“Insiders are selling stock like it’s 2007.” That’s a headline from August 27, 2019. Sounds ominous. One might have been inclined to think: The smart guys are dumping stock, guess I should too. Well that would have been a big mistake. Since that headline was posted, the S&P 500 is up over 15%. The Nasdaq 100 Index is up about 21%. The takeaway: Aggregate insider selling is not a good stock market timing signal.

There may be many indicators flashing warning signs of a market correction: The inverted yield curve, too bullish sentiment, high PE ratios, low put-call ratios, irrational exuberance…the list is a long one. But don’t count insider selling as a predictive indicator.

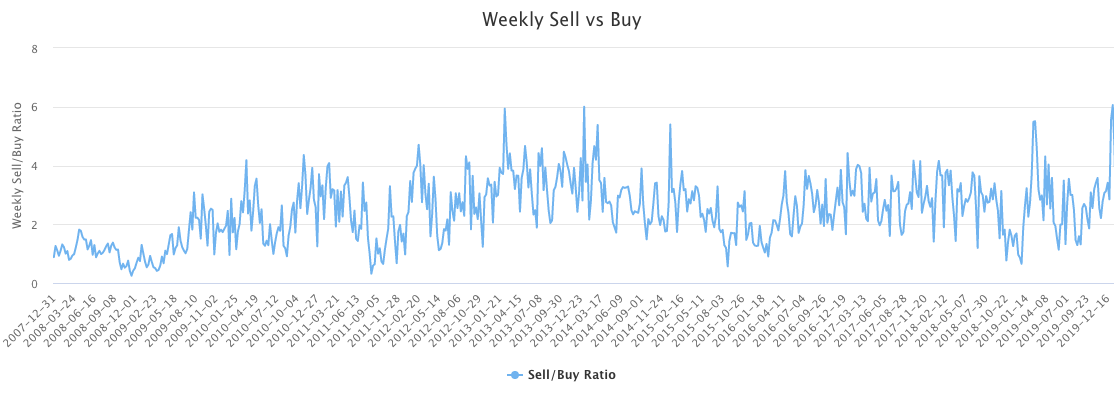

WhaleWisdom.com tallies the weekly buying and selling of officers and directors at U.S. public companies. 10% holders, considered insiders by the SEC, tend to be hedge funds, so their transactions are not included in the weekly Sell vs Buy indicator.

For the week of January 6, 2020, the Insider Sell vs Buy Ratio hit its highest reading — 6.06 — since 2008. That means for the week beginning Jan 6. and ending Jan. 10, there were over 6x more sell transactions than buy transactions executed by corporate insiders. But rather than a cause for alarm, investors would be well served to ignore this data and focus on other indicators to inform their stock market investment decisions.

WhaleWisdom’s weekly Insider Sell vs Buy Ratio recently hit its highest reading since 2008.

Below are the 10 highest readings of the Insider Weekly Sell vs Buy indicator since 2008. As you can see, the high readings did not correlate with a lower stock market levels six months out. In fact, the extreme insider selling readings were associated with a 5.51% higher S&P 500 level six months later.

| Date | Insider Weekly Sell vs Buy Ratio | 6 mo return |

| 1/6/20 | 6.06 | 1.60%* |

| 1/6/14 | 6.00 | 6.79% |

| 2/11/13 | 5.94 | 9.02% |

| 2/18/19 | 5.51 | 2.78% |

| 12/29/14 | 5.40 | 1.17% |

| 3/3/14 | 5.38 | 6.87% |

| 2/20/12 | 4.70 | 3.37% |

| 5/6/13 | 4.67 | 8.32% |

| 7/15/13 | 4.59 | 8.62% |

| 1/2/17 | 4.42 | 6.55% |

| Average | 5.51% |

Unlike spikes in insider selling, very low Insider Sell vs Buy ratios are associated with bear market bottoms and positive returns going forward.

In contrast, the ten lowest Insider Sell vs Buy readings were associated with very strong stock market returns going forward. The lowest reading of 0.25 for the week of Nov. 17, 2008, means there were 4x more buy than sell transactions by officers and directors. The table below shows that going long the S&P 500 on these dates resulted in a 16.85% average return over the next six months. There was only one six month period that showed a negative return — August 24, 2015 — and even then investors had ample opportunities to profit after buying the dip.

| Date | Insider Weekly Sell vs Buy Ratio | 6 mo return |

| 11/17/08 | 0.25 | 18.48% |

| 8/8/11 | 0.32 | 10.46% |

| 8/24/15 | 0.57 | -1.96% |

| 3/16/09 | 0.59 | 13.81% |

| 12/24/18 | 0.66 | 22.98% |

| 11/21/11 | 0.68 | 13.92% |

| 9/19/11 | 0.73 | 38.93% |

| 10/22/18 | 0.77 | 10.88% |

| 2/8/16 | 0.90 | 17.10% |

| 8/23/10 | 0.91 | 23.94% |

| Average | 16.85% |

Insiders sell shares for many reasons unrelated to their outlook for their company’s stock.

Obviously, aggregate insider buying is more significant than insider selling. Why? Because insiders sell their own company’s stock for a variety of reasons that aren’t related to their opinion of the stock’s prospects. Insiders may sell because they are raising cash for a purchase, paying for a child’s education, going through a divorce, etc. Also, many insiders are compensated via stock options in their companies — exercise and sale of those options does not typically imply a negative opinion of their company’s stock. Rather, the insider is essentially cashing in stock granted as employment compensation.

But insiders buy stocks pretty much for one reason only: They think the share price is going higher. In times of severe stock market declines, when the investing public is panic-selling, insiders as a group are buyers. Intimately familiar with the value of their own companies, officers and directors react aggressively when their company’s stock trades below fair value. The bigger the bargain, the more they tend to buy.

When you see insiders as a group aggressively buying their own shares, the market is very likely near a bottom.

So, the stock market has been on a roll, and may be due for a pullback. Insiders may be selling more than usual. But don’t get deceived by headlines suggesting that historic selling by the “smart money” suggests a market implosion is imminent. The market will no doubt have a big correction some day, but insiders won’t predict it.

On the other hand, keep some powder dry for when insiders as a group are feeling greedy and aggressively buying their own shares. When the insiders “back up the truck” and buy, you want to join them.

Contact Mark about investing based on SEC filings and smart money disclosures.

Disclaimer:

This investment blog (the “Blog”) is created and authored by Mark W. Gaffney (the “Content Creator”) and is published and provided for informational and entertainment purposes only (collectively, the “Blog Service”). The information in the Blog constitutes the Content Creator’s own opinions. None of the information contained in the Blog constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. You understand that the Content Creator is not advising, and will not advise you personally concerning the nature, potential, value or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter. To the extent any of the information contained in the Blog may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person.

From time to time, the Content Creator or its affiliates may hold positions or other interests in securities mentioned in the Blog and may trade for their own account(s) based on the information presented. The Content Creator may also take positions inconsistent with the views expressed in its messages on the Blog.

The Content Creator may hold licenses with FINRA, the SEC or states securities authorities and these licenses may or may not be disclosed by the Content Creator in the Blog.

Investing in the investments discussed in the Blog may be risky and speculative. The companies may have limited operating histories, little available public information, and the stocks they issue may be volatile and illiquid. Trading in such securities can result in immediate and substantial losses of the capital invested. You should use invest risk capital, and not capital required for other purposes, such as retirement savings, student loans, mortgages or education.