In recent days, four Enstar Group Limited (ESGR) insiders — the COO, CEO, CFO and President — purchased a total of $7 million of their own stock on the open market.

After the close on Wed. March 13, Dominic F. Silvester, the CEO and Founder of Enstar, reported a $4.7 million open market purchase of the property and casualty insurer’s shares at $169.93, increasing his holdings by 5.49%. In addition, COO Orla Gregory bought nearly $1 million of ESGR, increasing her position by 39%.

Yesterday’s buying by Enstar Group insiders brings the total shares purchased since March 8 to 41,095. The average cost was $169.38.

| Filing Date | Insider | Title | Transaction | Trade Date | Shares | Avg. Price | Total | Holdings | % Change |

| 13-Mar-2019 | Gregory Orla | Chief Operating Officer | Mkt Buy | 12-Mar-2019 | 5,820 | 171.25 | $ 996,675.00 | 20,866 | 39% |

| 13-Mar-2019 | Silvester Dominic Francis Michael | Chief Executive Officer | Mkt Buy | 12-Mar-2019 | 27,512 | 169.93 | $ 4,675,180.00 | 533,507 | 5.49% |

| 13-Mar-2019 | Silvester Dominic Francis Michael | Chief Executive Officer | Mkt Buy | 11-Mar-2019 | 263 | 164.88 | $ 43,363.40 | 505,995 | |

| 12-Mar-2019 | Bowker Guy Thomas Anthony | Chief Financial Officer | Mkt Buy | 08-Mar-2019 | 1,500 | 160.52 | $ 240,780.00 | 4,521 | 50% |

| 08-Mar-2019 | O’Shea Paul James | President, Director | Mkt Buy | 06-Mar-2019 | 6,000 | 167.41 | $ 1,004,460.00 | 201,335 | 3% |

The cluster buying by ESGR executives is the most by officers since at least 2003.

Enstar Group Insiders bought following recent share price drop

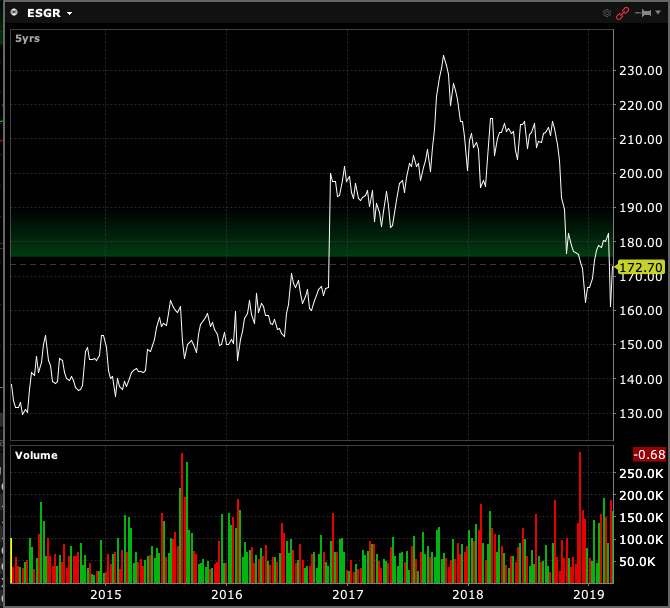

Enstar Group insiders bought after ESGR stock dropped as much as 12.6% in the wake of a Q4 earnings report showing a $7.84 loss per share for 2018. That compared to net earnings of $15.95 per share for 2017.

According to its 10K, “Enstar acquires discontinued or run-off business (unwanted liabilities) from insurance companies by acquiring either specific portfolios or whole firms. It then manages the run-off by settling claims in a professional manner until the liabilities are exhausted.” The company also manages specialty active underwriting businesses.

The company states that its “fundamental corporate objective is growing our net book value per share. We strive to achieve this primarily through growth in net earnings from both organic and accretive sources, including the completion of new acquisitions, the effective management of companies and portfolios of business acquired, and the execution of active underwriting strategies.”

Also from the company’s 2018 10K:

During 2018, our book value per share on a fully diluted basis decreased by 2.0% to $155.94 per share. The decrease was primarily attributable to net losses of $162.4 million, which were primarily driven by unrealized losses on investments and by adverse development in the reserves for our StarStone segment.

Enstar has consistently grown book value

As seen below, Enstar Group has consistently grown book value, however 2018 saw a drop of over 2% in book value.

| YEAR | Diluted Book Value Per Share | BV % CHG | Stock Price | Price to Book Ratio |

| Q4 2018 | 155.94 | -3.20% | 174 (current) | 1.12 |

| Q3 2018 | 161.1 | -0.35% | 208.5 | 1.29 |

| Q2 2018 | 161.67 | 2.94% | 207.3 | 1.28 |

| Q1 2018 | 157.06 | -1.34% | 210.25 | 1.34 |

| Q4 2017 | 159.19 | 3.69% | 200.75 | 1.26 |

| Q3 2017 | 153.53 | 1.97% | 222.35 | 1.45 |

| Q2 2017 | 150.56 | 2.69% | 198.65 | 1.32 |

| Q1 2017 | 146.62 | 2.05% | 191.3 | 1.30 |

| Q4 2016 | 143.68 | 0.57% | 197.7 | 1.38 |

| Q3 2016 | 142.86 | 6.07% | 164.47 | 1.15 |

| Q2 2016 | 134.68 | 1.38% | 161.99 | 1.20 |

| Q1 2016 | 132.85 | 2.47% | 162.58 | 1.22 |

| Q4 2015 | 129.65 | 3.15% | 150.04 | 1.16 |

| Q3 2015 | 125.69 | 1.53% | 150 | 1.19 |

| Q2 2015 | 123.8 | 2.62% | 154.95 | 1.25 |

| Q1 2015 | 120.64 | 1.19% | 141.86 | 1.18 |

| Q4 2014 | 119.22 | 4.00% | 152.89 | 1.28 |

| Q3 2014 | 114.64 | 0.61% | 136.32 | 1.19 |

| Q2 2014 | 113.94 | 6.55% | 150.73 | 1.32 |

| Q1 2014 | 106.94 | 1.65% | 136.31 | 1.27 |

| Q4 2013 | 105.2 | NA | 136.85 | 1.30 |

Enstar Group’s largest shareholder is Hillhouse Capital Management with an 8.14% stake. The managing director of Hillhouse, Jie Liu, is a member of Enstar’s board. Private equity firm Trident V owns 7.62% of ESGR, including 285,986 shares added during Q4 of 2018.

ESGR, with a book value of $3.72 billion, is thinly traded — average daily volume over the last 90 days was 43,500.

Disclaimer: Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this blog is meant for educational and informational purposes only. Do your own research before investing and don’t risk more than you can afford to lose. This article expresses my own opinions, and I am not receiving compensation for it (other than from WhaleWisdom). I do not have a business relationship with any company whose stock is mentioned in this article. I or my associates may hold positions in the stocks discussed.