There is an old saying — in reality a curse — supposedly of Chinese origin: May you live in interesting times. Well the last three weeks have been extraordinarily interesting. Amidst the backdrop of an expanding global pandemic, and an oil price war, the S&P 500 yesterday fell into bear market territory with a 20% drop from record highs hit on Feb. 19. Amid the extreme volatility, and drumbeat of bleak news, the number of million dollar insider purchases has begun to accelerate. The smart money is beginning to see value.

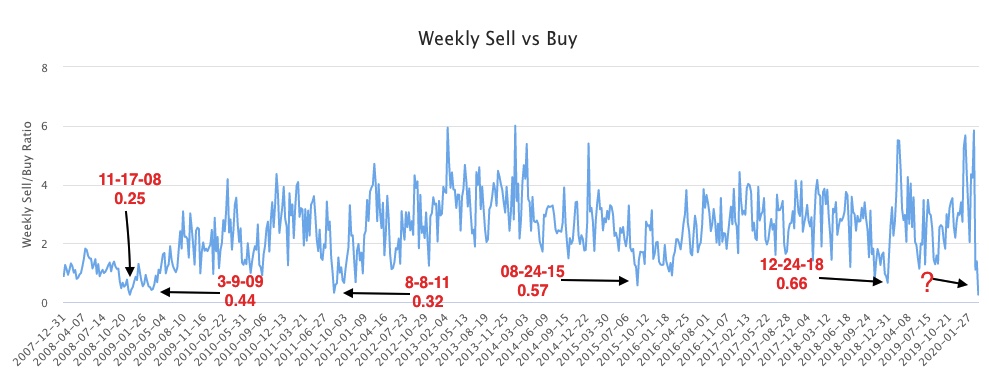

As we wrote on March 2, for the week ending Feb. 28, the WhaleWisdom Weekly Insider Sell vs Buy Ratio had yet to demonstrate the overwhelming insider buying seen during major correction bottoms since 2008. However, after the subsequent bloodbath in equities, the pace of insider buying has increased. While the Insider Sell vs Buy Ratio is a weekly indicator, through Wednesday it stood at 0.25. Should it close the week at these levels, it would be very close to the most extreme levels of insider buying seen during October of 2008.

Insider selling is most always greater than buying. Insiders are widely granted stock as employment compensation, so selling normally outpaces buying. And of course: Insiders may sell stock for any number of reasons. But they buy for basically one reason: They think they’ll make money. Insider Sell vs Buy Ratio readings less than 1.0 are unusual, and indicate that very well-informed officers and directors broadly view their own companies’ shares as undervalued. WhaleWisdom weekly Insider Sell vs Buy Ratio is on verge of a buy signal

Of course there’s nothing magical about million dollar insider purchases, or a bullishly low insider ratio — stocks can still go down significantly. When the ratio hit its all time low for the week ending Nov. 21, 2008, the market didn’t bottom until early March, dropping another 20%! However, when the ratio touched 0.44 for the week ending March 13 of 2009, that reading coincided closely with the low of the great recession bear market. Insiders are value buyers — they aren’t timing the market, but rather buying their stock when they believe it sells at a discount to fair value. The panic/irrational selling of a bear market can drive share prices well below fair value.

If you were an officer or director at a public company, and you strongly believed your shares were undervalued, what would you do? You’d buy your stock. And what if you thought the shares were very seriously undervalued? You’d buy your stock aggressively. When markets decline and investors panic-sell, we begin to see large insider purchases as insiders’ conviction increases. Below are the million dollar insider purchases by officers and directors filed so far this week.

Use these filings as a starting point for further research. And remember, insiders are often early — scale you buying into price weakness. Have a plan. Manage risk!

Million dollar insider purchases by Officers and Directors March 9 – 11.

| Most recent filing | Company | Symbol | Industry | # Insiders | Last Trade | Total Shares | Avg. Price | Total |

| 10-Mar-2020 | American Homes 4 Rent | AMH | REIT – Residential | 2 | 09-Mar-2020 | 1,679,958 | 28.12 | $ 47,245,956 |

| 11-Mar-2020 | Trinet Group, Inc. | TNET | Business Services | 1 | 10-Mar-2020 | 272059 | 52.28 | $ 14,224,469 |

| 10-Mar-2020 | Tcg Bdc Ii, Inc. | CGBD | Other | 3 | 06-Mar-2020 | 579,446 | 20.42 | $ 11,832,287 |

| 10-Mar-2020 | Energy Transfer Equity, L.P. | ET | Oil & Gas Pipelines | 2 | 09-Mar-2020 | 1,308,000 | 7.79 | $ 10,188,135 |

| 09-Mar-2020 | Nielsen Holdings plc | NLSN | Information & Delivery Services | 1 | 06-Mar-2020 | 250,000 | 16.33 | $ 4,082,500 |

| 09-Mar-2020 | Freeport-McMoRan Copper & G… | FCX | Copper | 2 | 05-Mar-2020 | 335,000 | 10.02 | $ 3,358,326 |

| 11-Mar-2020 | Amneal Pharmaceuticals, Inc. | AMRX | Other | 3 | 10-Mar-2020 | 850000 | 3.71 | $ 3,156,973 |

| 10-Mar-2020 | Healthways Inc. | TVTY | Specialized Health Services | 2 | 09-Mar-2020 | 265,405 | 11.51 | $ 3,053,608 |

| 09-Mar-2020 | Qurate Retail, Inc. | QRTEA | Computer Peripherals | 1 | 06-Mar-2020 | 550,000 | 5.44 | $ 2,994,575 |

| 10-Mar-2020 | NuStar Energy L.P. | NS | Oil & Gas Pipelines | 5 | 10-Mar-2020 | 236,000 | 12.34 | $ 2,911,982 |

| 09-Mar-2020 | Trinet Group, Inc. | TNET | Business Services | 1 | 06-Mar-2020 | 52,599 | 52.84 | $ 2,779,331 |

| 10-Mar-2020 | Revolve Group, Inc. | RVLV | Other | 2 | 09-Mar-2020 | 196,000 | 13.11 | $ 2,569,002 |

| 11-Mar-2020 | PNC Financial Services Grou… | PNC | Money Center Banks | 1 | 09-Mar-2020 | 24415 | 102.39 | $ 2,499,730 |

| 10-Mar-2020 | Gates Industrial Corp Plc | GTES | Other | 1 | 10-Mar-2020 | 250400 | 9.24 | $ 2,314,888 |

| 09-Mar-2020 | Newell Rubbermaid Inc. | NWL | Housewares & Accessories | 3 | 06-Mar-2020 | 145,000 | 14.46 | $ 2,096,574 |

| 10-Mar-2020 | Western Midstream Partners,… | WES | Gas Utilities | 2 | 10-Mar-2020 | 350700 | 5.86 | $ 2,053,986 |

| 11-Mar-2020 | Range Resources Corp. | RRC | Independent Oil & Gas | 2 | 10-Mar-2020 | 918128 | 2.19 | $ 2,014,271 |

| 10-Mar-2020 | KAR Auction Services, Inc. | KAR | Auto Dealerships | 3 | 09-Mar-2020 | 111,355 | 17.52 | $ 1,951,490 |

| 11-Mar-2020 | Drew Industries Inc. | LCII | General Building Materials | 2 | 09-Mar-2020 | 20000 | 87.19 | $ 1,743,900 |

| 10-Mar-2020 | Planet Fitness, Inc. | PLNT | Sporting Activities | 2 | 06-Mar-2020 | 26,000 | 63.45 | $ 1,649,591 |

| 10-Mar-2020 | First Financial Bankshares … | FFIN | Regional – Southwest Banks | 3 | 10-Mar-2020 | 67,292 | 24.17 | $ 1,626,648 |

| 10-Mar-2020 | AMERCO | UHAL | Rental & Leasing Services | 1 | 09-Mar-2020 | 5,101 | 311.25 | $ 1,587,704 |

| 10-Mar-2020 | Assured Guaranty Ltd. | AGO | Life Insurance | 1 | 09-Mar-2020 | 39,632 | 37.82 | $ 1,498,882 |

| 09-Mar-2020 | Upwork Inc. | UPWK | Other | 1 | 05-Mar-2020 | 150,000 | 8.04 | $ 1,205,610 |

| 09-Mar-2020 | Myos Rens Technology Inc. | MYOS | Other | 4 | 05-Mar-2020 | 929753 | 1.21 | $ 1,125,001 |

| 10-Mar-2020 | Hexcel Corp. | HXL | Aerospace/Defense Products & Services | 1 | 09-Mar-2020 | 20,000 | 55.96 | $ 1,119,280 |

| 10-Mar-2020 | Lincoln National Corp. | LNC | Life Insurance | 2 | 10-Mar-2020 | 29,900 | 35.27 | $ 1,054,694 |

| 11-Mar-2020 | WhiteHorse Finance, Inc. | WHF | Asset Management | 2 | 09-Mar-2020 | 81600 | 12.85 | $ 1,048,400 |

| 10-Mar-2020 | Williams Companies, Inc. | WMB | Oil & Gas Pipelines | 4 | 10-Mar-2020 | 68900 | 15.17 | $ 1,045,178 |

| 10-Mar-2020 | Lowe’s Companies Inc. | LOW | Home Improvement Stores | 1 | 06-Mar-2020 | 10,000 | 103.86 | $ 1,038,595 |

| 11-Mar-2020 | Aramark | ARMK | Specialty Eateries | 1 | 11-Mar-2020 | 40000 | 25.82 | $ 1,032,652 |

| 11-Mar-2020 | The Home Depot, Inc | HD | Home Improvement Stores | 1 | 09-Mar-2020 | 4745 | 210.78 | $ 1,000,151 |

Disclaimer:

This investment blog (the “Blog”) is created and authored by Mark W. Gaffney (the “Content Creator”) and is published and provided for informational and entertainment purposes only (collectively, the “Blog Service”). The information in the Blog constitutes the Content Creator’s own opinions. None of the information contained in the Blog constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. You understand that the Content Creator is not advising, and will not advise you personally concerning the nature, potential, value or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter. To the extent any of the information contained in the Blog may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person.

From time to time, the Content Creator or its affiliates may hold positions or other interests in securities mentioned in the Blog and may trade for their own account(s) based on the information presented. The Content Creator may also take positions inconsistent with the views expressed in its messages on the Blog.

The Content Creator may hold licenses with FINRA, the SEC or states securities authorities and these licenses may or may not be disclosed by the Content Creator in the Blog.

Investing in the investments discussed in the Blog may be risky and speculative. The companies may have limited operating histories, little available public information, and the stocks they issue may be volatile and illiquid. Trading in such securities can result in immediate and substantial losses of the capital invested. You should use invest risk capital, and not capital required for other purposes, such as retirement savings, student loans, mortgages or education.