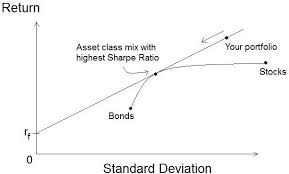

The Sharpe ratio is a popular way to measure the return of an investment compared to the amount of risk taken. Risk is measured as volatility or standard deviation. So, the equity managers with the highest Sharpe ratios in the WhaleWisdom database have demonstrated skill picking stocks with market beating returns. However, their picks have shown relatively tame price fluctuations.

Developed by Nobel laureate William F. Sharpe in 1966, the Sharpe ratio is defined as the difference between the returns of the investment and the risk-free return, divided by the standard deviation of the investment (i.e., its volatility).

Here’s how to calculate the Sharpe ratio:

(average rate of return on the investment – the risk-free rate of return) divided by the standard deviation of the investment.

WhaleWisdom provides tools for analyzing the stock portfolios of large hedge funds and investment advisers who are required to report holdings to the SEC quarterly via 13F filings. Studying and emulating the stock picks of elite investment managers can be an excellent way to build profitable portfolios.

Below are the top performing managers in WhaleWisdom.com’s database of 3516 13F filers as of Q3 2019. (13F filings for Q4 holdings must be reported by Feb. 15.) Sharpe ratios are calculated based on the performance of equal-weighted portfolios of the managers’ top 20 holdings, rebalanced quarterly. The manager must have had a minimum of 20 13F positions as of Q3 2019.

It should be noted that, according to WhaleWisdom.com, the three year Sharpe Ratio of the S&P 500 Total Return Index has been 1.07 over the last three years.

Managers with the highest Sharpe ratios over the last three years.

| NAME | 13F MKT VALUE | TOTAL HOLDINGS | 3 YR SHARPE | 1 YR PERF | Q3 2019 PERF |

| REILLY HERBERT FAULKNER III | 238,174,000 | 50 | 2.064 | 19.58 | 4.38 |

| JUNTO CAPITAL MANAGEMENT LP | 1,682,556,000 | 40 | 1.9357 | 17.82 | 5.88 |

| BLAIR WILLIAM & COMPANY | 17,355,103,000 | 1692 | 1.9161 | 24.66 | 2.83 |

| EADS & HEALD WEALTH MANAGEMENT | 178,910,000 | 129 | 1.8858 | 21.44 | 1.9 |

| LIBERTY CAPITAL MANAGEMENT, INC. | 226,905,000 | 119 | 1.882 | 22.15 | 5.19 |

| BROWN ADVISORY INC | 35,638,030,000 | 1008 | 1.8736 | 22.15 | 3.14 |

| WENDELL DAVID ASSOCIATES INC | 682,889,000 | 153 | 1.8556 | 17.95 | 1.46 |

| BRANDYWINE MANAGERS, LLC | 298,877,000 | 48 | 1.8443 | 34.83 | -1.6 |

| BATH SAVINGS TRUST COMPANY | 521,210,000 | 125 | 1.8284 | 24.36 | 1.81 |

| SUSTAINABLE GROWTH ADVISERS, LP | 9,965,170,000 | 52 | 1.8269 | 20.78 | 4.7 |

| HUNTER ASSOCIATES INVESTMENT MANAGEMENT LLC | 290,897,000 | 163 | 1.8168 | 20.29 | 6.83 |

| OWNERSHIP CAPITAL B.V. | 2,163,731,000 | 22 | 1.8146 | 22.92 | 4.37 |

| JLB & ASSOCIATES INC | 504,791,000 | 73 | 1.7317 | 24.54 | 9.34 |

| WESTFIELD CAPITAL MANAGEMENT COMPANY LP | 12,488,835,000 | 234 | 1.7163 | 23.83 | 12.05 |

| NORRIS PERNE & FRENCH LLP | 802,479,000 | 133 | 1.7136 | 20.5 | 5.92 |

| LINDSELL TRAIN LTD | 5,918,173,000 | 11 | 1.709 | 14.95 | -1.07 |

| CANTILLON CAPITAL MANAGEMENT LLC | 10,286,687,000 | 33 | 1.705 | 21.92 | 0.13 |

| DOUGLASS WINTHROP ADVISORS, LLC | 2,614,301,000 | 260 | 1.6971 | 23.45 | 7.4 |

| LANNEBO FONDER AB | 329,357,000 | 24 | 1.6926 | 20.88 | 8.02 |

| SECURITY ASSET MANAGEMENT | 152,001,000 | 80 | 1.6922 | 19.81 | 3.41 |

Herbert F. Reilly III, manager of HFR Advisory Services, generated the highest risk adjusted returns, based on 13F holdings, of qualifying managers over the last three years.

Of the managers with the top Sharpe Ratios, number one was none other than Herbert Faulkner Reilly III, with a Sharpe of 2.06. Reilly started Niskayuna, New York-based HFR Advisory Services in 1995. As of Q3, the adviser had $261 million under management. HFR’s #1 position for Q3 was Cintas Corporation (CTAS).

HFR’s 13F positions averaged a 22.51% return over the last three years vs the S&P 500’s 14.24%. Yet Reilly’s standard deviation of returns was 10.29% — less than the S&P 500’s 11.82%.

From the adviser’s ADV Part II:

Our stock portfolios typically include 35 – 40 stocks of financially strong, well established companies, that are very “liquid”, or sellable, and trade frequently on major market exchanges. Stock holdings are diversified across market “sectors”, or broad industry categories. Generally our clients will hold the same stocks as held in our Model Portfolio, though the exact weightings will differ depending on account size, tax considerations, and potential specific client needs or concerns.

While many money management approaches attempt to “beat The Market” over the short term through a myriad of formulas and trend strategies, we believe that a short-term focus will often increase portfolio volatility and exposure to speculative trends. Rather than pursuing or adding to stock holdings in strongly performing market sectors, (quantifiable by increased monthly trading activity), we typically look to pare back on stock exposure in apparent momentum driven areas, to the extent that any of our holdings are participating in speculative growth phases. We do not have multiple stock portfolio strategies, nor do we over-concentrate portfolios with higher risk, “beta”, holdings to suit aggressive investors.

Junto Capital Management generated the highest Sharpe among hedge funds over the last three years — 1.94 vs the S&P’s 1.07.

Number two on the list of managers with the highest Sharpe ratios — and the highest ranked hedge fund — was New York City-based Junto Capital Management. Junto is managed by principal owner James Parsons. As of December 31, 2018, the firm’s AUM was

$3.3 billion. According to Junto’s regulatory filing:

The Investment Adviser employs an investment process grounded in fundamental analysis and valuation assessment to identify an attractive opportunity set within a universe of companies, and to build a concentrated portfolio of investments comprised of the long and short ideas that it believes have the most attractive risk/reward. The investment process focuses on identifying differentiated drivers of businesses that influence revenue, profitability and valuation, as well as strategic capital allocation decisions by companies’ management teams which may have a meaningful impact on stock prices.

Junto’s three year annual return was 23.96%. It’s standard deviation was 11.69%.

As of Q3 end, the hedge fund’s top long position was BlackRock Inc. Class A (BLK). We should note that 13F filings do not include short positions.

Ranked number three among managers with the highest Sharpe ratios was the giant investment firm William Blair and Company, with a Sharpe of 1.92. As of Q3, Chicago-based William Blair had $23.38 billion in managed 13F securities. Its largest holding was a $1 billion position in Alibaba Group Holding Ltd ADR (BABA), representing 4.29% of the fund’s portfolio.

Contact Mark about investing based on SEC filings and smart money disclosures.

Disclaimer:

This investment blog (the “Blog”) is created and authored by Mark W. Gaffney (the “Content Creator”) and is published and provided for informational and entertainment purposes only (collectively, the “Blog Service”). The information in the Blog constitutes the Content Creator’s own opinions. None of the information contained in the Blog constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. You understand that the Content Creator is not advising, and will not advise you personally concerning the nature, potential, value or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter. To the extent any of the information contained in the Blog may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person.

From time to time, the Content Creator or its affiliates may hold positions or other interests in securities mentioned in the Blog and may trade for their own account(s) based on the information presented. The Content Creator may also take positions inconsistent with the views expressed in its messages on the Blog.

The Content Creator may hold licenses with FINRA, the SEC or states securities authorities and these licenses may or may not be disclosed by the Content Creator in the Blog.

Investing in the investments discussed in the Blog may be risky and speculative. The companies may have limited operating histories, little available public information, and the stocks they issue may be volatile and illiquid. Trading in such securities can result in immediate and substantial losses of the capital invested. You should use invest risk capital, and not capital required for other purposes, such as retirement savings, student loans, mortgages or education.