Is Bill Oberndorf the best stock picker in the U.S.? According to a recent report by WhaleWisdom.com, two professional fund managers shared the top ranking for risk-adjusted performance of their stock picks. One of the top ranked funds was Abdiel Capital Advisers, L.P. with a WhaleScore ranking of 99.

You may know of Abdiel Capital. We recently profiled the New York-based fund and its use of a concentrated portfolio to achieve 3 year annualized returns of over 50%.

Who is Bill Oberndorf and how can he be one of the top stock pickers in the U.S.?

The other top-rated manager, according to WhaleWisdom’s scoring, is none other than Bill Oberndorf. You may be asking, Bill who? How can this obscure guy be a better stock picker than Warren Buffett, Ray Dalio or Michael Burry?

WhaleWisdom’s WhaleScore ranking is designed to help investors quickly identify Form 13F filers who consistently beat the market. The proprietary model uses a mixture of risk-return measures (things like Sharpe Ratio, Omega, Calmar, etc.) that tend to best predict future Alpha.

With WhaleScores of 99, Abdiel and San Francisco-based Oberndorf are the top two managers in the U.S. based on 3 and 5-year risk-reward metrics.

William Oberndorf co-founded value fund SPO Partners in 1969, retiring in 2012 to invest family money.

While Bill Oberndorf may not be a household name, he is by no means a Johnny-come-lately to the hedge fund world. He co-founded SPO Partners in 1969 when tech pioneer John Scully launched San Francisco Partners. Oberndorf retired in 2012 to invest his family’s money. After decades of success, SPO closed in 2018, its managing partner Eli Weinberg telling investors: “Today, we are finding it exceedingly difficult to deploy capital with an acceptable margin of safety.”

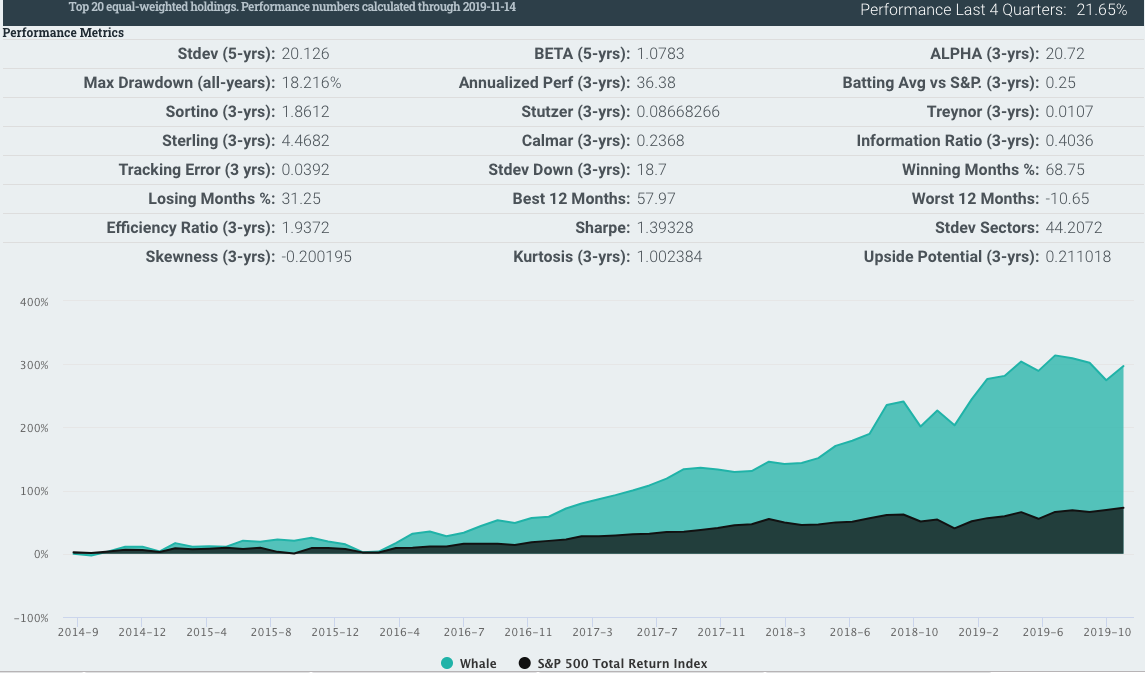

Apparently, Bill Oberndorf had no problem making profitable value investments in recent years. Holding a concentrated portfolio focused on information technology equities, Oberndorf’s stock picks averaged a 36.38% annual return over the last three years, based on equal-weighted returns of his 13F portfolio, balanced quarterly.

The “Oberndorf Entities,” which he invests for include William E. Oberndorf, Oberndorf Investments LLC and the Bill & Susan Oberndorf Foundation.

William Oberndorf’s 13F portfolio vs the S&P 500 total return since 2014.

Below are William Oberndorf’s holdings as of Q3 2019. Note that his top holding, Appfolio Inc. (APPF) is 49.66% of the entire portfolio — it’s overweighting the result of appreciation. The manager filed a 13G on APPF in June of 2015, buying the stock at an estimated $14.10. APPF recently traded at $115.

William Oberndorf Q3 2019 13F holdings.

| Stock | Symbol | Shares Held | Market Value | % of Portfolio | Ranking | % Change | Change Type | Qtr first owned | Avg Price |

| Appfolio inc | APPF | 967,124 | 92,102,000 | 49.663% | 1 | 0.00% | Q2 2015 | 28.1526 | |

| Instructure inc | INST | 1,458,538 | 56,504,000 | 30.4679% | 2 | (7.12%) | reduction | Q3 2018 | 36.1961 |

| Twilio inc | TWLO | 127,774 | 14,050,000 | 7.576% | 3 | 0.00% | Q3 2017 | 41.5898 | |

| Herbalife nutrition ltd | HLF | 195,922 | 7,418,000 | 3.9999% | 4 | 1010.98% | addition | Q1 2016 | 37.3101 |

| Liberty global plc class c | LBTYK | 289,812 | 6,895,000 | 3.7179% | 5 | 0.00% | Q2 2014 | 42.31 | |

| Mongodb inc | MDB | 55,000 | 6,626,000 | 3.5729% | 6 | new | Q3 2019 | 120.48 | |

| Tempur sealy international inc | TPX | 24,084 | 1,859,000 | 1.0024% | 7 | (67.56%) | reduction | Q3 2017 | 64.52 |

| Appian corp | APPN | 0 | 0 | (100.00%) | soldall | Q2 2019 | 36.07 | ||

| Charter communications inc | CHTR | 0 | 0 | (100.00%) | soldall | Q4 2016 | 287.92 | ||

| Zoom video communications inc | ZM | 0 | 0 | (100.00%) | soldall | Q2 2019 | 88.79 |

You can view the top 25 managers based on WhaleScore, along with other 13F data, in WhaleWisdom’s Q3 2019 Newsletter.

Contact Mark about investing based on SEC filings and smart money disclosures.

Disclaimer:

This investment blog (the “Blog”) is created and authored by Mark W. Gaffney (the “Content Creator”) and is published and provided for informational and entertainment purposes only (collectively, the “Blog Service”). The information in the Blog constitutes the Content Creator’s own opinions. None of the information contained in the Blog constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. You understand that the Content Creator is not advising, and will not advise you personally concerning the nature, potential, value or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter. To the extent any of the information contained in the Blog may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person.

From time to time, the Content Creator or its affiliates may hold positions or other interests in securities mentioned in the Blog and may trade for their own account(s) based on the information presented. The Content Creator may also take positions inconsistent with the views expressed in its messages on the Blog.

The Content Creator may hold licenses with FINRA, the SEC or states securities authorities and these licenses may or may not be disclosed by the Content Creator in the Blog.

Investing in the investments discussed in the Blog may be risky and speculative. The companies may have limited operating histories, little available public information, and the stocks they issue may be volatile and illiquid. Trading in such securities can result in immediate and substantial losses of the capital invested. You should use invest risk capital, and not capital required for other purposes, such as retirement savings, student loans, mortgages or education.