There is an old saying -- in reality a curse -- supposedly of Chinese origin: May you live in interesting times. Well the last three weeks have been extraordinarily interesting. Amidst the backdrop of an expanding global pandemic, and an oil price war, the S&P 500 yesterday...

As we've previously written, when insiders as a group buy en masse, it has historically signaled that stocks were broadly undervalued and a market bottom was at hand. As of Friday's close, the WhaleWisdom Insider Sell vs Buy Ratio for the week of Feb. 24 was 1.42....

Donald Trump's insider buying history is short, but interesting, given the fact that the former corporate insider is now the 45th President of the United States.

It was Monday, Sept. 15, 2008 at 3:08 PM when Donald J. Trump filed a Form 4...

Insiders buy market crashes, backing up the truck if their shares get cheap enough. The smartest fund managers can make their year -- even careers -- acquiring great companies at phenomenal bargains during market crashes. True market crashes are rare--black swans. But garden variety "panics" occur fairly...

We’ve heard the Warren Buffett’s saying a hundred times: Be fearful when others are greedy and greedy when others are fearful. Over the last year, corporate insiders as a group have done just that. During most of 2018 officers and directors sold heavily. However, as panic selling by investors has intensified in recent weeks, so has insider buying.

Through Thursday of this holiday-shortened trading week, the WhaleWisdom Insider Sell vs Buy ratio was at 0.44.

For the first time in a decade, there’s a whiff of real fear in the financial markets. I’m not talking about the low-grade anxiety we’ve seen occasionally during the bull market, where investors worry about when to buy the dip. Over the last few days we’ve seen something different -- a deeper fear, fear that comes from not knowing if there is a bottom.

In June of 2008, Aubrey McClendon, the Chairman and CEO of Chesapeake Energy (NYSE:CHK) was riding high: He was a superstar of the Oil and Gas world, a financial wizard who had started Chesapeake with a $50,000 stake in 1989, and grown the company into a behemoth with a market cap over $30 billion, the nation’s 2nd largest producer of natural gas after ExxonMobil.

Continuing the series on the greatest insider trades: On October 15, 2018, Citigroup (NYSE:C) reported Q3 2018 EPS of $1.73 on revenues of $18.39B, generally in line with expectations. Trading near $70, Citi has a market cap of $175 billion, and is one of the premiere U.S. financial institutions.

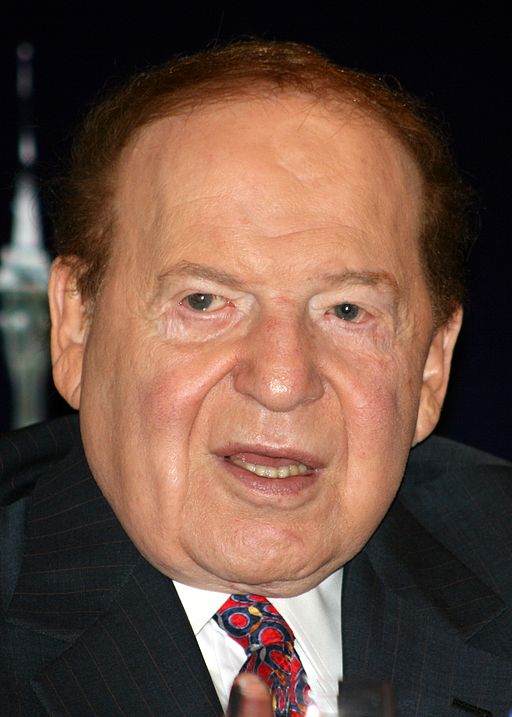

On Sunday, January 18, 2009, as the financial crisis intensified, the Las Vegas Sun ran an article entitled: “Las Vegas Sands: A big rise, a big fall.” The piece chronicled how Las Vegas Sands casino founder and CEO Sheldon Adelson’s personal fortune peaked in 2007 at $28 billion on the strength of his stake in Las Vegas Sands (NYSE:LVS) stock, making him the third richest man in America.

Baron Rothschild purportedly said: “Buy when there’s blood in the streets, even if the blood is your own.” During the financial crisis of 2008-09, investor blood flooded Wall Street – and main street. But for many prescient corporate insiders, buying during the market carnage earned them fortunes. And for investors who had the foresight – and nerve – to follow insiders into these ultra-contrarian investments, the worst of times turned into the best of times.