Michael Burry’s Scion Asset Management released its 13F showing the hedge fund’s holdings at year end. Gamestop Corp (GME) remained the fund’s top holding, though Scion’s Q4 2019 13F showed Burry had reduced his GME position by 21% during the quarter. Maxar Technologies Ltd (MAXR), a new position, was Scion’s #4 holding.

Here is Scion’s Q4 2019 13F portfolio reflecting changes over the quarter. Source WhaleWisdom.com.

| Stock | Symbol | Shares Held | Market Value | % of Portfolio | Ranking | % Change | % Ownership | Qtr first owned | Avg Price |

| Gamestop Corp. | GME | 2,350,000 | 14,288,000 | 17.3613% | 1 | (21.67%) | 2.5978% | Q4 2018 | 5.52 |

| Tailored Brands | TLRD | 3,300,000 | 13,662,000 | 16.6006% | 2 | 14.78% | 6.5166% | Q4 2018 | 6.8011 |

| Alphabet Inc. Class C | GOOG | 8,000 | 10,696,000 | 12.9967% | 3 | 0.00% | 0.0012% | Q2 2019 | 1080.91 |

| Maxar Technologies | MAXR | 650,000 | 10,186,000 | 12.377% | 4 | new | 1.0904% | Q4 2019 | 15.67 |

| Qorvo Inc | QRVO | 75,000 | 8,717,000 | 10.592% | 5 | new | 0.0637% | Q4 2019 | 116.23 |

| Covetrus Inc | CVET | 555,900 | 7,338,000 | 8.9164% | 6 | new | 0.4964% | Q4 2019 | 13.2 |

| Cenovus Energy | CVE | 600,000 | 6,090,000 | 7.3999% | 7 | new | 0.0488% | Q4 2019 | 10.15 |

| Blackberry ltd | BB | 900,000 | 5,778,000 | 7.0208% | 8 | new | 0.1641% | Q4 2019 | 6.42 |

| Sportsman’s Warehouse | SPWH | 690,294 | 5,543,000 | 6.7353% | 9 | (57.52%) | 1.5968% | Q4 2018 | 4.274 |

| Bed Bath & Beyond | BBBY | 0 | 0 | (100.00%) | 0.00% | Q3 2019 | 10.64 | ||

| Canadian Natural Resources | CNQ | 0 | 0 | (100.00%) | 0.00% | Q3 2019 | 26.63 | ||

| Nuvectra Corp | NVTR | 0 | 0 | (100.00%) | 0.00% | Q3 2019 | 19.27 |

Gamestop remains Scion’s #1 position, though Burry reduced his stake in GME.

Gamestop (GME) remains Scion’s #1 position, with a $14.29 million market value — 17.36% of the fund’s long portfolio. However, Burry sold over 21% of his GME stake. He first bought GME in Q4 of 2018. WhaleWisdom estimates the fund’s cost as $5.52. GME closed at $6.10 on Dec. 31. As of Feb. 14, Gamestop shares were at $4.00. Last August, Burry sent a letter to Gamestop management recommending an aggressive share repurchase program.

Tailored Brands (TLRD), another stock Burry first accumulated in Q4 of 2018, remained #2 among Scion’s Q4 2019 13F holdings. Burry added 425,000 shares to the fund’s 2.87 million share Q3 position. Scion holds 6.52% of Tailored’s outstanding shares. Whale Wisdom estimates the fund’s average cost for TLRD is $6.80. The stock closed at $3.94 on Feb. 14. Also last August, Burry sent a letter to Tailored Brands management recommending TLRD cut its dividend and buy back stock.

Maxar Technologies Ltd (MAXR) was a new 650,000 position disclosed in Scion’s Q4 2019 13F. The MAXR stake ranked as the fund’s #4 position. On Dec. 27, the satellite imagery company announced it was selling its Canadian space robotics business to a an investment group for $765 million. Maxar stock closed Q3 2019 at $7.60. On Feb. 14 MAXR closed at $19.14.

Maxar Tech. was a new position for Scion at Q4 end. The stock appears to have been a big winner for Burry, though overall Scion’s longs have struggled recently.

Burry drastically reduced Scion’s position in Sportsman’s Warehouse (SPWH) over Q4, as that stock nearly doubled in price.

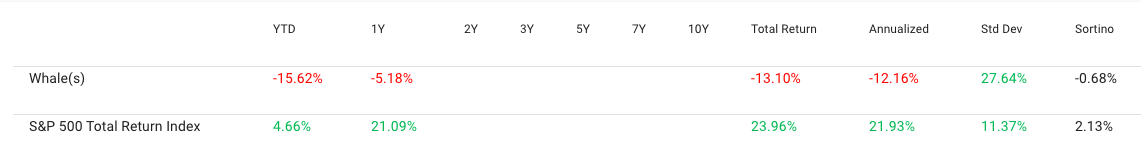

According to WhaleWisdom’s 13F backtester, cloning Scion’s 13F holdings based on Burry’s weightings would have resulted in a loss of 13.10% since Scion Asset Management started filing 13Fs in Q1 of 2018. YTD Scion’s manager-weighted long portfolio is down 15.62%, mostly due to losses in Burry’s top two positions.

We should point out that 13F filings include long positions only. Scion’s Q4 2019 13F shows $82,298,000 in 13F long positions. However, Scion’s ADV from 2019-10-01 discloses $263,255,046 in assets under management. Obviously Burry is investing in — or shorting — significant assets not disclosed in Scion’s 13F.

Burry was featured in Michael Lewis’ book The Big Short. Burry was portrayed by Christian Bale in the 2015 movie of the same name. The reclusive Burry is a die hard value investor, and is renowned for shorting sub-prime mortgage securities and making hundreds of millions for himself and his Scion investors during the financial crisis a decade ago.

Contact Mark about investing based on SEC filings and smart money disclosures.

Disclaimer:

This investment blog (the “Blog”) is created and authored by Mark W. Gaffney (the “Content Creator”) and is published and provided for informational and entertainment purposes only (collectively, the “Blog Service”). The information in the Blog constitutes the Content Creator’s own opinions. None of the information contained in the Blog constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. You understand that the Content Creator is not advising, and will not advise you personally concerning the nature, potential, value or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter. To the extent any of the information contained in the Blog may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person.

From time to time, the Content Creator or its affiliates may hold positions or other interests in securities mentioned in the Blog and may trade for their own account(s) based on the information presented. The Content Creator may also take positions inconsistent with the views expressed in its messages on the Blog.

The Content Creator may hold licenses with FINRA, the SEC or states securities authorities and these licenses may or may not be disclosed by the Content Creator in the Blog.

Investing in the investments discussed in the Blog may be risky and speculative. The companies may have limited operating histories, little available public information, and the stocks they issue may be volatile and illiquid. Trading in such securities can result in immediate and substantial losses of the capital invested. You should use invest risk capital, and not capital required for other purposes, such as retirement savings, student loans, mortgages or education.