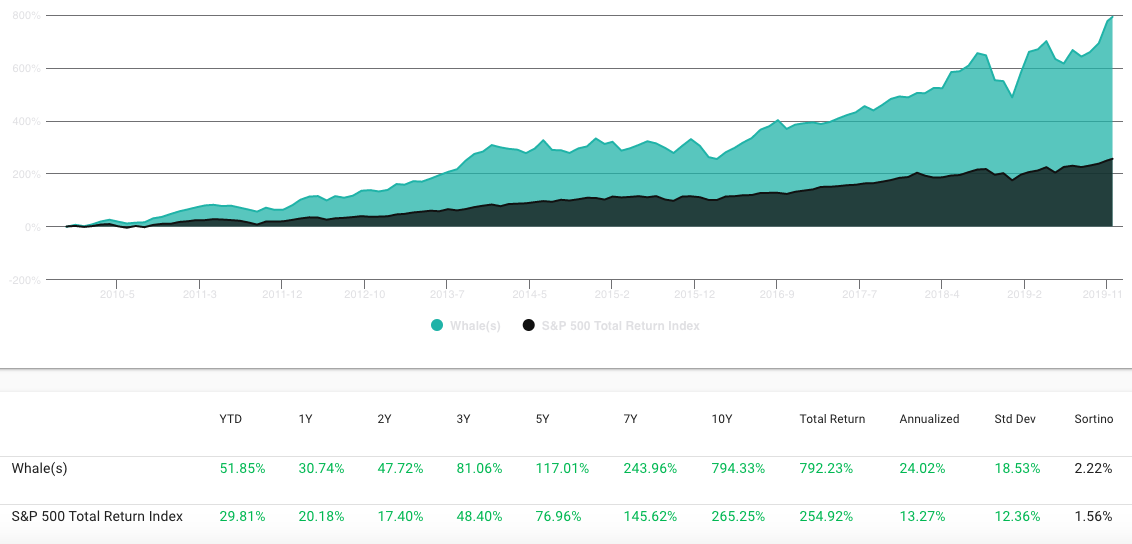

The decade’s top 20 hedge funds did something remarkable: They handily outperformed the S&P 500 — a difficult accomplishment during the relentless bull market.

The S&P 500 total return index has averaged about a 13.5% annual return over the last decade. But the average fund on the top 20 hedge fund list returned more than 21% annually.

The returns we’ve measured are based on 13F filings — quarterly reports disclosing stock positions filed with the SEC by investors with greater than $100 million under management. To be eligible for our list, a fund must have filed 13Fs every quarter for the last 10 years. Also, only hedge funds with more than 9 holdings are considered.

The decade’s top 20 hedge funds. Based on equal weighted performance of top 20 13F holdings, rebalanced quarterly. Source: WhaleWisdom.com.

| Hedge Fund | 10 Yr Performance Annualized | # Holdings | 13F MV | Avg Qtrs Held | % Holdings in Top 10 | 5 Yr Performance Annualized |

| RA CAPITAL MANAGEMENT, L.P. | 30.53 | 32 | 1,678,386,000 | 5 | 74.63 | 14.23 |

| BAKER BROS. ADVISORS LP | 25.5 | 109 | 14,699,689,000 | 13 | 85.95 | 15.5 |

| RGM CAPITAL, LLC | 25.42 | 20 | 1,502,092,000 | 13 | 62.87 | 18.54 |

| WHALE ROCK CAPITAL MANAGEMENT LLC | 23.46 | 39 | 5,414,864,000 | 6 | 46.51 | 25.76 |

| PERCEPTIVE ADVISORS LLC | 21.18 | 109 | 3,711,799,000 | 6 | 52.04 | 11.82 |

| ANCIENT ART, L.P. | 20.77 | 18 | 603,189,000 | 7 | 90.84 | 18.16 |

| PAR CAPITAL MANAGEMENT INC | 20.61 | 52 | 5,775,488,000 | 14 | 79.01 | 9.03 |

| TCI FUND MANAGEMENT LTD | 20.52 | 15 | 19,271,771,000 | 6 | 95.30 | 13.72 |

| BRANDYWINE MANAGERS, LLC | 20.42 | 48 | 298,877,000 | 6 | 93.88 | 23.06 |

| TREMBLANT CAPITAL GROUP | 20.37 | 38 | 1,739,601,000 | 8 | 51.43 | 14.59 |

| HARVEY PARTNERS, LLC | 19.44 | 29 | 138,365,000 | 4 | 64.99 | 12.06 |

| ECHO STREET CAPITAL MANAGEMENT LLC | 19.09 | 181 | 5,896,734,000 | 8 | 17.72 | 13.96 |

| SHANNON RIVER FUND MANAGEMENT LLC | 19.04 | 24 | 575,662,000 | 5 | 74.87 | 18.14 |

| PORTOLAN CAPITAL MANAGEMENT, LLC | 18.98 | 87 | 887,069,000 | 7 | 36.17 | 11.04 |

| MIG CAPITAL, LLC | 18.91 | 22 | 774,286,000 | 8 | 61.09 | 16.58 |

| ARCHON CAPITAL MANAGEMENT LLC | 18.89 | 27 | 424,107,000 | 4 | 76.79 | 20.17 |

| RIVERBRIDGE PARTNERS LLC | 18.68 | 134 | 5,277,498,000 | 22 | 25.68 | 14.49 |

| GLYNN CAPITAL MANAGEMENT LLC | 18.47 | 43 | 547,022,000 | 28 | 65.05 | 18.97 |

| ORBIMED ADVISORS LLC | 18.4 | 116 | 5,269,963,000 | 9 | 38.70 | 3.92 |

| ADAMS STREET PARTNERS LLC | 18.22 | 14 | 500,369,000 | 5 | 99.56 | 13 |

Biotech-focused hedge funds are well represented on the list of the decade’s top 20 hedge funds.

Over the last decade, RA Capital led all hedge funds with a 30.53% annualized return through the end of Q3. Health sciences-focused RA Capital is managed by Peter Kolchinsky, who co-founded the fund in 2001. With a Ph. D. in virology from Harvard, Kolchinsky has a reputation for extensive scientific analysis of the companies in his portfolio.

Number two on the list of the decade’s top 20 hedge funds is Baker Bros Advisors LP with an annualized 13F return of 25.5% through Q3. Baker Bros, managed by Julian and Felix Baker, is the largest fund to crack the top 20, with $14.7 billion in 13F market value. Two other biotech-focused funds also appear on list: Perceptive Advisors and Orbimed Advisors.

Naples-based RGM Capital, founded in 2003 and managed by Robert G. Moses, ranks #3 for 10 year annualized performance at 25.42%. RGM’s specialty is information technology.

Harvey Partners, with a 13F market value of $138 million, is the smallest hedge fund to crack the top 20.

Tarrytown-based Harvey Partners is the smallest of the leading funds, with 13F AUM of $138 million. The Firm is owned and managed by Jeffrey C. Moskowitz and James A. Schwartz. Since Q3 2009, Harvey Partner’s longs have averaged a 19.44% annual return. YTD the fund’s equal weighted top 20 long portfolio is up nearly 52%.

We’ve previously written about Whale Rock Capital’s exceptional returns. The fund’s manager Alex Sacerdote is renown for his use of S-curve analysis to inform his investment decisions. Whale Rock, #4 on the on the list of the decade’s top 20 hedge funds, has averaged a 23.46% annual return over the last decade.

Echo Street Capital has the distinction of being the most diversified fund on the list, with 181 holdings on its most recent 13F. Only 17.72% of the funds long assets are invested in its top 10 positions. Founded in 2002, New York-based Echo Street is owned and managed by Greg Poole. An equal weighted portfolio of the fund’s top 20 positions averaged a 19.09% since Q3 2009.

Contact Mark about investing based on SEC filings and smart money disclosures.

Disclaimer:

This investment blog (the “Blog”) is created and authored by Mark W. Gaffney (the “Content Creator”) and is published and provided for informational and entertainment purposes only (collectively, the “Blog Service”). The information in the Blog constitutes the Content Creator’s own opinions. None of the information contained in the Blog constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. You understand that the Content Creator is not advising, and will not advise you personally concerning the nature, potential, value or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter. To the extent any of the information contained in the Blog may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person.

From time to time, the Content Creator or its affiliates may hold positions or other interests in securities mentioned in the Blog and may trade for their own account(s) based on the information presented. The Content Creator may also take positions inconsistent with the views expressed in its messages on the Blog.

The Content Creator may hold licenses with FINRA, the SEC or states securities authorities and these licenses may or may not be disclosed by the Content Creator in the Blog.

Investing in the investments discussed in the Blog may be risky and speculative. The companies may have limited operating histories, little available public information, and the stocks they issue may be volatile and illiquid. Trading in such securities can result in immediate and substantial losses of the capital invested. You should use invest risk capital, and not capital required for other purposes, such as retirement savings, student loans, mortgages or education.