Lottery ticket stocks are equities perceived by investors to provide a small chance of a huge payoff. Like playing the lottery, many investors find these stocks -- usually low-priced, thinly traded with little or no earnings -- very alluring. However, studies show that -- like the...

Over the last several days SRS Investment added to its Avis Budget Group (CAR) stake. The New York-based hedge fund acquired 243,000 shares of the rental car company from Aug. 17-19. In Form 4s disclosed Wednesday, SRS reported buying the stock on the...

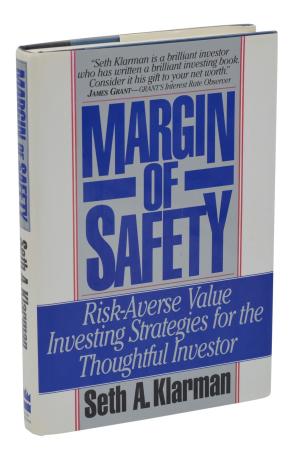

In 1991 the first (and only) edition of Seth Klarman's book Margin of Safety: Risk-Averse Value Investing Strategies for the Thoughtful Investor was published. Just 5000 copies were printed, and initial sales were slow. You could have bought it for $25. Today, it might be worth $3000.

Abdiel Capital Advisors has never held more than 9 long positions since the 4th quarter of 2015. Over that period, the $1.4 billion hedge fund has averaged a 55.1% annual return (based on 13F filings). Abdiel's portfolio concentration is anathema to Modern Portfolio Theory, which preaches diversification...

On February 28 , Martha Stewart's Sequential Brands (SQBG) announced that the lifestyle celebrity has teamed up with Canopy Brands (CGC) to develop and promote a line of hemp-based CBD products. SQBG stock spiked higher on the news, nearly doubling at one point before settling at $2.00...

The Lottery Ticket Stocks Q2 2019 portfolio was down 6.72% for the quarter, tracking the Russell 2000 Index lower. However, the portfolio of top hedge funds' most speculative holdings, rebalanced quarterly based on 13F filings, was up 35.65% year-to date as of August 15.

Macerich insiders have bought a record $2.8 million of the retail mall developer's stock over the last two months as Macerich (MAC) shares hit seven year lows.

A great story needs a great title. And what could be better than "Retail Apocalypse" to capture...

U.S. Hedge Funds are buying cannabis stocks. Despite regulatory issues and limited investment choices, the "smart money" is increasingly eager to gain exposure to the booming marijuana sector.

But you won't see Warren Buffett and Charlie Munger jumping on the pot stock...

On March 4, Marathon Partners called ELF Beauty "undervalued" in a 13D filing with the SEC. The New York City-based hedge fund disclosed a 5.2% stake, and said in the filing it has "engaged, and plans to continue to engage, with the Issuer’s management and Board of...

Ten rising star hedge funds with surprisingly small AUMs. These managers are worth watching in 2021.

As I've written about previously, small hedge funds tend to outperform large hedge funds. The famous managers typically gained their reputations when their funds were small and they were more aggressive. But as a fund's managed assets swell, it's forced to focus on more liquid, less profitable...