Tiger Global and Matrix Capital are the two best performing "Tiger Cubs" over the last year. In fact, the two hedge funds' long 13F returns are two of the best in the entire hedge fund universe. That's based on equal-weighted holdings of each fund's top 20 positions,...

Hedge fund managers with hundreds of millions of dollars rarely buy the illiquid shares of a micro-cap company -- but when they do it's often a prelude to much higher prices for that stock. Below I discuss the 13F "secret" to uncovering micro-cap winners as the "Whales"...

Scion's ADV Part 2 filed with the SEC provides insights into the business practices and strategies of renowned investment manager Dr. Michael Burry.

One of the world's most intriguing fund managers, Burry made himself -- and investors in his Scion...

GE is another Enron, only worse. That's according to forensic accountant Harry Markopolos, famous for raising red flags about Bernie Madoff ’s Ponzi scheme before most anyone else had a clue.

Markipolos released a report on Thursday claiming General Electric (GE) has been...

Engine Capital filed a 13D on Cymabay (CBAY) two weeks after the development stage biotech company halted a trial of its leading drug candidate causing it's shares to fall as much as 75%.

In a 13D filing Thursday evening, New York-based Engine Capital, L.P....

Baupost Group activist filings are rare events. Seth Klarman, the renowned value investor who heads Baupost, prefers to take passive stakes in companies. Since 2006, Baupost has filed 352 passive 13G filings, and made only 25 activist 13D filings, according to data from WhaleWisdom.com.

Let's create a portfolio that holds the top stock ideas of the smartest, best informed, best performing hedge fund managers in the world. We won't pay hedge fund fees, nor will our money be "locked up." We'll rebalance this portfolio quarterly, so it always owns the highest...

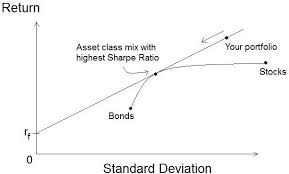

The Sharpe ratio is a popular way to measure the return of an investment compared to the amount of risk taken. Risk is measured as volatility or standard deviation. So, the equity managers with the highest Sharpe ratios in the WhaleWisdom database have demonstrated skill picking stocks...

Back in 2013, Bloomberg ran a profile of Brad Gerstner's Altimeter Capital that described the up-and-coming hedge fund manager as an adventurer -- an amateur pilot and heli-skier who hangs out with big-time CEOs at Burning Man. The article said Gerstner wanted to build a Venture Capital...

In the roaring stock market of the 1920's, it was common for groups of shrewd traders to secretly accumulate big stakes in a stock, then promote it, and drive up the price. When unsuspecting buyers chased the stock higher, the manipulators would sell at a big profit,...