The stock market crash over the last week is drawing comparisons to the mother of all bad markets — October of 2008. There are many similarities, including this one: Bank insiders bought heavily into weakness back then, and they’re beginning to buy heavily now.

We’ve just witnessed the biggest oil-price plunge since 1991, an astonishing free-fall in Treasury yields, a 25% S&P 500 correction in barely three weeks, and a massive spike in fear. All 2008-like events, though maybe not quite on the same extreme scale. Investors who were in the market back in 2008, might have a feeling of deju vu — that gut-wrenching anxiety that accompanies watching a chunk of one’s wealth evaporate in a matter of weeks. And then the question: “How much worse can it get?”

Banks were at the center of the 2008-09 crisis. They’d spent years packaging risky subprime loans as investment grade securities and selling them to unwitting investors who lost their shirts. The contagion associated with subprime mortgages caused the deepest recession in the U.S. since the Great Depression.

In 2008, the contagion to the economy was internal — subprime mortgages. In 2020 the contagion is external — Covig-19.

But the contagion is different this time around. An exogenous shock — a global pandemic — is behind the market carnage. Banks, though they have some exposure to leveraged loans, are not nearly as vulnerable as 12 years ago — a fact banking insiders appear to be well aware of.

Banks are confronting the emerging economic threat of the Coronavirus “with more capital and better capital” than they had leading up to the 2008 crisis, Jaret Seiberg, an analyst with Cowen Washington Research Group, told American Banker. Unlike before the financial crisis, banks now undergo rigorous stress testing, he said.

“Regulators and bankers know these risks and have planned for these risks,” Seiberg said. “It is hard for us to believe that leveraged loans could become the new subprime mortgages given this focus.”

Seiberg added that both today’s banks and today’s housing market are more stable compared to 2008 and are “better able to withstand turbulence and economic losses associated with COVID-19 than they were for losses connected to subprime loans.”

Farley says the economic impact of the coronavirus is much more likely to be a blip rather than a cataclysmic event for mounting corporate debt.

“Given the availability and extremely low cost of capital, I think all but the most highly leveraged, directly impacted businesses will sail through,” he said.

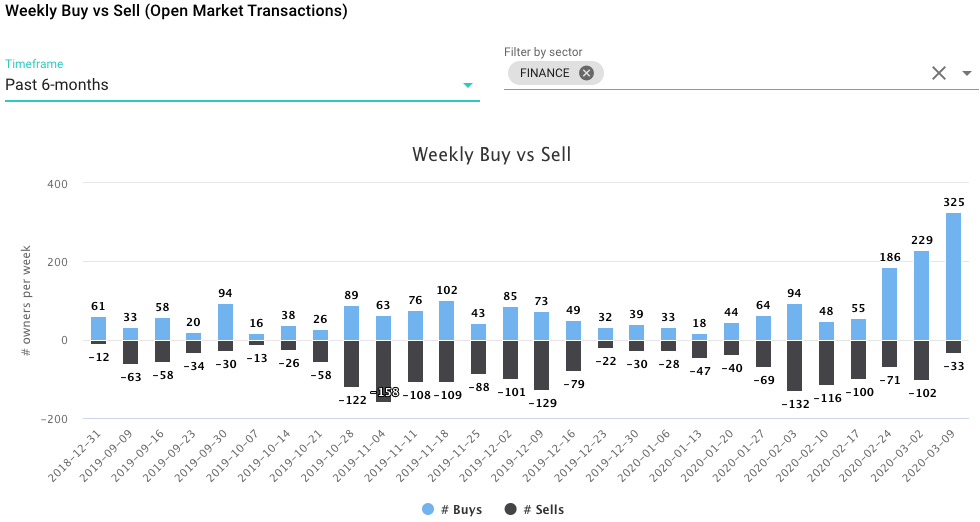

With one day left in the week, the number of purchases by banking insiders is nearing record highs.

Banking insiders would seem to agree. Over the last four days alone, Banking sector officers and directors have made 325 purchases — 4th highest for a week since 2008 began. And there’s one day left in the week! The WhaleWisdom ratio of bank insider sales vs buys registered 0.10 as of Thursday. That’s a bullish level similar to Aug. 2011, Nov. 2008 and March of 2009 — all near correction lows.

Keep in mind that in volatile, panic-driven markets, price may overshoot value on the downside. Banking insiders buying may be early. However, if history repeats, investors following insiders into the battered financial stocks will be rewarded over time.

Here are some of the largest/most significant insider purchases by officers and directors in the banking sector from March 9 through March 12. Again, use these filings as a starting point for further research. Scale in slowly. Manage risk!

Bank insiders’ significant purchases March 9 – 12.

| Most Recent Filing | Company | Symbol | Industry | # Insiders | Last Trade | Total Shares | Avg. Price | Total |

| 12-Mar-2020 | Prosperity Bancshares Inc. | PB | Regional – Southwest Banks | 6 | 11-Mar-2020 | 71,300 | 51.05 | $ 3,639,874 |

| 12-Mar-2020 | PNC Financial Services Grou… | PNC | Money Center Banks | 2 | 10-Mar-2020 | 24,465 | 102.38 | $ 2,504,813 |

| 12-Mar-2020 | First Financial Bankshares … | FFIN | Regional – Southwest Banks | 3 | 12-Mar-2020 | 77,841 | 23.78 | $ 1,851,388 |

| 12-Mar-2020 | Live Oak Bancshares, Inc. | LOB | Savings & Loans | 4 | 11-Mar-2020 | 117,869 | 11.67 | $ 1,376,106 |

| 12-Mar-2020 | Pinnacle Financial Partners… | PNFP | Regional – Southeast Banks | 3 | 11-Mar-2020 | 23,159 | 42.85 | $ 992,322 |

| 12-Mar-2020 | First Horizon National Corp. | FHN | Regional – Southeast Banks | 1 | 12-Mar-2020 | 100,000 | 9.08 | $ 907,700 |

| 11-Mar-2020 | Lakeland Financial Corp. | LKFN | Regional – Midwest Banks | 4 | 10-Mar-2020 | 22,854 | 37.1 | $ 847,830 |

| 11-Mar-2020 | German American Bancorp Inc. | GABC | Regional – Midwest Banks | 2 | 10-Mar-2020 | 19,500 | 26.97 | $ 525,825 |

| 12-Mar-2020 | BancFirst Corporation | BANF | Regional – Southwest Banks | 4 | 12-Mar-2020 | 12,950 | 36.42 | $ 471,578 |

| 11-Mar-2020 | Washington Federal Inc. | WAFD | Savings & Loans | 3 | 11-Mar-2020 | 17,919 | 25.75 | $ 461,404 |

| 12-Mar-2020 | Centerstate Banks of Florid… | CSFL | Regional – Southeast Banks | 4 | 12-Mar-2020 | 26,500 | 17.13 | $ 453,880 |

| 10-Mar-2020 | Synovus Financial Corp. | SNV | Regional – Mid-Atlantic Banks | 4 | 10-Mar-2020 | 18,733 | 23.11 | $ 432,960 |

| 12-Mar-2020 | Sandy Spring Bancorp Inc. | SASR | Regional – Mid-Atlantic Banks | 3 | 12-Mar-2020 | 16,819 | 25.53 | $ 429,344 |

| 12-Mar-2020 | SCBT Financial Corp. | SSB | Regional – Mid-Atlantic Banks | 2 | 11-Mar-2020 | 7,000 | 58.73 | $ 411,130 |

| 12-Mar-2020 | First Financial Corp. | THFF | Regional – Midwest Banks | 3 | 10-Mar-2020 | 11,441 | 35.83 | $ 409,924 |

| 12-Mar-2020 | First Busey Corporation | BUSE | Regional – Midwest Banks | 7 | 12-Mar-2020 | 21,450 | 18.32 | $ 392,894 |

| 12-Mar-2020 | Independent Bank Group, Inc. | IBTX | Regional – Southeast Banks | 2 | 09-Mar-2020 | 10,450 | 37.26 | $ 389,368 |

| 12-Mar-2020 | Auburn National Bancorporat… | AUBN | Regional – Southeast Banks | 1 | 12-Mar-2020 | 7,357 | 46.5 | $ 342,101 |

| 12-Mar-2020 | Cornerstone Bancshares Inc. | SMBK | Regional – Southeast Banks | 3 | 11-Mar-2020 | 18,100 | 17.85 | $ 323,145 |

Disclaimer:

This investment blog (the “Blog”) is created and authored by Mark W. Gaffney (the “Content Creator”) and is published and provided for informational and entertainment purposes only (collectively, the “Blog Service”). The information in the Blog constitutes the Content Creator’s own opinions. None of the information contained in the Blog constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. You understand that the Content Creator is not advising, and will not advise you personally concerning the nature, potential, value or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter. To the extent any of the information contained in the Blog may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person.

From time to time, the Content Creator or its affiliates may hold positions or other interests in securities mentioned in the Blog and may trade for their own account(s) based on the information presented. The Content Creator may also take positions inconsistent with the views expressed in its messages on the Blog.

The Content Creator may hold licenses with FINRA, the SEC or states securities authorities and these licenses may or may not be disclosed by the Content Creator in the Blog.

Investing in the investments discussed in the Blog may be risky and speculative. The companies may have limited operating histories, little available public information, and the stocks they issue may be volatile and illiquid. Trading in such securities can result in immediate and substantial losses of the capital invested. You should use invest risk capital, and not capital required for other purposes, such as retirement savings, student loans, mortgages or education.