Insiders buy market crashes, backing up the truck if their shares get cheap enough. The smartest fund managers can make their year — even careers — acquiring great companies at phenomenal bargains during market crashes. True market crashes are rare–black swans. But garden variety “panics” occur fairly often. Whatever volatility the market has in store, following the moves of the wisest investors can be highly profitable.

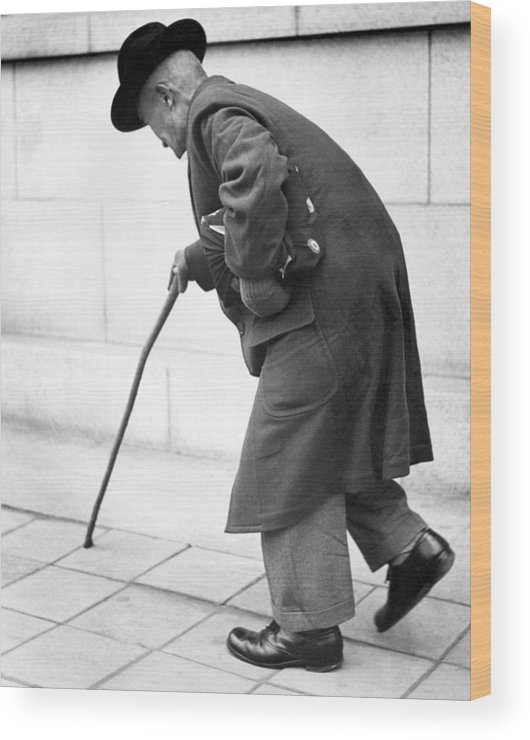

Whenever I sense panic in the stock market — like today — I always think of the classic writing of one Henry Clews who wrote Fifty Years in Wall Street in 1888. Clews, an investing titan back in the day, said this in Chapter III, How to Make Money in Wall Street.

“But few gain sufficient experience in Wall Street to command success until they reach that period of life in which they have one foot in the grave. When this time comes these old veterans of the Street usually spend long intervals of repose at their comfortable homes, and in times of panic, which recur sometimes oftener than once a year, these old fellows will be seen in Wall Street, hobbling down on their canes to their brokers’ offices. Then they always buy good stocks to the extent of their bank balances, which have been permitted to accumulate for just such an emergency.

The panic usually rages until enough of these cash purchases of stock is made to afford a big “rake in.” When the panic has spent its force, these old fellows, who have been resting judiciously on their oars in expectation of the inevitable event, which usually returns with the regularity of the seasons, quickly realize, deposit their profits with their bankers, or the overplus thereof, after purchasing more real estate that is on the up grade, for permanent investment, and retire for another season to the quietude of their splendid homes and the bosoms of their happy families.

Like the wizened investors of 1888, today’s elite investors bide their time, buying into panics that “recur sometimes oftener than once a year.”

Many things have changed since Henry Clews wrote Fifty Years in Wall Street 131 years ago — but much has not. Barroom tippers and bucket shops have been replaced by internet trading sites and day traders. Computers and even Artificial Intelligence now drive most investment decisions. But investors still panic. Stocks still crash. And when they do, there is opportunity. Clews’ hobbled, but successful investors are enjoying their golden years. Decades of Wall Street experience have left them with no doubt how to accumulate wealth: Buy the stocks of good businesses during panics when prices are cheap…

To my thinking, the equivalent of Clew’s crooked cane investors in todays world are leading corporate insiders and fund managers. They bide their time, waiting for panics that “recur sometimes oftener than once a year.” Just like the wizened investors of 1888, today’s insiders buy market crashes. They purchase “good stocks to the extent of their bank balances.” Using funds that “have been permitted to accumulate for just such an emergency.”

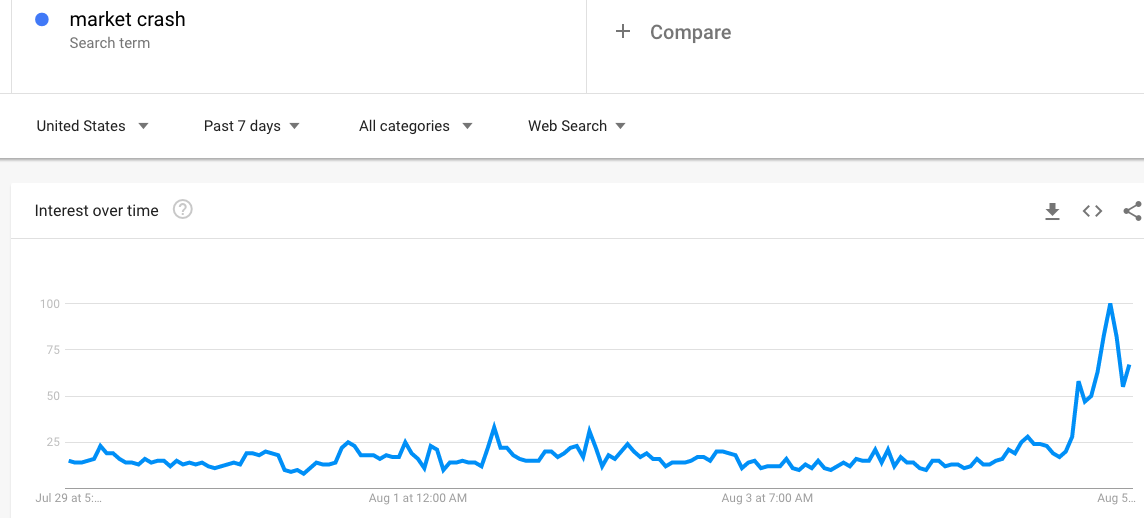

Today, as stock market crash fears rise, it may be time to watch for the old timers shuffling toward the broker’s office.

Insiders buy market crashes — Jamie Dimon’s Insider buying history is a prime example

I’ve written previously about some of The Greatest Insider Trades in History. Most of these happened during the dark days of 2008-2009. Jamie Dimon is a great example. Though certainly not an old man with “one foot in the grave,” Diamond is an elite executive who rarely buys shares of JP Morgan Chase (JPM). But when he does, JPM stock represents significant value. Over time, Dimon has generated stellar returns from his insider buying.

Will the current selloff devolve into the kind of panic that drives JPM — a cornerstone bank of the US economy — into bargain range? It’s not probable. But it wasn’t probable a decade ago either.

They are as certain to be seen on the eve of a panic as spiders creeping steathily and noiselessly from their cobwebs just before rain…

Here’s a plan for what to do if the market comes unglued. And we’ll monitor aggregate insider buying vs selling which gave a great buy signal in late 2018.

You can follow insider buying on WhaleWisdom.com.

I close with more words from Henry Clews circa 1888.

I say to the young speculators, therefore, watch the ominous visits to the Street of these old men. They are as certain to be seen on the eve of a panic as spiders creeping stealthily and noiselessly from their cobwebs just before rain. If you only wait to see them purchase, then put up a fair margin for yourselves, keep out of the “bucket shops” as well as the “sample rooms,” and only visit Delmonico’s for light lunch in business hours, you can hardly fail to realize handsome profits on your ventures.

Disclaimer:

Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this blog is meant for educational and informational purposes only. Do your own research before investing and don’t risk more than you can afford to lose. This article expresses my own opinions, and I am not receiving compensation for it (other than from WhaleWisdom). If you buy a book after clicking on one of the above links, I may received an affiliate fee. I do not have a business relationship with any company whose stock is mentioned in this article. I or my associates may hold positions in the stocks discussed.