Solid Biosciences' private placement featured investments by an all star list of top biotech institutional investors.

Cambridge-based Solid Biosciences (SLDB) trades at 1/3 of its January 2018 IPO value. But based on the A-list biotech investors buying shares in the company's July 26 $60...

Stock market prognosticators are getting bearish. “We’re now in a bear market, get ready for lower prices…” a growing chorus of pessimistic “experts” are saying. “Watch out for the Death Cross!” Yikes.

Of course, this great advice comes after the market has already tanked 10%. Where was this helpful advice in Sept. before things went south in a hurry?

Many traders know of Bruce Kovner, the cab driver turned multi-billionaire, from his interview with Jack Schwager in the classic investment book Market Wizards. As founder and Chairman of Caxton Associates from 1983 to 2011, Kovner reportedly averaged 21% annual returns. Kovner managed as much as $14 billion...

In recent days, four Enstar Group Limited (ESGR) insiders -- the COO, CEO, CFO and President -- purchased a total of $7 million of their own stock on the open market.

After the close on Wed. March 13, Dominic F. Silvester, the...

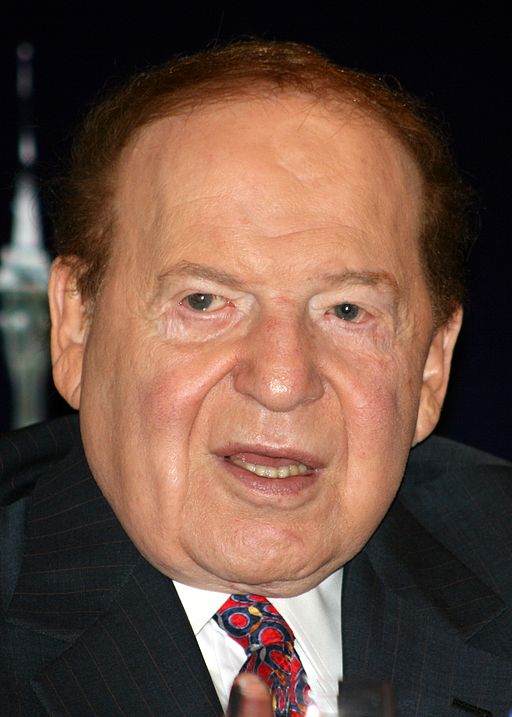

On Sunday, January 18, 2009, as the financial crisis intensified, the Las Vegas Sun ran an article entitled: “Las Vegas Sands: A big rise, a big fall.” The piece chronicled how Las Vegas Sands casino founder and CEO Sheldon Adelson’s personal fortune peaked in 2007 at $28 billion on the strength of his stake in Las Vegas Sands (NYSE:LVS) stock, making him the third richest man in America.

Donald Trump's insider buying history is short, but interesting, given the fact that the former corporate insider is now the 45th President of the United States.

It was Monday, Sept. 15, 2008 at 3:08 PM when Donald J. Trump filed a Form 4...

As we've previously written, when insiders as a group buy en masse, it has historically signaled that stocks were broadly undervalued and a market bottom was at hand. As of Friday's close, the WhaleWisdom Insider Sell vs Buy Ratio for the week of Feb. 24 was 1.42....

A stock buyback announcement presumably means management believes a company’s shares are undervalued. So a stock typically jumps on buyback news. Indeed, IBTX shares rallied after the announcement and insider buying disclosures despite a weak broad market. Unfortunately, insider buying after a buyback announcement is the exception. Here’s a dirty little secret – the very same officers and other insiders who initiate buyback programs often sell personal shares immediately after the buyback news.

Chairman Joseph C. Papa and CFO Paul Herendeen of Bausch Health Companies (NYSE:BHC) purchased a total of 40,000 BHC shares on Sept. 14 at an average price of $22.39, spending $896,000. And thanks to a “Matching Share Program” offered by Bausch Health, the insiders were granted an additional 40,000 shares. The granted shares are restricted – 1/3 of the granted shares vest on each of the three anniversaries of the date granted. If the insider leaves the company, he or she would forfeit unvested shares.