Bill Stiritz may not have the name recognition of Jeff Bezos, Elon Musk or Warren Buffett, but the 84-year-old Non-Executive Chairman of Post Holdings, Inc. may be one of the greatest CEOs of the last half century.

An investment of $100 made in Ralston Purina in 1981 when Stiritz was named CEO, would have would have been worth $5,700 by 2000 -- a compound annual return of 20%.

When screening insider trades, my interest is always piqued when I see both top executives of a company buying shares. It implies that the two people with the best information on that company agree the shares are a good value.

That’s what just happened at FS KKR Capital Corp (FSK). Both the Chief Investment Officer (CIO) and the CEO, along with a director, purchased a total of $495,000 of their company’s stock.

Question: If you’re a top hedge fund manager and the value of your highest conviction stock suddenly drops by 20%, what do you do? Answer: You buy more.

Late in 2018, investors panic-sold en masse. Indiscriminate selling. Babies thrown out with bathwater. While the public freaked-out about interest rates, trade wars and recessions, leading hedge funds added to their best ideas.

Many “effects” in finance have been linked to the calendar. There’s the Weekend Effect, the Turn-of-the-Month Effect, the October Effect, even the Mark Twain Effect. But probably the most widely discussed is the January Effect. This is the tendency for stocks – particularly small-cap stocks – to outperform in January vs other months.

The January Effect is a market “anomaly” – market price behavior that “shouldn’t” happen.

When the equities in your portfolio plummet, you may find yourself asking: What are these stocks really worth? They’ve fallen ten or twenty percent – what’s to keep them from declining even further? Well here’s one thing that can anchor a portfolio: Sizeable dividend payments.

When Steve Kelley was named CEO of Amkor Technology (AMKR) in May of 2013, AMKR was around $4.50. As an incentive, the company granted him 750,000 shares in stock and options at the equivalent of $4.50. After the grant fully vested, SEC filings indicate the CEO sold most all of the granted stock and options between Nov. of 2016 and June of 2017 at an average price of $11.38 for total proceeds of $8.9 million.

AMKR closed Wednesday at $6.53.

So, since his employment began with Amkor, Kelley did not buy any AMKR on the open market. His only actions were disposing of shares granted to him as compensation. His timing was good.

Amin Maredia, formerly the CEO of Sprouts Farmers Market (SFM), was a valuable member of the natural grocer’s management team over the last few years. How valuable? Well, his services are apparently worth $600 million. Because that’s how much market value SFM stock lost on Friday after Maredia suddenly resigned.

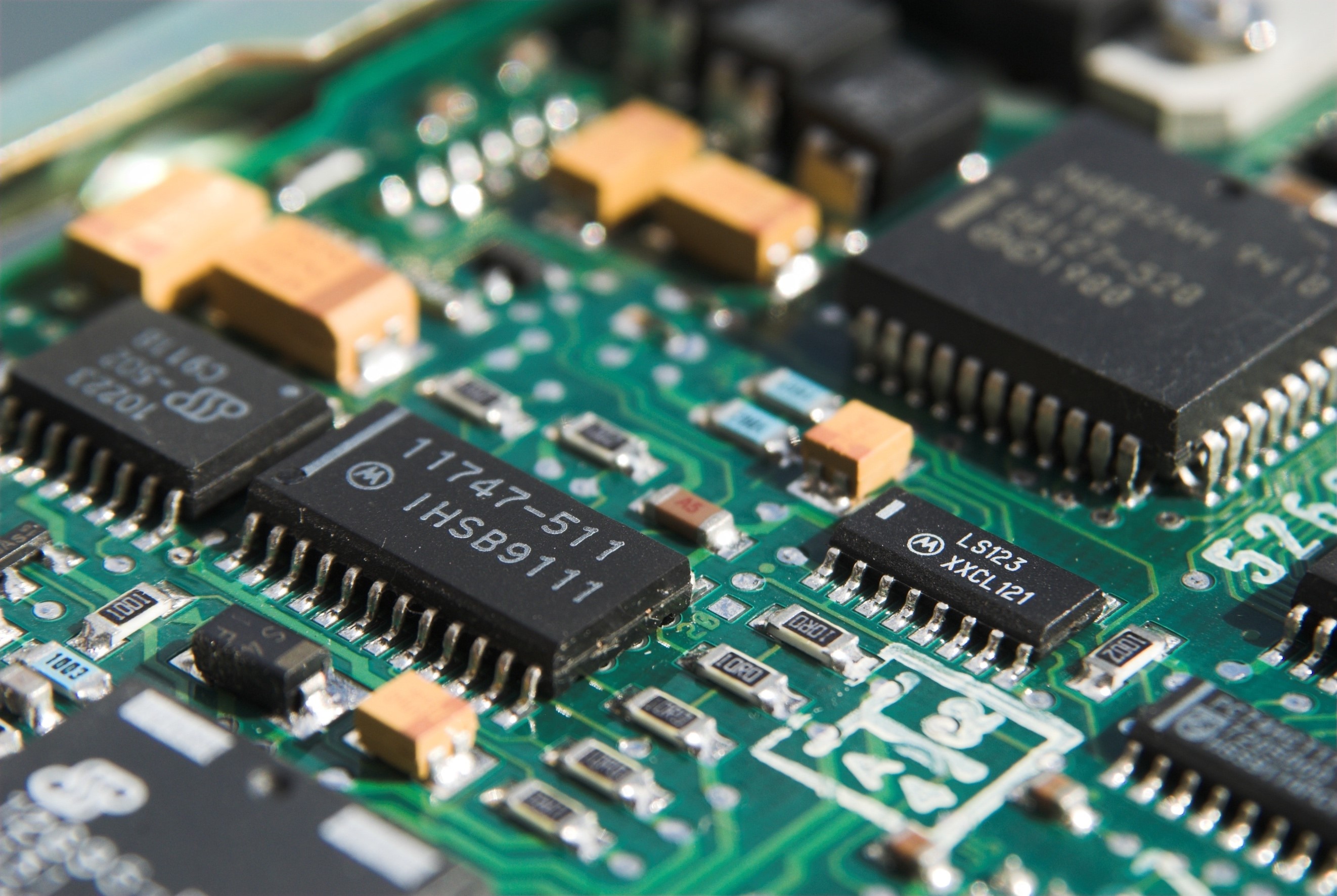

When investors sell an entire market sector indiscriminately, they always throw out a few babies with the bathwater. That may be the case with these two small-cap specialty semiconductor companies where insiders recently purchased shares on the open market.

When the stock market swoons, I like to watch insider buying to see where the smart money is finding value. Here are three stocks with interesting insider activity that also showed good relative strength in Monday’s weak market.

If history is any indication, On Deck Capital (NYSE:ONDK) stock is likely to trade higher in the months to come.