In May of 2015, Nelson Obus’s lawyer opened his client’s trial by saying that either the hedge fund manager is an honest man or "the lamest insider trader in history." Twelve years after he was first charged by the SEC for insider trading, Obus, the manager of New York-based hedge fund Wynnefield Capital Inc., was found not guilty by a jury.

Fast forward to January 14, 2019 and Obus just submitted an insider filing to his nemesis the SEC, disclosing that his fund purchased 20,000 shares of Landec Corp. (LNDC) at $11.33. It’s a trade that investors may want to note – not because of any alleged impropriety, but because the stock being bought may be an attractive opportunity.

Nothing like putting a million bucks where your mouth is.

After a presentation yesterday at the JPMorgan healthcare conference yesterday, an analyst bad-mouthed medical device giant Medtronic Plc (MDT) and cut price targets. As the stock tumbled over 6%, Medtronic CEO Omar Ishrak went on television to defend his company and debunk critics.

Then today he bought $1 million dollars of MDT on the open market.

In a classic scene from the 1967 film Cool Hand Luke, the prison warden whips an insubordinate inmate (Paul Newman) into a ditch then stands over him and seethes: “What we got here is a failure to communicate.”

In a Dec. 17 letter to Houston Wire and Cable (HWCC), D3 Funds’ David Nierenberg disclosed a 9.9% stake in the company and quoted the famous movie line. But while Nierenberg was friendlier than the warden in Coll Hand Luke, his sense of frustration with his fund’s long-held investment was evident.

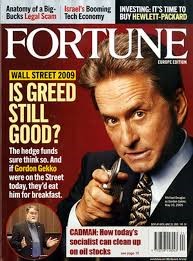

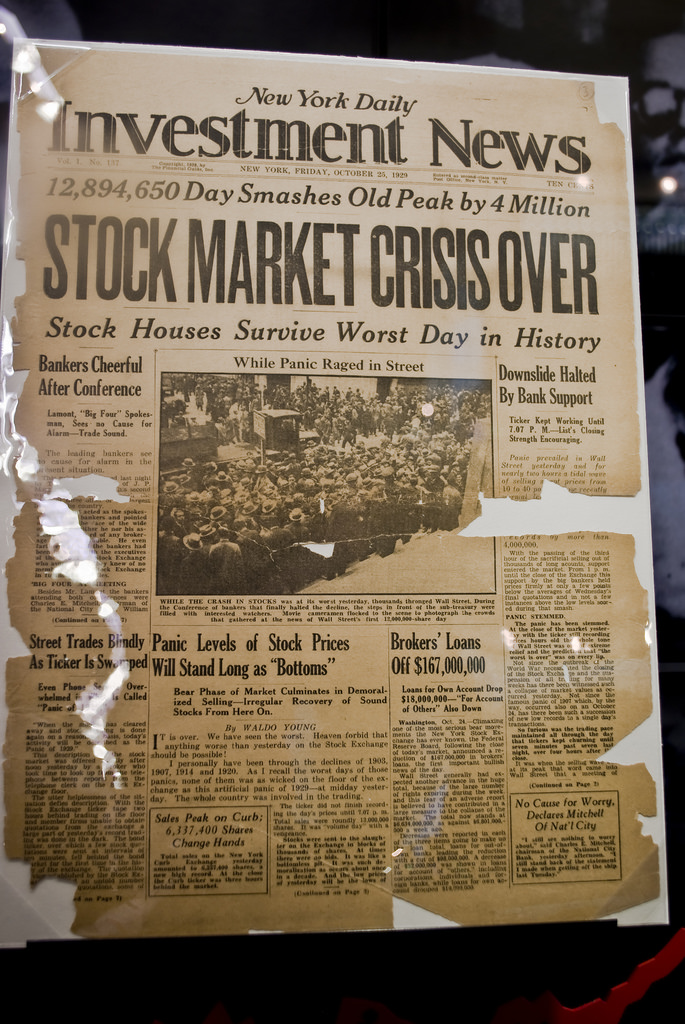

We’ve heard the Warren Buffett’s saying a hundred times: Be fearful when others are greedy and greedy when others are fearful. Over the last year, corporate insiders as a group have done just that. During most of 2018 officers and directors sold heavily. However, as panic selling by investors has intensified in recent weeks, so has insider buying.

Through Thursday of this holiday-shortened trading week, the WhaleWisdom Insider Sell vs Buy ratio was at 0.44.

Somewhere, Benjamin Graham is smiling. The father of Value Investing and mentor to Warren Buffett had a favorite investment strategy: Buying “Net-Net” stocks. These are stocks that because of bad markets, bad business, bad luck – or a combination of all three -- are trading for less than the net cash they have in the bank.

When the equities in your portfolio plummet, you may find yourself asking: What are these stocks really worth? They’ve fallen ten or twenty percent – what’s to keep them from declining even further? Well here’s one thing that can anchor a portfolio: Sizeable dividend payments.

There’s an old Wall Street saying: “Don’t try to catch a falling knife.” Sage advice, but in recent weeks stocks have been falling like a thousand machetes. If you’re an investor, every buy decision made since October has likely had the same result – you’ve ended up bloodied.

However, there...

When Steve Kelley was named CEO of Amkor Technology (AMKR) in May of 2013, AMKR was around $4.50. As an incentive, the company granted him 750,000 shares in stock and options at the equivalent of $4.50. After the grant fully vested, SEC filings indicate the CEO sold most all of the granted stock and options between Nov. of 2016 and June of 2017 at an average price of $11.38 for total proceeds of $8.9 million.

AMKR closed Wednesday at $6.53.

So, since his employment began with Amkor, Kelley did not buy any AMKR on the open market. His only actions were disposing of shares granted to him as compensation. His timing was good.

Stock market prognosticators are getting bearish. “We’re now in a bear market, get ready for lower prices…” a growing chorus of pessimistic “experts” are saying. “Watch out for the Death Cross!” Yikes.

Of course, this great advice comes after the market has already tanked 10%. Where was this helpful advice in Sept. before things went south in a hurry?

While the machines took over the stock market on Monday, relentlessly selling anything with a stock ticker, a few smart-money investors waded into the fray, using old fashioned fundamentals like earnings and valuations to inform their stock-picking.

One of the value/contrarian buyers was Stephen M. Zide, who disclosed Monday evening the purchase of 20,000 shares of chemical producer Trinseo S.A.