Spirit Air insider Christine Richards bought 5000 shares of the discount airline despite worries Coronavirus could impact global travel. Richards was appointed director at Spirit Airlines Inc. (SAVE) in Sept. of last year. A Form 4 filed today disclosed the purchase of $216K of SAVE at $43.24.

As Executive VP and General Counsel at FedEx Corporation until her retirement in 2017, Richards filed many Form 4s dating back to 2005. But this is her first open market purchase ever as corporate insider.

News of the Coronavirus outbreak in China began impacting global markets in late January. If the virus spreads widely beyond China, there are concerns that travel-related companies’ will suffer as travelers stay home.

In 2014, the Ebola scare gave airline stocks a hit. But it didn’t last long.

Back in October of 2014, when news broke that a nurse in Texas had contracted Ebola, airline stocks took a hit as investors feared a boycott of air travel. However, those fears proved unfounded as only a dozen cases of Ebola occurred in the United States. Airline stocks soon rallied to new highs. Below is a chart of the Airline Index (XAL) back then.

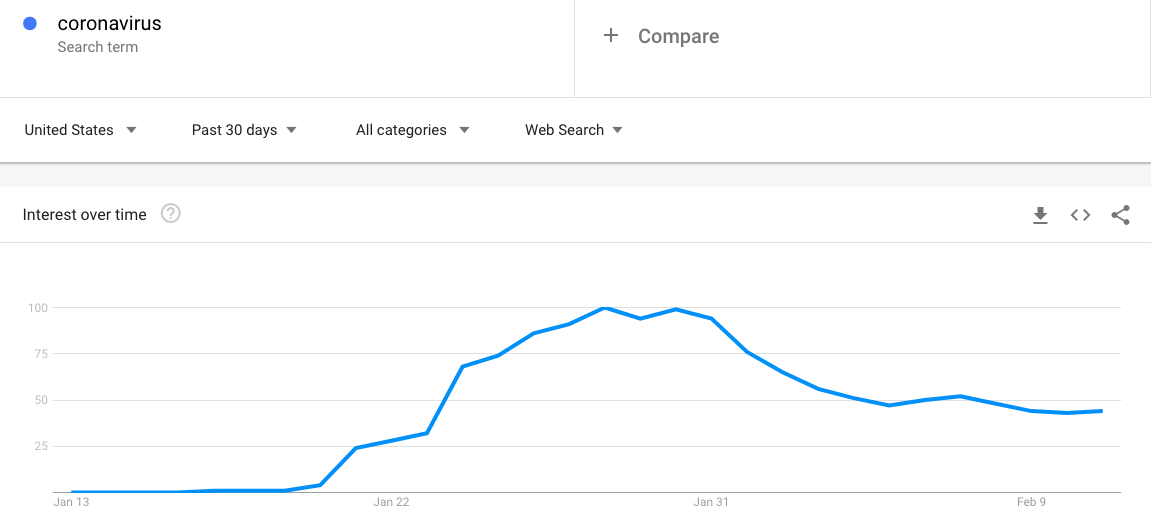

However, the recent Coronavirus scare has so far not affected U.S.-based airline stocks much. Based on Google Trends data for “coronavirus” search, the scare which began on around Jan. 20, peaked on Jan. 28. At least so far — experts caution that the virus is not under control and could yet spread globally. A global market selloff based on pandemic fears is still a possibility.

Despite the Coronavirus epidemic, Spirit Air stock has moved above its 200 day moving average.

Meanwhile, Spirit Air stock has managed to climb above its 200 day moving average (blue line on above chart). The upside traction has happened despite background worries about the epidemic.

Operations at the low fare carrier have been on the upswing. From Motley Fool on Feb. 8:

2019 got off to a great start for Spirit Airlines (NYSE:SAVE), but it ended up being a bumpy year for the ultra-low-cost carrier. During the spring and summer, Spirit suffered from a sharp downturn in its operational performance, because of an unfortunate combination of aggressive scheduling, runway closures, and frequent severe weather events. This drove up unit costs. Meanwhile, unit revenue trends deteriorated as the year progressed, because of tougher year-over-year comparisons as well as changes in the competitive landscape.

Even with all these headwinds, Spirit Airlines posted a double-digit increase in adjusted earnings per share for 2019 as a whole. The company’s preliminary guidance for 2020 implies a similar performance this year. That makes Spirit Airlines stock look like a steal at less than nine times trailing earnings.

The purchase by Spirit Air insider Christine Richards suggests she agrees SAVE is a bargain.

Contact Mark about investing based on SEC filings and smart money disclosures.

Disclaimer:

This investment blog (the “Blog”) is created and authored by Mark W. Gaffney (the “Content Creator”) and is published and provided for informational and entertainment purposes only (collectively, the “Blog Service”). The information in the Blog constitutes the Content Creator’s own opinions. None of the information contained in the Blog constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. You understand that the Content Creator is not advising, and will not advise you personally concerning the nature, potential, value or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter. To the extent any of the information contained in the Blog may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person.

From time to time, the Content Creator or its affiliates may hold positions or other interests in securities mentioned in the Blog and may trade for their own account(s) based on the information presented. The Content Creator may also take positions inconsistent with the views expressed in its messages on the Blog.

The Content Creator may hold licenses with FINRA, the SEC or states securities authorities and these licenses may or may not be disclosed by the Content Creator in the Blog.

Investing in the investments discussed in the Blog may be risky and speculative. The companies may have limited operating histories, little available public information, and the stocks they issue may be volatile and illiquid. Trading in such securities can result in immediate and substantial losses of the capital invested. You should use invest risk capital, and not capital required for other purposes, such as retirement savings, student loans, mortgages or education.