Back in 2013, Bloomberg ran a profile of Brad Gerstner's Altimeter Capital that described the up-and-coming hedge fund manager as an adventurer -- an amateur pilot and heli-skier who hangs out with big-time CEOs at Burning Man. The article said Gerstner wanted to build a Venture Capital...

Sun Valley Gold led all hedge funds in Q2 of 2019 with a 56% 13F-based return. But the eye-popping performance by the Ketchum, Idaho-based fund comes with an asterisk, as explained below.

Ketchum-based Sun Valley is a materials-focused hedge fund managed by Peter F....

Is Bill Oberndorf the best stock picker in the U.S.? According to a recent report by WhaleWisdom.com, two professional fund managers shared the top ranking for risk-adjusted performance of their stock picks. One of the top ranked funds was Abdiel Capital Advisers, L.P. with a WhaleScore ranking...

Dr. Michael Burry's Scion Asset Management disclosed holdings on Feb. 15 for the first time in over two years. The investing legend was one of the first people to recognize the massive risk in the pre-2007 sub-prime real estate market -- the then unknown money manager bet...

The best performing hedge funds are often ones you haven't heard of. You're not doubt familiar with Berkshire Hathaway and Bridgewater Associates. But you probably don't know Casdin Capital or King Street Management.

While investors fawned over Bridgewater's 14.6% gain...

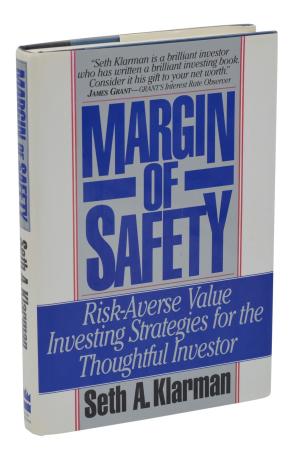

In 1991 the first (and only) edition of Seth Klarman's book Margin of Safety: Risk-Averse Value Investing Strategies for the Thoughtful Investor was published. Just 5000 copies were printed, and initial sales were slow. You could have bought it for $25. Today, it might be worth $3000.

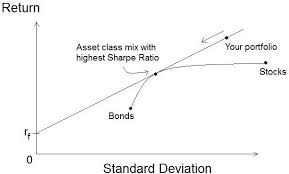

The Sharpe ratio is a popular way to measure the return of an investment compared to the amount of risk taken. Risk is measured as volatility or standard deviation. So, the equity managers with the highest Sharpe ratios in the WhaleWisdom database have demonstrated skill picking stocks...

Arlington Value's Allan Mecham increased his position in Warren Buffett's Berkshire Hathaway(BRK.B) by 8% during the second quarter of 2019. Including Berkshire A and B shares, Berkshire was 29.93% of Arlington's portfolio at Q2 end. The Salt Lake City-based fund's 13F also showed increases in its Alliance...

We can assume that the 50 best performing hedge funds over the last few years have been doing something right. The managers of the top 50 funds exploited an edge the other 930 hedge funds in WhaleWisdom universe didn't have.

No doubt there is...

Hedge fund managers with hundreds of millions of dollars rarely buy the illiquid shares of a micro-cap company -- but when they do it's often a prelude to much higher prices for that stock. Below I discuss the 13F "secret" to uncovering micro-cap winners as the "Whales"...