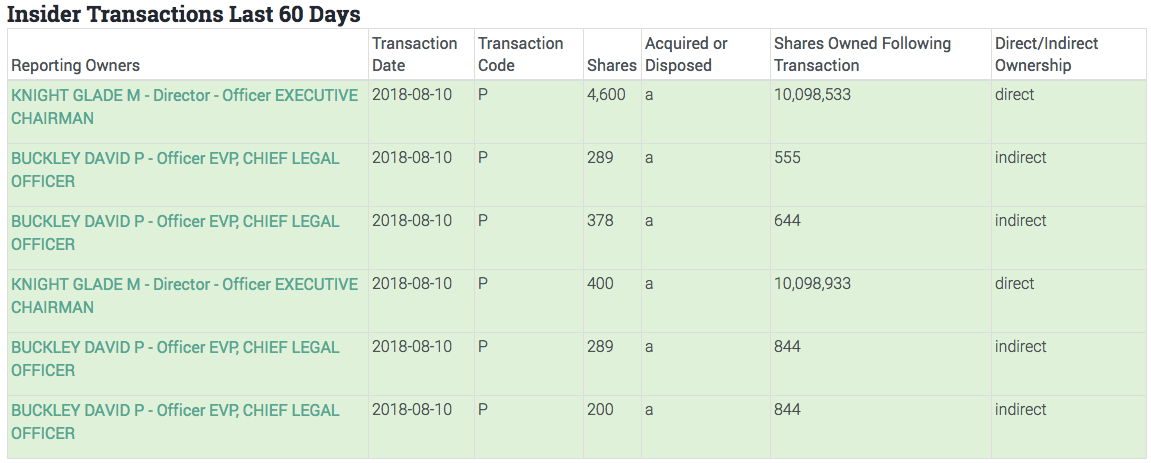

But recent purchases by Executive Chairman and Director Glade M. Knight and EVP, Chief Legal Officer David P. Buckley suggest the selloff may have been overdone.

Apple Hospitality REIT, Inc. (APLE)

Source: WhaleWisdom.com

Glade Knight is the founder of Apple Hospitality and has served as Executive Chairman of the Company since 2014, and previously served as Chairman and Chief Executive Officer of the Company prior to its IPO. He has been a frequent buyer of APLE shares since it’s NYSE listing, increasing his holdings from 8.13 million shares to 10.36 million over that period.

Knight’s most recent purchase of 5,000 shares at 17.33 follows 5,000 purchased on May 14 at $18.52 and 10,000 bought at $17.16 on March 8.

Also joining Knight buying APLE shares on August 10 was David P Buckley, EVP and Chief Legal Officer of Apple Hospitality. Buckley spent $20K buying shares in his children’s’ names.

A May 11 article by Brad Thomas in Forbes speculated that Apple Hospitality would make a good merger candidate with another small cap REIT. According to Thomas, a consolidation trend is unfolding with M&A in the lodging REIT sector as management teams look to capitalize on efficiency and tactical brand and market strategies.

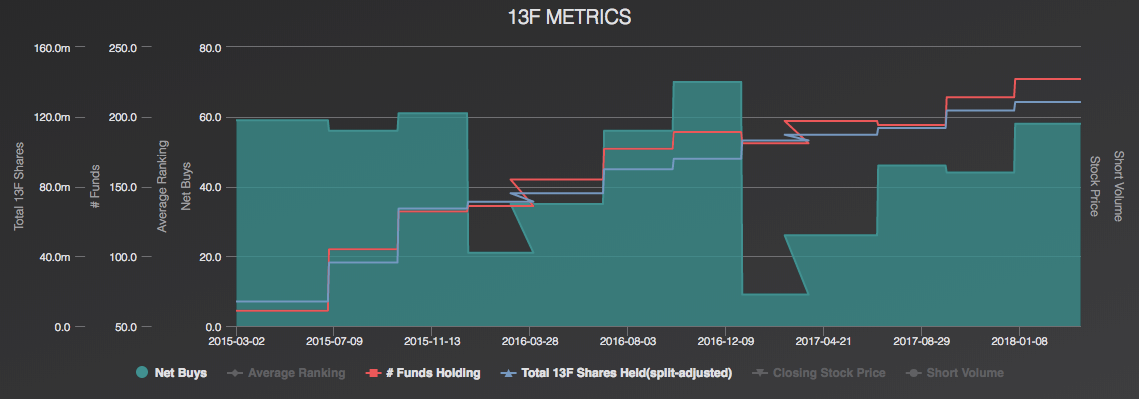

Institutional investors have been steadily accumulating APLE shares as the chart below indicates. Net buys by funds, the number of funds holding APLE shares and total 13F shares held all show positive trends. (Not all funds had reported 2nd quarter holdings as of this writing.)

Apple Hospitality quarterly 13F holdings data since 2015.

Source: WhaleWisdom.com

Traders should buy APLE around $17.50 for a move back to 52-week highs at $20. Investors may want to add Apple Hospitality to their income portfolio.