In a 13G filed Friday evening, Citadel Advisors disclosed a 19.9% Avianca Holdings (AVH) stake. Ken Griffin's hedge fund reported that it owns 82,364,111 preferred shares of AVH issued to Citadel in exchange for a $356 million investment in Avianca.

To...

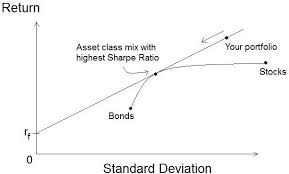

The Sharpe ratio is a popular way to measure the return of an investment compared to the amount of risk taken. Risk is measured as volatility or standard deviation. So, the equity managers with the highest Sharpe ratios in the WhaleWisdom database have demonstrated skill picking stocks...

Due to to years of lagging performance, investors have largely abandoned energy stocks. But with the recent explosion of U.S - Iran tensions, oil stocks are suddenly in the spotlight again. Investors must now consider the possibility that a Mid East war could cause a "super spike"...

Perceptive Advisors' Neptune Wellness Solutions (NEPT) position increased by 50% during the 3rd quarter of 2019, to 4.5 million shares. The stake represents 14.53% of the Cannabis extraction company's outstanding shares. NEPT was Perceptive Advisors' #20 position at Q3 close.

The increase in Perceptive'...

Is Bill Oberndorf the best stock picker in the U.S.? According to a recent report by WhaleWisdom.com, two professional fund managers shared the top ranking for risk-adjusted performance of their stock picks. One of the top ranked funds was Abdiel Capital Advisers, L.P. with a WhaleScore ranking...

Stadium Capital's Q3 return of 33.01% was best among all hedge funds in the WhaleWisdom universe*. Tiger Legatus ranked #2 with a 31.81% return for the third quarter.

*Performance was measured based on a "manager weighted" portfolio of all hedge funds' top 10 holdings...

Whale Rock Capital's returns have been hard to beat. An equal-weighted portfolio of Whale Rock's top ten long 13F positions, rebalanced quarterly, has averaged a 17.30% annual return since the fund's inception in 2006. The fund's 10-year annualized performance of 25.57% is #2 among all fund's in...

Cloning Carl Icahn is a good idea.

Now I'm of course not talking about a laboratory experiment whereby we create an army of little corporate activists that will grow into so many billionaires.

Rather, I'm referring to following the renowned...

Replicating Baker Brothers holdings, using 13F filings submitted quarterly by the life sciences hedge fund, has been an awesome strategy over the years. But by focusing on the smaller stocks owned by the fund, returns were even better.

Baker Bros Advisors LP, with $17.33...

The Lottery Ticket Stocks Q2 2019 portfolio was down 6.72% for the quarter, tracking the Russell 2000 Index lower. However, the portfolio of top hedge funds' most speculative holdings, rebalanced quarterly based on 13F filings, was up 35.65% year-to date as of August 15.