Independent Bank Group (Nasdaq:IBTX) announced on October 25 that it was reestablishing a $75 million stock repurchase program. And five corporate insiders responded to the news by buying a total of $1.1 million of IBTX on the open market.

Commenting on the announcement David R. Brooks, Chairman and CEO of the Texas-based bank holding company, said: “Given the current market for bank stock prices, we believe that now is a good time for us to reestablish a share repurchase program. This program gives us an additional tool with which to enhance shareholder value. We plan to implement the program at such time and price as repurchases are considered beneficial to the Company and its stockholders.”

A stock buyback announcement presumably means management believes a company’s shares are undervalued. So a stock typically jumps on buyback news. Indeed, IBTX shares rallied after the announcement and insider buying disclosures despite a weak broad market. Unfortunately, insider buying after a buyback announcement is the exception. Here’s a dirty little secret – the very same officers and other insiders who initiate buyback programs often sell personal shares immediately after the buyback news.

Unlike the Independent Bank Group insiders who added skin in the game by increasing their holdings, more often buybacks allow executives to take significant cash off the table by selling into the post-news price bump.

If the stock of a company is cheap enough to justify spending corporate cash to repurchase shares, why would corporate insiders sell into the price bump? This practice has the whiff of a pump-and-dump scheme – where a promoter touts a stock with the intention of selling as traders bid up the promoted stock’s price. It’s probably not illegal for corporate insiders to cash out their personal shares after a buyback announcement. But is it ethical?

Study: Stock returns after quarters with repurchase programs and net insider selling are “negligible.” However, stock returns after quarters with repurchase programs and insider buying are “substantial.”

The practice has caught the attention of the SEC. In a June 11, 2018 speech SEC Commissioner Robert J. Jackson Jr. addressed the issue:

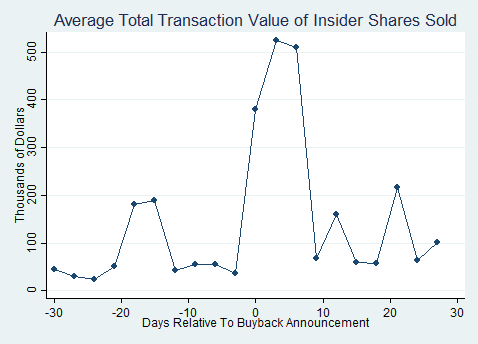

“… studying 385 buybacks over the last fifteen months. We matched those buybacks by hand to information on executive stock sales available in SEC filings. First, we found that a buyback announcement leads to a big jump in stock price: in the 30 days after the announcements we studied, firms enjoy abnormal returns of more than 2.5%. That’s unsurprising: when a public company in the United States announces that it thinks the stock is cheap, investors bid up its price.

What did surprise us, however, was how commonplace it is for executives to use buybacks as a chance to cash out. In half of the buybacks we studied, at least one executive sold shares in the month following the buyback announcement. In fact, twice as many companies have insiders selling in the eight days after a buyback announcement as sell on an ordinary day. So right after the company tells the market that the stock is cheap, executives overwhelmingly decide to sell.”

And they tend to sell in unusually large size. According to Jackson, during the eight days following a buyback announcement, executives on average sell more than $500,000 worth of stock each day—a fivefold increase from their typical selling.

SEC Chairman Jackson went on to say:

“Now, let’s be clear: this trading is not necessarily illegal. But it is troubling, because it is yet another piece of evidence that executives are spending more time on short-term stock trading than long-term value creation… [using the buyback] as an opportunity to pocket some cash at the expense of the shareholders they have a duty to protect, the workers they employ, or the communities they serve.”

Source: SEC

Which brings us back to Independent Bank Group, where five insiders spent $1.1 million buying stock in the wake of a buyback announcement. Not only does this this seem appropriate – if the stock is a bargain why wouldn’t they buy? But there’s something else about situations where a company initiates a buyback program and insiders are buying– it tends to signal an attractive opportunity for investors.

A 2013 paper Insider trading and share repurchases found that stock returns after quarters with repurchase programs and net insider selling are “negligible”. However, stock returns after quarters with repurchase programs and insider buying are “substantial.”

From the study:

“We find that insider trades either validate or mitigate the undervaluation signal of the repurchase. Abnormal returns of repurchasing firms with net insider buying versus net insider selling in a given quarter are significantly higher for the quarter immediately after the repurchase and the three subsequent years. For repurchases accompanied by net insider selling, abnormal returns are negligible after only one year.”

There are lots banks to invest in, but Independent Bank Group, where corporate insiders are validating the undervaluation implied by a buyback program, deserves special consideration.

IBTX Daily Chart since April 2018

Disclaimer: Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this post is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in the article.