I'm “done with fossil fuels." That's what Jim Cramer just said on CNBC's Squawk Box. Cramer compared fossil fuel companies to the stigmatized tobacco companies, saying oil stocks are in the “death knell phase.” But if that's true, I wonder why billionaire oil tycoon and hotelier Bob...

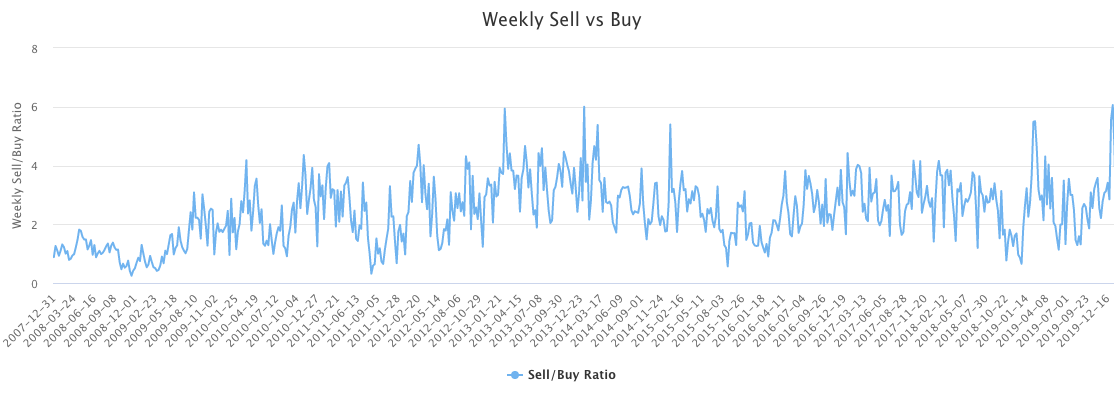

"Insiders are selling stock like it's 2007." That's a headline from August 27, 2019. Sounds ominous. One might have been inclined to think: The smart guys are dumping stock, guess I should too. Well that would have been a big mistake. Since that headline was posted, the...

ConAgra insider Craig Omtvedt bought $1.35 million of the food giants's stock two weeks after ConAgra Brands Inc (CAG) reported surprisingly good earnings and upped its guidance. CAG hit 52-week highs after the report. Omtvedt's Form 4 disclosing his purchase came after market hours on Jan. 3....

On Dec. 23, Nierenberg Investment filed a 13D/A on Houston Wire and Cable (HWCC). The investment adviser expressed frustration that the market value of its long-held position in the micro-cap has "widened substantially over the last two years."

The filing amended a 13D...

Myriad Genetics co-founder Walter Gilbert PhD bought $150K of MYGN on Dec. 13 @ $25.60. Gilbert, who won the Nobel Prize for Chemistry in 1980, has a history of Form 4 filings at Myriad dating back to 2006. However, this is the insider's first open market purchase...

Protagonist Therapeutics insiders bought on Tuesday as their company's stock plummeted after preliminary data appeared to cast doubt on Protagonist's (PGTX) key drug.

On Monday, the company presented an initial look at preliminary results from the TRANSCEND Ph2 open-label study of PTG-300 (hepcidin...

The January Effect and insider trading anomaly can combine for unusually profitable opportunities. As year-end approaches, it's a great time to scan the universe of equities for oversold, cheap stocks being accumulated by insiders.

The January Effect refers to the tendency for stock prices -- especially...

Live Nation insider James Kahan bought 4,500 shares of the concert promotion and ticketing company at $61.54 on Nov. 6. Kahan, a director at Live Nation, Inc. (LYV) since 2007, last bought LYV stock at $8.40 in August of 2010. LYV closed Friday at $63.16. Kahan's Live...

BlueLinx insiders bought after their company's stock price was cut in half after a surprise revenue decline.

On Nov. 5, BXC closed at $31. Then came an earnings report showing a significant revenue decline. On Thursday morning BlueLinx (BXC) traded as low as $13.47...

The insider trading anomaly was first formally identified by James Lorie and Victor Niederhoffer in a 1968 article Predictive and Statistical Properties of Insider Trading. Much has changed in the investment markets over the ensuing years. But the predictive properties of insider trading remain as relevant today...