When the equities in your portfolio plummet, you may find yourself asking: What are these stocks really worth? They’ve fallen ten or twenty percent – what’s to keep them from declining even further? Well here’s one thing that can anchor a portfolio: Sizeable dividend payments.

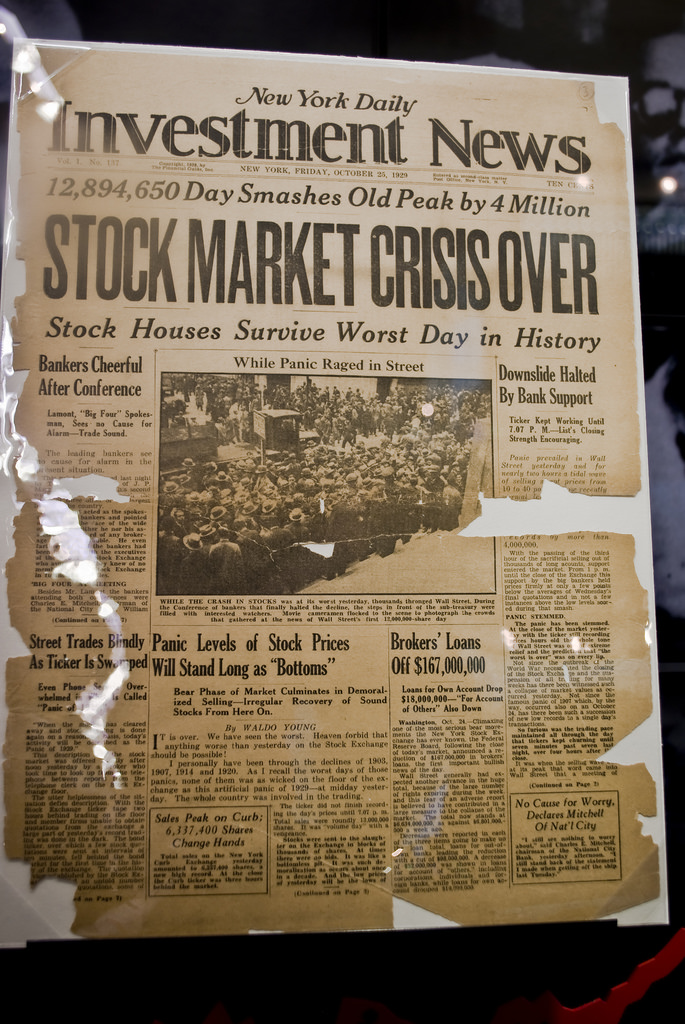

There’s an old Wall Street saying: “Don’t try to catch a falling knife.” Sage advice, but in recent weeks stocks have been falling like a thousand machetes. If you’re an investor, every buy decision made since October has likely had the same result – you’ve ended up bloodied.

However, there is a group of investors that is stepping into the...

When Steve Kelley was named CEO of Amkor Technology (AMKR) in May of 2013, AMKR was around $4.50. As an incentive, the company granted him 750,000 shares in stock and options at the equivalent of $4.50. After the grant fully vested, SEC filings indicate the CEO sold most all of the granted stock and options between Nov. of 2016 and June of 2017 at an average price of $11.38 for total proceeds of $8.9 million.

AMKR closed Wednesday at $6.53.

So, since his employment began with Amkor, Kelley did not buy any AMKR on the open market. His only actions were disposing of shares granted to him as compensation. His timing was good.

Stock market prognosticators are getting bearish. “We’re now in a bear market, get ready for lower prices…” a growing chorus of pessimistic “experts” are saying. “Watch out for the Death Cross!” Yikes.

Of course, this great advice comes after the market has already tanked 10%. Where was this helpful advice in Sept. before things went south in a hurry?

While the machines took over the stock market on Monday, relentlessly selling anything with a stock ticker, a few smart-money investors waded into the fray, using old fashioned fundamentals like earnings and valuations to inform their stock-picking.

One of the value/contrarian buyers was Stephen M. Zide, who disclosed Monday evening the purchase of 20,000 shares of chemical producer Trinseo S.A.

Amin Maredia, formerly the CEO of Sprouts Farmers Market (SFM), was a valuable member of the natural grocer’s management team over the last few years. How valuable? Well, his services are apparently worth $600 million. Because that’s how much market value SFM stock lost on Friday after Maredia suddenly resigned.

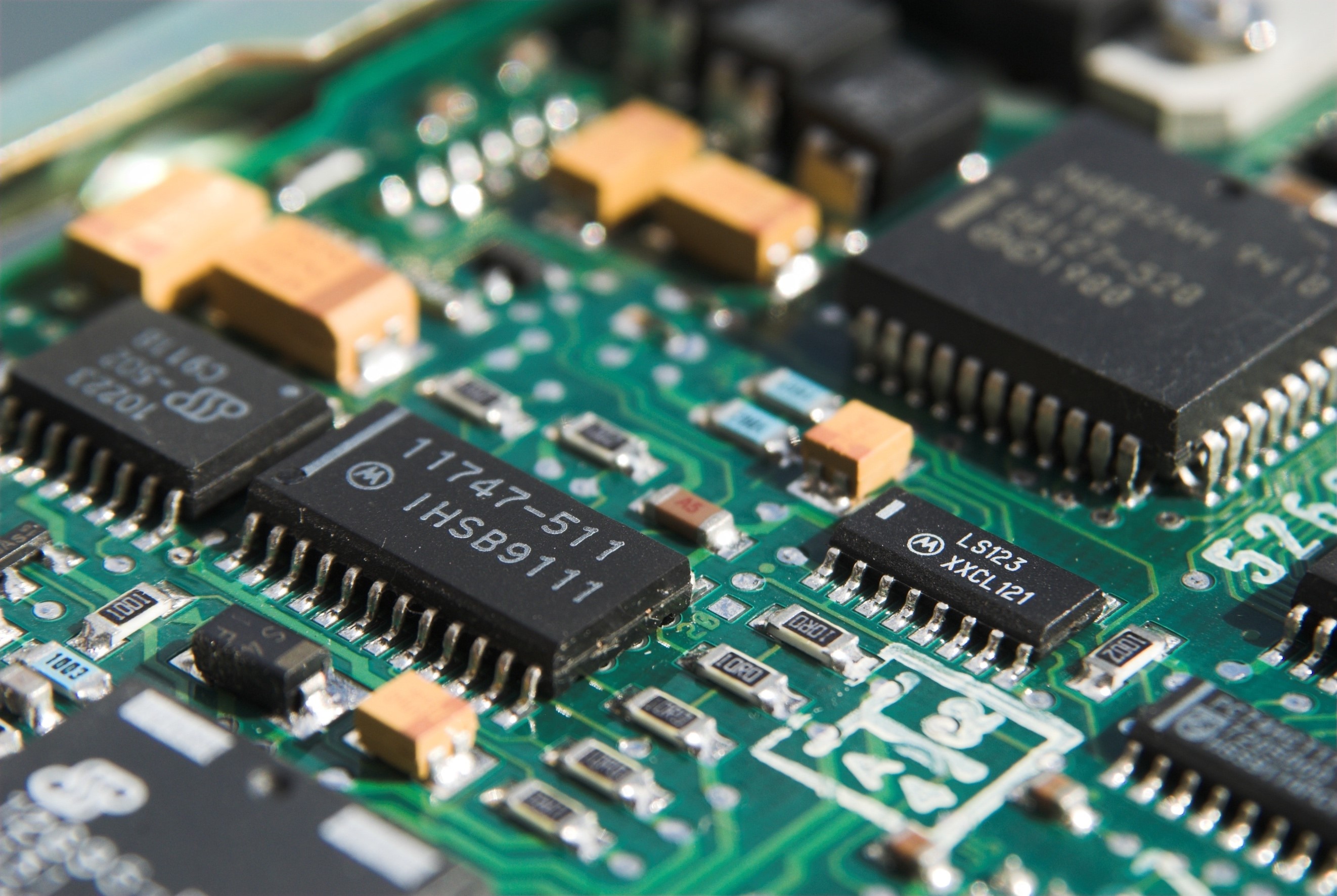

When investors sell an entire market sector indiscriminately, they always throw out a few babies with the bathwater. That may be the case with these two small-cap specialty semiconductor companies where insiders recently purchased shares on the open market.

As tech stocks were battered last week, a hedge fund with a history of smart moves was buying. Activist Hedge Fund ValueAct Holdings reported on Nov. 23 that it upped its stake in Seagate Technology (STX) from 26.4 to 26.77 million shares. The purchases by the $16.48 billion fund, headed by Jeffrey Ubben, increased ValueAct’s ownership of STX to about 9.32%.

When the stock market swoons, I like to watch insider buying to see where the smart money is finding value. Here are three stocks with interesting insider activity that also showed good relative strength in Monday’s weak market.

Warren Buffett is generally regarded as the greatest investor of our time. That’s why every quarter, when Buffett’s fund Berkshire Hathaway updates portfolio holdings, Buffett followers scrutinize the reports, hoping to profit from the moves of the world’s 3rd richest person