Amin Maredia, formerly the CEO of Sprouts Farmers Market (SFM), was a valuable member of the natural grocer’s management team over the last few years. How valuable? Well, his services are apparently worth $600 million. Because that’s how much market value SFM stock lost on Friday after Maredia suddenly resigned.

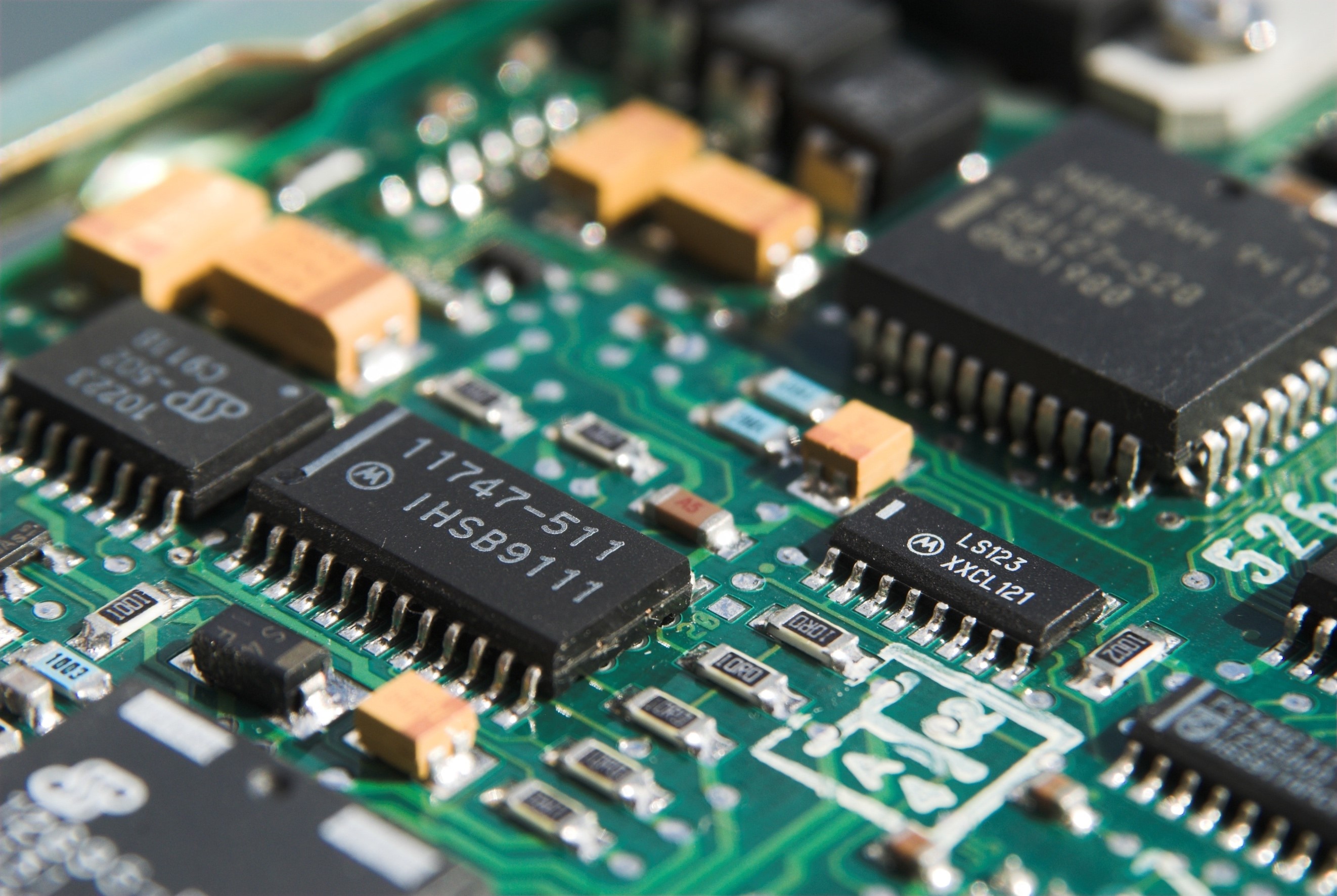

When investors sell an entire market sector indiscriminately, they always throw out a few babies with the bathwater. That may be the case with these two small-cap specialty semiconductor companies where insiders recently purchased shares on the open market.

As tech stocks were battered last week, a hedge fund with a history of smart moves was buying. Activist Hedge Fund ValueAct Holdings reported on Nov. 23 that it upped its stake in Seagate Technology (STX) from 26.4 to 26.77 million shares. The purchases by the $16.48 billion fund, headed by Jeffrey Ubben, increased ValueAct’s ownership of STX to about 9.32%.

When the stock market swoons, I like to watch insider buying to see where the smart money is finding value. Here are three stocks with interesting insider activity that also showed good relative strength in Monday’s weak market.

For the first time in a decade, there’s a whiff of real fear in the financial markets. I’m not talking about the low-grade anxiety we’ve seen occasionally during the bull market, where investors worry about when to buy the dip. Over the last few days we’ve seen something different -- a deeper fear, fear that comes from not knowing if there is a bottom.

The price of oil has plummeted over 21% since October 3. Brent crude has traded lower for the last 10 consecutive sessions -- it’s longest losing streak since 1984.

A number of energy-related companies have seen unusually aggressive insider accumulation. These stocks may be the biggest winners when the inevitable rebound take place. Here is a list of stocks showing the greatest insider accumulation over the last couple weeks.

General Electric (GE), once the bluest of blue-chip stocks, has fallen hard. Since the end of 2016, GE’s market cap has dropped by 70% -- from $277 billion to $83 billion. In June GE was dropped from the Dow Jones Industrial Average after more than a century. The stock now trades at $9.30, down nearly 50% year-to date.

In early 2018 Tandem Diabetes Care (TNDM) traded just above $2 a share – one of a hundred small cap heath care companies with more potential than profits. Bankruptcy seemed more likely than breakout success. No one suspected that by September TNDM would trade at $50, a gain of 2000%? Well, almost no one.

A stock buyback announcement presumably means management believes a company’s shares are undervalued. So a stock typically jumps on buyback news. Indeed, IBTX shares rallied after the announcement and insider buying disclosures despite a weak broad market. Unfortunately, insider buying after a buyback announcement is the exception. Here’s a dirty little secret – the very same officers and other insiders who initiate buyback programs often sell personal shares immediately after the buyback news.

In June of 2008, Aubrey McClendon, the Chairman and CEO of Chesapeake Energy (NYSE:CHK) was riding high: He was a superstar of the Oil and Gas world, a financial wizard who had started Chesapeake with a $50,000 stake in 1989, and grown the company into a behemoth with a market cap over $30 billion, the nation’s 2nd largest producer of natural gas after ExxonMobil.