For investment manager Pat Dorsey, moats are the key to value investing. The head of Dorsey Asset Management, LLC has used his understanding of competitive advantages — otherwise known as business or economic moats — to compile an impressive track record.

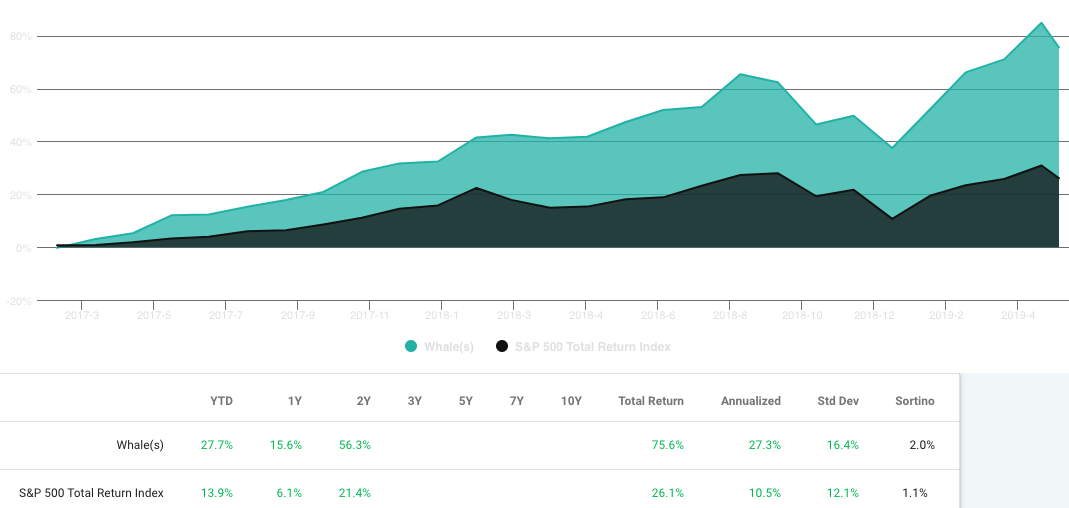

Chicago-based Dorsey Asset Management was founded by Pat Dorsey in 2013 and had $526 million assets under management as of March 31, 2019. Since the firm began filing 13Fs in Q1 of 2017 (when 13F assets reached $100 million), Pat Dorsey’s picks have have racked-up a total return of 75.6% vs the S&P 500’s total return of 26.1% over the same period.

From 2000 to 2011, Pat Dorsey was Director of Equity Research for Morningstar, where he developed Morningstar’s economic moat ratings, as well as the methodology behind Morningstar’s framework for analyzing competitive advantage. He is also the author of two books — The Five Rules for Successful Stock Investing and The Little Book that Builds Wealth.

The Pat Dorsey moats portfolio has been very concentrated. Since Q4 of 2016, his firm has never held more than 12 positions. Here are Dorsey’s Q1 2019 13F holdings:

Dorsey Asset Management 13F holdings as of March 31, 2019

| Stock | % of Portfolio |

| Facebook Inc (FB) | 20.4328 |

| Wix.com Ltd (WIX) | 19.0864 |

| PayPal Holdings Inc (PYPL) | 13.1351 |

| Alphabet Inc. Class C (GOOG) | 10.6678 |

| Despegar.com Corp (DESP) | 8.6976 |

| Cimpress N.V (CMPR) | 8.1332 |

| eBay Inc. (EBAY) | 7.989 |

| The Trade Desk Inc Class A (TTD) | 7.7305 |

| ANSYS, Inc. (ANSS) | 4.1275 |

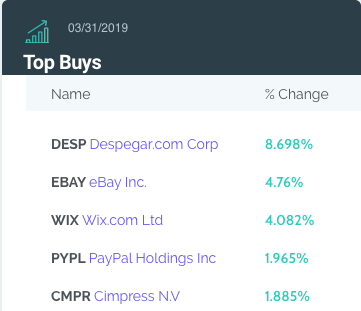

Here were Dorsey’s top portfolio changes in Q1:

Pat Dorsey’s moats portfolio adds Despegar.com

The most intriguing change is the addition of Despegar.com (DESP) as the firm’s fifth largest position. Despegar.com is the leading travel agency serving Latin America. The Company went public in 2017 at $26. The stock now trades at 14, 46% less than the IPO price.

In 2018, DESP had $530 million in revenue. That compares with $524 million in 2017. However, if you factor out a fluctuating exchange rate, revenue was up 19%.

Here’s what CEO Damian Scokin said about Despegar.com’s Q1 2019 results:

We saw gross bookings increased 28% on an FX-neutral basis. Excluding Argentina, that experienced a 51% FX devaluation in the year, transactions and room nights were up 18% and 33% year-over-year. We are strengthening our relationships with major hotel owners and vendors and gaining better access to inventory. And in addition, to our inventory increase, we are optimizing the participation of our key hotels supplier with our top 100 hotels in Latin America, increasing by 270 basis points their share of total LatAm hotel gross bookings.

According to a Jan. 31 Forbes article by Adam Straus,

“Despegar has an operating partnership with Expedia, which owns 13.9% of Despegar’s shares and could very well decide to acquire the balance of the business at some point in the future. Expedia’s cost basis for its Despegar shares, which were purchased several years ago while Despegar was still private, is above where the stock is currently trading. If you are using an Expedia website to book travel to Latin America, Expedia is likely offering you Despegar’s inventory for your booking.

With 3.36% ownership, Dorsey Asset Management is now DESP’s second largest shareholder after Expedia.

Pat Dorsey says there are four basic types of business moats or types of competitive advantages:

• Intangible Assets — Brands, patents, or regulatory licenses that allow a company to sell products or services at larger margins that competitors can’t match.

• Switching Costs — If it’s expensive or difficult for a customer to switch from one product to another, that is considered a switching cost. If the products or services offered by a company have high switching costs then the firm has greater pricing power and profit margins.

• Network Effects — Companies whose value increases as the number of users increases. Facebook (Dorsey’s largest holding) is a prime example. The value of Facebook’s service increases with the number of users. So, people feel compelled to use it — you might say forced to use it — because of its popularity.

• Cost Advantages — Process-based cost advantages — where a company invents a better mousetrap, or creates a better way to deliver a service, tend not to be that durable. Contrast that with a scale-based cost advantage, whereby the moat only gets stronger as the company gets bigger. Think UPS –it has a large network of vans delivering packages worldwide, so the incremental cost of putting one more package on a van is minimal.

I’ll leave it to readers to decide what Despegar’s competitive advantage is, but if Pat Dorsey is buying it for his clients, you can bet the company has a significant business moat.

Disclaimer:

Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this blog is meant for educational and informational purposes only. Do your own research before investing and don’t risk more than you can afford to lose. This article expresses my own opinions, and I am not receiving compensation for it (other than from WhaleWisdom). I do not have a business relationship with any company whose stock is mentioned in this article. I or my associates may hold positions in the stocks discussed.