Scion Asset’s Q3 13F shows renowned value investor Dr. Michael Burry clearing out seven previous holdings and adding four new stocks. Based on the Q3 13F filings submitted on Nov. 14, Scion now has a concentrated long portfolio consisting of four consumer discretionary companies, a communications stock, and an energy stock. And a tiny position in a health care penny stock.

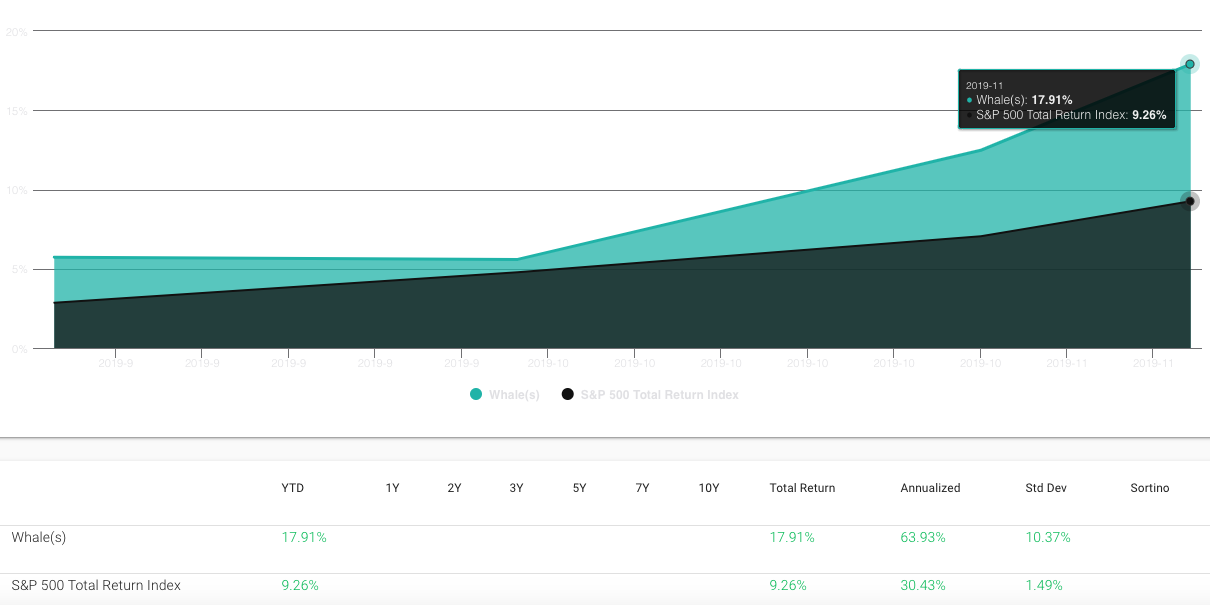

Burry’s portfolio was up 17.91% for the quarter, compared to the S&P 500’s return of 9.26%. Scion’s return was based on an equal-weighted portfolio consisting of the 10 stocks the fund held at Q2’s close.

Leading Scion Asset’s Q3 13F performance was Gamestop Corp. (GME). Scion’s Q3 holdings show that GME is the fund’s top holding. As we reported previously, Burry told Barron’s on August 21 that Scion owned 3 million shares, or 3.3% of GME and he sent a letter to the board of directors of the company urging an aggressive buyback of shares. Burry did not file a 13D in connection with GME, as Scion owned less than 5% of outstanding shares.

Since Burry’s disclosure, GME is up 69%.

During Q3, Burry also disclosed a stake in Tailored Brands(TLRD). On August 30, Scion Capital filed a 13D reporting a 5.18% position in the troubled formal apparel retailer that owns Men’s Warehouse and Jos. A. Bank. The hedge fund also disclosed it sent three separate letters sent to management. In the letter dated August 30, Burry reiterated that TLRD should cut its dividend and buy back shares. TLRD was up 23% since the filings. Scion Capital’s Q3 holdings show TLRD as it #2 position.

Scion Capital’s Q3 holdings

| Stock | Symbol | Shares Held | Market Value | % of Portfolio | Ranking | % Change | % Ownership | Avg Price |

| Gamestop Corp. | GME | 3,000,000 | 16,560,000 | 27.7768% | 1 | new | 2.9334% | 5.52 |

| Tailored Brands | TLRD | 2,875,000 | 12,650,000 | 21.2184% | 2 | 55.41% | 5.6908% | 7.1945 |

| Alphabet Inc. class C | GOOG | 8,000 | 9,752,000 | 16.3575% | 3 | (11.11%) | 0.0012% | 1080.91 |

| Sportsmans Warehouse Holdings | SPWH | 1,625,000 | 8,418,000 | 14.1199% | 4 | 1.75% | 3.7703% | 4.274 |

| Bed Bath & Beyond | BBBY | 750,000 | 7,980,000 | 13.3852% | 5 | new | 0.587% | 10.64 |

| Canadian Natural Resources Ltd | CNQ | 150,000 | 3,995,000 | 6.701% | 6 | new | 0.0126% | 26.63 |

| Nuvectra Corp | NVTR | 193,491 | 263,000 | 0.4411% | 7 | new | 1.0816% | 1.36 |

| Walt Disney | DIS | 0 | 0 | (100.00%) | 0.00% | 109.65 | ||

| Cleveland-Cliffs | CLF | 0 | 0 | (100.00%) | 0.00% | 8.6382 | ||

| Alibaba Group | BABA | 0 | 0 | (100.00%) | 0.00% | 169.45 | ||

| Cardinal Health | CAH | 0 | 0 | (100.00%) | 0.00% | 47.1 | ||

| Fedex Corp | FDX | 0 | 0 | (100.00%) | 0.00% | 164.19 | ||

| Western Digital | WDC | 0 | 0 | (100.00%) | 0.00% | 43.42 | ||

| Greensky Inc | GSKY | 0 | 0 | (100.00%) | 0.00% | 12.5847 |

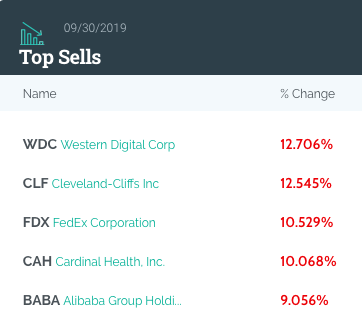

Notably, Burry sold his top two holdings from Q2 — Western Digital Corp (WDC) and Cleveland-Cliffs Inc (CLF).

Burry adds new Bed Bath & Beyond position to his portfolio.

Possibly the most intriguing disclosure from the Q3 13F is Scion’s new position in Bed Bath & Beyond Inc. (BBBY). The fund acquired 750,000 shares of BBBy during the quarter, equating to an $8 million position, the fund’s #5 holding at quarter’s end. BBBY, currently trading around $14, has doubled since the end of August. The retailed announced on Oct. 9 that Target’s chief merchant, Mark Tritton, would be its new CEO.

Also of interest, Burry disclosed a tiny position in Nuvectra Corp (NVTR). As of Q3’s close, the stock traded at $1.36. However, on Thursday the company filed for Chapter 11 bankruptcy protection. In response, NVTR shares tanked, closing at $0.23.

Nuvectra said in a statement that it is reviewing it’s options, including sale of the company or sales of specific assets, including its Algovita Spinal Cord Stimulation System, an implanted device that stimulates nerves to override pain signals, and Virtis, a device under development to treat chronic urinary retention and overactive bladder.

Burry had invested $263,000 in NVTR, just 0.44% of Scion’s portfolio.

Disclaimer:

Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this blog is meant for educational and informational purposes only. Do your own research before investing and don’t risk more than you can afford to lose. This article expresses my own opinions, and I am not receiving compensation for it (other than from WhaleWisdom). If you buy a book after clicking on one of the above links, I may received an affiliate fee. I do not have a business relationship with any company whose stock is mentioned in this article. I or my associates may hold positions in the stocks discussed.