Billionaire John Malone’s insider buying may be rare, but when he does make a purchase, it pays to join him. On May 15, Malone along with two other Qurate Retail Inc. (QRTEA) insiders, bought over $14 million of the retailing and media stock at an average price of $12.48.

The Qurate insider buying came as QRTEA dropped by as much as 33% in response to disappointing Q1 earnings announced on May 9. QRTEA reported Q1 EPS of $0.35, $0.03 worse than the analyst estimate of $0.38. Revenue for the quarter came in at $3.1 million versus the consensus estimate of $3.25 billion.

John Malone is “The man who left Warren Buffett in the Dust.”

Few people have investment track records that equal John Malone’s. When he became CEO of cable tv company TCI in 1973, it had 400,000 subscribers, $12 million in annual sales, owed creditors $132 million, and was on the verge of bankruptcy. He sold the firm to AT&T for more than $50 billion in 1999.

Malone parlayed the capital from this sale into an ongoing series of media deals with complicated corporate structures designed to maximize profits and minimize taxes. Forbes estimates Malone’s personal fortune at $7 billion. The Connecticut native is the nation’s biggest individual landowner, with over two million acres across seven states.

A Barron’s article from Nov. of 2018 called Malone “The Man Who Left Warren Buffett in the Dust,” Malone’s investment returns since 2006 have beaten even the Oracle of Omaha’s.

A backtest shows copying John Malone insider buying, and holding a year, would have returned 81.2% per trade on average.

In the relatively few instances that John Malone has filed Form 4s, buying as a corporate insider, it would have paid handsomely to follow the “Cable Cowboy” into every trade.

Using WhaleWisdom’s insider backtester, I researched the returns an investor would have made copying Malone’s insider buying. Since 2008, what if every time John Malone made an open market transaction, we bought that same stock on the close the next day? We buy after Malone’s initial trade in the stock, and don’t buy that same stock again for 90 days. We sell at the end of one year.

The Malone backtest entered nine trades, prior to his recent QRTEA purchase. Buying one day after an initial John Malone insider buying disclosure and holding for one year would have resulted in an average return of 81.20%

Backtest results – John Malone insider buying

| Trade Date | Stock | Ticker | Action | Trade Price | % Change |

| 2010-03-23 | Ascent Capital Group Inc A | ASCMA | New Buy | 28.29 | |

| 2011-03-24 | Ascent Capital Group Inc A | ASCMA | elapsed time rule | 47.14 | 66.63% |

| 2012-11-15 | Ascent Capital Group Inc A | ASCMA | New Buy | 58.23 | |

| 2013-11-18 | Ascent Capital Group Inc A | ASCMA | elapsed time rule | 81.67 | 40.25% |

| 2008-12-10 | Discovery Inc Series A | DISCA | New Buy | 7.03 | |

| 2009-12-11 | Discovery Inc Series A | DISCA | elapsed time rule | 16.32 | 132.15% |

| 2017-12-15 | Discovery Inc Series A | DISCA | New Buy | 21.04 | |

| 2018-12-17 | Discovery Inc Series A | DISCA | elapsed time rule | 27.52 | 30.80% |

| 2013-06-24 | Liberty Media Corp Series A | FWONA | New Buy | 15.94 | |

| 2014-06-25 | Liberty Media Corp Series A | FWONA | elapsed time rule | 17.42 | 9.28% |

| 2017-07-10 | Liberty Global plc Class A | LBTYA | New Buy | 31.72 | |

| 2018-07-11 | Liberty Global plc Class A | LBTYA | elapsed time rule | 28.96 | -8.70% |

| 2008-11-19 | Qurate Retail Group Inc Series A (Formerly Liberty Interactive) | QRTEA | New Buy | 2.23 | |

| 2009-11-20 | Qurate Retail Group Inc Series A (Formerly Liberty Interactive) | QRTEA | elapsed time rule | 8.99 | 303.14% |

| 2010-05-25 | Qurate Retail Group Inc Series A (Formerly Liberty Interactive) | QRTEA | New Buy | 10.46 | |

| 2011-05-26 | Qurate Retail Group Inc Series A (Formerly Liberty Interactive) | QRTEA | elapsed time rule | 14.91 | 42.54% |

| 2012-12-20 | Starz, Series A | STRZA | New Buy | 13.33 | |

| 2013-12-23 | Starz, Series A | STRZA | elapsed time rule | 28.62 | 114.70% |

| 2019-05-16 | Qurate Retail Group Inc Series A (Formerly Liberty Interactive) | QRTEA | New Buy | 13.31 |

Qurate Retail stock is down over 50% from its 2018 high

Qurate owns QVC, the leading home-shopping channel, and No. 2 HSN, as well as online retailer Zulily. The shares have performed poorly in recent years as investors have reacted to lackluster revenue growth, disappointing results from HSN, and the possibility of greater involvement by Amazon in home shopping.

Mike George, President and CEO of Qurate Retail, commenting on Q1 results:

“Our first quarter performance was disappointing amidst a changing retail and media landscape. Our recent results have been more variable as we navigate the evolution of our business model and the integration of HSN, fine-tune our investments, and strike the right balance between sensible revenue growth, margin expansion, new customer acquisition and our strategic initiatives. We are taking a disciplined approach, investing in initiatives to drive high-quality customer growth and engagement, broaden and deliver our assortments, particularly across new digital platforms, and optimize our fulfillment network. Our customer fundamentals remain strong, including customer count, retention and purchase frequency. We are confident we are taking the right actions to deliver attractive operating margins and free cash flow for the long-term.”

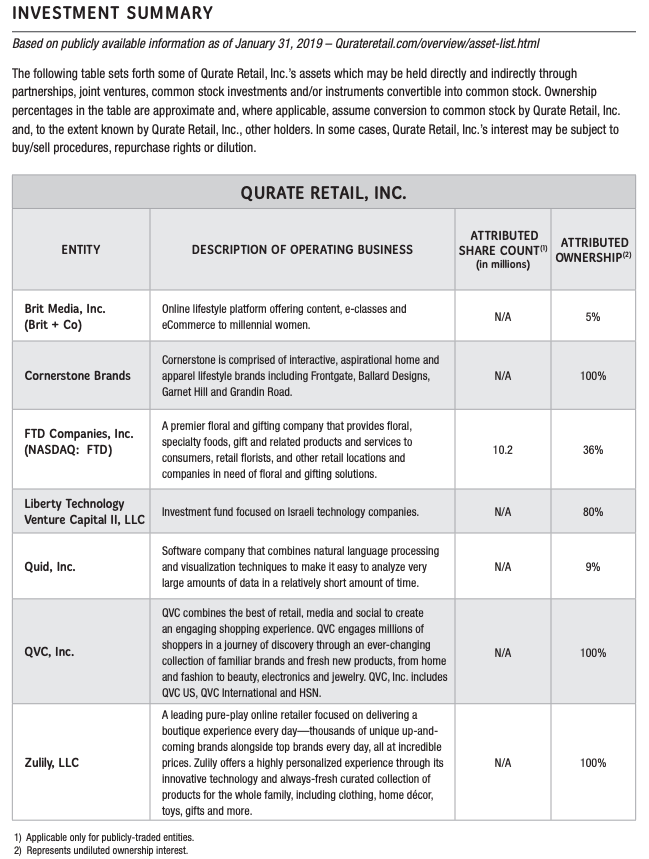

Qurate Retail Inc. is comprised of the following assets (from 2018 annual report):

After Qurate’s Q1 report, UBS analyst Jay Sole raised the price target on QRTEA to $25.00 (from $18.00) while maintaining a Buy rating. DA Davidson analyst Tom Forte lowered his price target on Qurate to $15.00 (from $25.00) while maintaining a Buy rating.

Disclaimer:

Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this blog is meant for educational and informational purposes only. Do your own research before investing and don’t risk more than you can afford to lose. This article expresses my own opinions, and I am not receiving compensation for it (other than from WhaleWisdom). I do not have a business relationship with any company whose stock is mentioned in this article. I or my associates may hold positions in the stocks discussed.