RA Capital Management leads the pack when it comes to health care stock selection. Since 2008, an equal-weight portfolio of the Boston-based hedge fund’s top ten 13F positions would have averaged a 37.05% annual return. So, when RA Capital adds to a position, it pays to investigate.

That’s why a Form 4 filed on April 15 by RA Capital caught our attention. The fund disclosed the open-market purchase of 389,862 shares of scPharmaceuticals Inc. (SCPH) at $2.70. As a 10%+ holder, the hedge fund was required to report its April 11 purchases as an insider, disclosing the trades within two business days. The new purchases raised RA Capital’s stake in scPharma to 3,247,005 shares, or 18.46% of SCPH’s shares outstanding.

RA Capital is managed by Peter Kolchinsky, who co-founded the fund in 2001. With a Ph. D. in virology from Harvard, Kolchinsky has a reputation for extensive scientific analysis of the companies in his portfolio. From RA Capital’s ADV disclosure with the SEC:

RA Capital’s methods of analysis involve due diligence that includes, in particular cases, interviews with management, clinical investigators, physicians, and sell-side research analysts…RA Capital has, and intends to continue to: (1) conduct extensive surveys of physicians to identify new market opportunities; (2) engage consultants to validate aspects of investment theses; and (3) acquire general scientific/healthcare/life sciences knowledge and/or for related reasons, and may act as manager, managing member, general partner, executive, board member, consultant, or advisor of or to various portfolio companies, or may spend considerable time assisting, various portfolio companies.

Here are the top performing health care-oriented hedge funds over last 10 years, based on 13F filings.

| Filer | Location | Holdings | MV | Turnover | Avg Time Held | 1 Year Perf | 10 Yr Perf Annualized | Avg Qtrs Held |

| RA CAPITAL MANAGEMENT, LLC | Boston, MA | 25 | 1,717,985,000 | 36 | 6.2 | 11.58 | 37.05 | 6.20 |

| BAKER BROS. ADVISORS LP | New York, NY | 93 | 12,212,527,000 | 11.82 | 13.67 | 19.04 | 28.75 | 13.67 |

| PERCEPTIVE ADVISORS LLC | New York, NY | 101 | 2,627,578,000 | 67.33 | 6.46 | -17.17 | 25.76 | 6.46 |

| PALO ALTO INVESTORS LP | Palo Alto, CA | 36 | 1,878,470,000 | 5.56 | 23.83 | -2.25 | 24.29 | 23.83 |

| REDMILE GROUP, LLC | San Francisco, CA | 78 | 2,489,274,000 | 39.74 | 5.87 | 0.14 | 23.09 | 5.87 |

| BVF INC | San Francisco, CA | 55 | 765,187,000 | 7.27 | 7.04 | -20.48 | 22.14 | 7.04 |

| BRIDGER MANAGEMENT, LLC | New York, NY | 34 | 1,199,589,000 | 35.29 | 8.32 | 9.58 | 20.96 | 8.32 |

| ORBIMED ADVISORS LLC | New York, NY | 131 | 5,407,812,000 | 42.75 | 10.01 | 3.83 | 19.98 | 10.10 |

| HEALTHCOR MANAGEMENT, L.P. | New York, NY | 40 | 3,199,037,000 | 57.5 | 4.35 | 8.4 | 18.63 | 4.35 |

| DEERFIELD MANAGEMENT COMPANY, L.P. (SERIES C) | New York, NY | 98 | 2,498,187,000 | 38.78 | 5.93 | 10.87 | 18.59 | 5.93 |

SCPH has the smallest market cap of all RA Capital’s holdings.

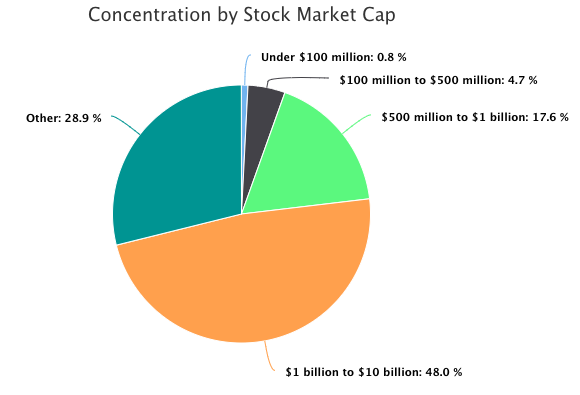

Kolchinsky’s fund is heavily concentrated, with only 25 positions for the almost $2.7 billion fund. $1.7 billion of those assets were invested in long positions as per the hedge fund’s year-end 13F disclosure. RA Capital’s stake in scPharaceuticals is unusual given SCPH’s market cap of just $52.39 million. RA rarely holds companies with market caps less than $100 million, according to WhaleWisdom.com.

ScPharmaceutical’s lead drug candidate is FUROSCIX, a new formulation of furosemide (brand name Lasix) — a diuretic used to treat fluid retention and swelling caused by congestive heart failure. ScPharmaceuticals’ version of the drug is designed to be delivered with a wearable device at home instead of a hospital IV. The idea is to reduce the number of days a patient must be hospitalized for therapy.

ScPharma is developing a novel drug delivery device for congestive heart failure.

SCPH filed a new drug application for FUROSCIX with the FDA in August of 2017; however, on June 11, 2018 the FDA notified the company that modifications to its device were needed. The stock dropped 30% on the news, and has continued to decline, hitting an all time low of $2.44 on April 11. The company has been developing a new “SmartDose” system for the heart failure drug in partnership with West Pharmaceuticals.

In a January 29 press release, John Tucker, president and CEO of scPharmaceuticals said:

“We believe the features and functionality of the SmartDose system improves the overall patient experience with FUROSCIX. Heart failure remains a large market opportunity with high unmet patient need and significant associated healthcare costs. We anticipate filing a New Drug Application for FUROSCIX with the next-generation technology in 2020, subject to meeting with the Food and Drug Administration (FDA) to define the regulatory path.”

RA Capital bought SCPH at $2.70, averaging down its $12.09 cost.

Also, The company Forecast 2018 year-end cash of $82 – $87 million, implying that as of year end, scPharma traded at about 60% of cash value. SCPH estimated 2019 expenditures of $8 – $10 million per quarter.

RA Capital first reported a position in scPharma in Q4 of 2017. WhaleWisdom estimated its cost at $12.09 per share as of 2018 year end. So, by purchasing at $2.70, the fund is averaging down.

SCPH is a rarity for RA Capital — a position that has performed poorly. But based on RA Capital’s recent insider purchases, we can assume the top-rated health care hedge fund still sees upside in scPharmaceuticals Inc.

Disclaimer: Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this blog is meant for educational and informational purposes only. Do your own research before investing and don’t risk more than you can afford to lose. This article expresses my own opinions, and I am not receiving compensation for it (other than from WhaleWisdom). I do not have a business relationship with any company whose stock is mentioned in this article. I or my associates may hold positions in the stocks discussed.